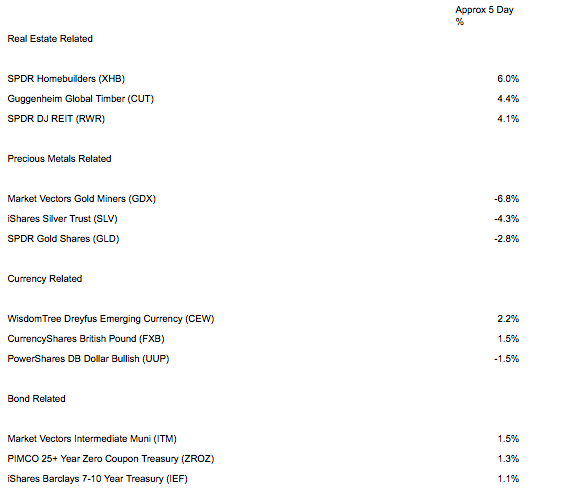

U.S. Treasury bonds via iShares 7-10 Year Treasury (IEF) have gotten off the mat and moved higher over the course of five days. The SPDR Gold Trust (GLD) has resumed its downtrend by falling below a 50-day trendline. WisdomTree Dreyfus Emerging Currency (CEW) has rallied strongly in September. Meanwhile, most of the beneficiaries of a Federal Reserve commitment to the suppression of lending rates — homebuilders, timber producers, real estate investment trusts — head the leader-board over the last week.

In essence, virtually every asset class is performing in a manner that is consistent with the Fed doing little more than “saving face.” Specifically, investors believe that committee members will need to follow through on some reduction of bond-buying activity, but the reduction will be minimal and the statement will acknowledge increasing weaknesses in the domestic economy.

Taper Lite: Markets believe the Fed will barely rein-in its bond buying.

Don't Forget Employment And Inflation

Frankly, I think investors have mostly interpreted the likelihood of Fed action (or inaction) correctly. Supposedly, the Fed is responsible for two things — steady employment and modest inflation. The worst labor-force participation rate since 1978 is indicative of employment woes, not vibrant job growth, while exceptionally flat wages stoke the debate over whether inflation or deflation is the primary concern; either way, inflation is below Fed targeted levels. Topping it all off, budget stand-offs in Washington mean there is zero chance of fiscal stimulus, leaving the monetary authorities to do any of the heavy lifting.

Don’t misunderstand. If it were up to me, I would have ended the emergency quantitative easing back at QE1 and allowed the economy to heal on its own from there. So I am not advocating endless bond purchases with electronic money printing. Nevertheless, it is clear to me that the Fed has little reason to slow its purchases substantially, other than to break our collective addiction to unnaturally low lending rates. And the Fed simply does not have the stomach or wherewithal to break that addiction with a major tapering.

Indeed, one should expect an exceptionally modest tapering… a token gesture, if you will. My “guestimate” is 10% or $8.5 billion less, leaving the institution still in the market for the acquisition of a whopping $76.5 billion in U.S. debt each month. Moreover, I expect the Fed to acknowledge increasing weakness in the job market, which may be interpreted by investors as a sign that the Fed will not continue tapering activity until 2014 at the earliest.

Bottom Line

Clearly, the seven-day stock market rally for the S&P 500 is largely tethered to a belief that the Fed won’t be very active on September 18. That said, there is a wide range of possibilities that might prove the bets of market participants as well as my “guestimate” wrong. Add the potential for the federal government to create yet another debt ceiling debacle, and I am content to keep plenty of cash on hand. It may be difficult to be patient for sell-offs, but patience is required for long-term investing success.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Investors Bet On “Taper Lite”

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.