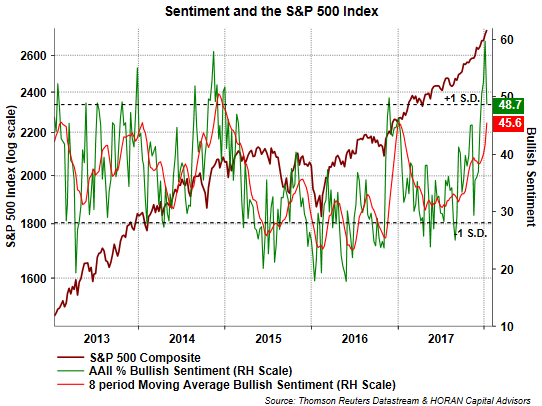

Today's weekly AAII Sentiment Survey reports a drop in bullish investor sentiment of 11.1 percentage points to 48.7%. The bullish sentiment reading has been on a steady move higher since November 16 when the bullishness reading was 29.4%. The weekly readings tend to be more volatile and one can look at the 8-week moving average in order to eliminate some of this volatility. As a result, although the sentiment reading fell this week, the longer period average of bullish sentiment increased to 45.6%, largely due to dropping the 29.4% bullishness reading from November 16.

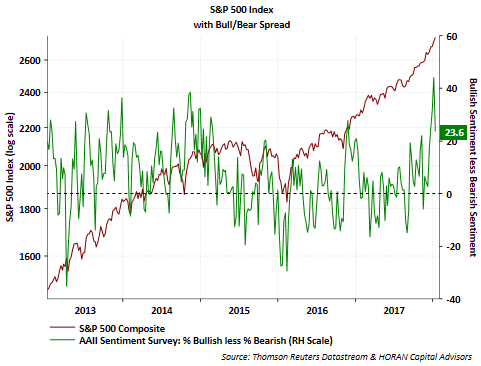

Most of the reported decline in bullish sentiment was reported in the 9.5 percentage point increase in the bearishness reading. The net affect was a decline in the bull/bear spread by 20.6 percentage points to 23.6%.

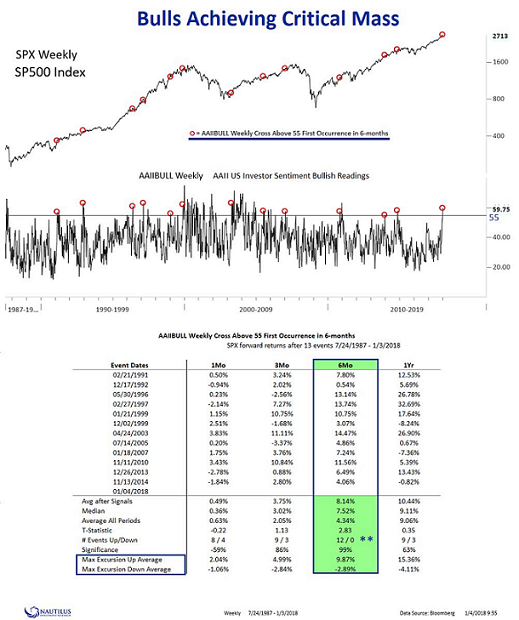

Given the low level of equity market volatility, the uninterrupted climb in the market for nearly two years and elevated investor sentiment readings, one would expect a market pullback. One reason a pullback is not occurring may be due to the simple fact most investors and strategists are expecting one. The market loves proving the consensus wrong. Secondly, as contrarian indicators, the sentiment measures tend to be most predictive of future market returns at market bottoms versus market tops. Nautilus Investment Research recently released some detail via the firm's Twitter site that provides some detail on this difference and one of their charts is included below. Notable is the fact when the AAII bullish sentiment reading cross above 55 for the first time within six months, which occurred last week, six months later, the market was up 12 out of 12 times with an average return of 8.14%.

A number of sentiment measures continue to note the elevated bullishness readings. As noted in our recent Investor Letter and prior blog posts, an improving fundamental backdrop, both economically and financially, is serving as a tailwind for companies. A large portion of this improvement seems to be driven by the positive expectations around the recent tax reform legislation passed by Congress. Time will certainly be the weighing machine, but some type of market pullback would be healthy if only to reduce any speculative market froth.