Brexit hogged the limelight on Wednesday as British PM May faced a vote of no-confidence. Although there was a surprise in the decision, this was widely speculated. The sterling initially slipped on the news only to recover strongly later towards the evening.

The outcome of the no-confidence vote was that the PM May managed to hold her ground with 200 votes in her favor and 117 against her. However, uncertainties remain on the final Brexit deal, which is yet to be approved by the UK parliament.

Industrial production in the Eurozone rose 0.2% matching estimates. This followed a revised 0.6% decline from the month before. The U.S. headline inflation was flat for November, as per estimates. This followed a 0.3% increase the month back. The core inflation rate was also up 0.2% as per estimates, and the increase was the same pace as seen in the previous month.

Investors look to a busy day in the markets amid a line up of central bank meetings. The day starts with the final inflation figures from Germany and France. Consumer prices in Germany are forecast to rise 0.1% on the month while French CPI is expected to fall 0.2%.

The Swiss national bank will be holding its monetary policy meeting today. No changes are expected as the labor rate is forecast to remain unchanged at -075%. This SNB's meeting is followed by the European central bank's monetary policy meeting.

The ECB is all set to announce an end to its QE program at today's meeting. However, there could be a cautious tone to the ECB's forward guidance. President Mario Draghi will be speaking later in the day.

The NY trading session will see the U.S. import price data. Import prices are forecast to fall 1.0% in November.

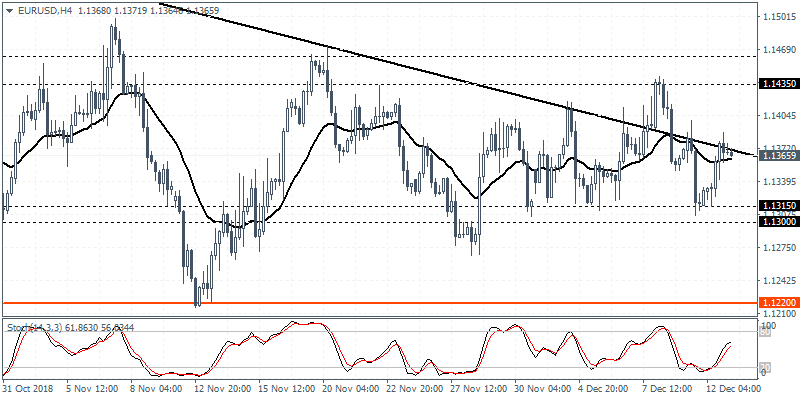

EUR/USD intraday analysis

EUR/USD (1.1365): The EUR/USD currency pair was trading somewhat subdued after briefly attempting to rally during the day. Price action was seen once again testing the falling trend line, and the 4-hour session posted a reversal. We expect the euro to remain weak into the ECB's meeting, but expect a possible rebound off the support level near 1.1315 - 1.1300 region.

Failure to hold the declines could potentially risk pushing the EUR/USD lower to test the previous lows at 1.1200 level. To the upside, the resistance at 1.14350 needs to be cleared for any signs of a breakout to the upside.

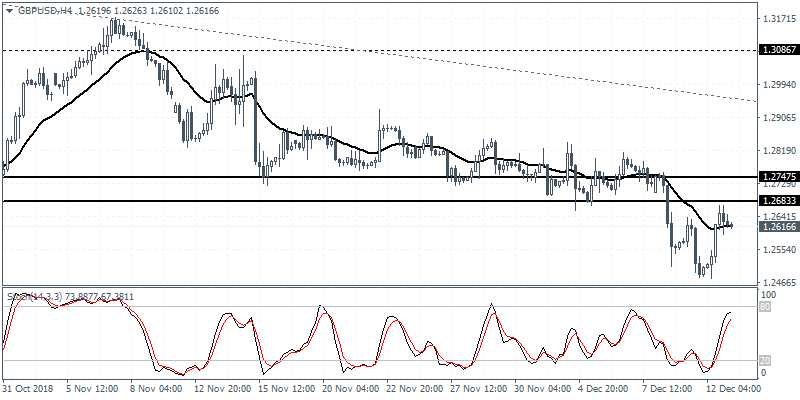

GBP/USD intraday analysis

GBP/USD (1.2616): The GBP/USD currency managed to lift off the intraday lows and closed higher, just below the recently breached support level of 1.2683. The reversal in the sterling came after the UK's no-confidence vote saw PM May winning the vote. However, with Brexit still significant uncertainty, the GBP/USD could potentially remain subdued below the price level. We expect a possible retest of 1.2683 for the price level to be tested as resistance.

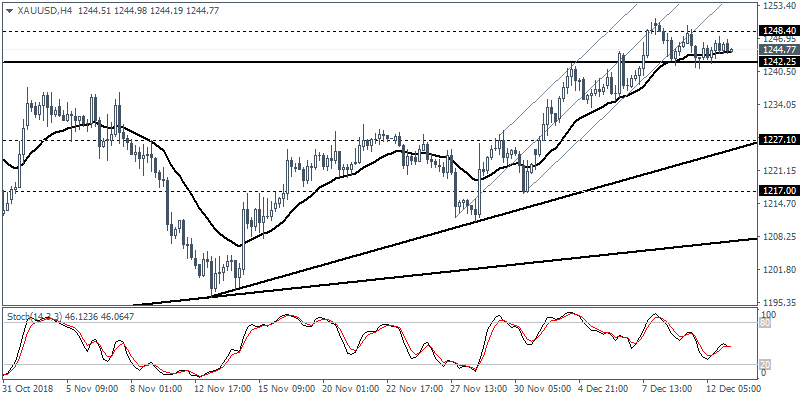

XAU/USD intraday analysis

XAU/USD (1244.77): Gold prices have turned flat following the strong rally to 1248 region. The support at 1242.25 is seen holding up for the moment. This could potentially keep the bias balanced as gold prices could be seen breaking out higher above 1248.00. To the downside, a clear break of the support is needed for gold prices to retest the support area of 1227.10.