Take-Two Interactive Software Inc (NASDAQ:TTWO) stock had a rough day in the market on Friday November 17…

Shares dropped -0.91% and closed the day at $117.82. They're now trading 2.32% below their 52-week high of $120.62.

With today's drop, Take-Two Interactive Software now has a market cap of $14 billion. That makes it a large cap company.

The business operates in the entertainment software industry and employs 3,707 people. Its shares trade primarily on the NASDAQ stock exchange.

Take-Two Interactive Software has 114.05 million shares outstanding and 3.14 million traded hands for the day. That's above the average 30-day volume of 1.91 million shares.

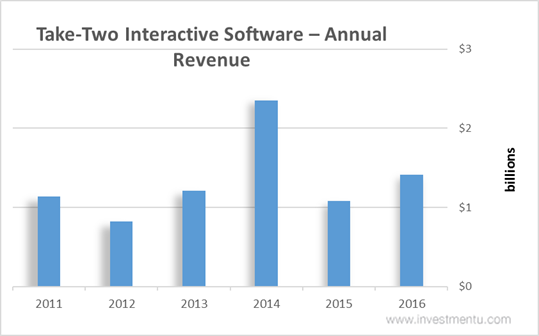

Over the last five years, Take-Two Interactive Software's revenue is up by 24.35%.

You can see this growth in annual revenue chart below...

In the last year alone, Take-Two Interactive Software's revenue has grown by 30.54%. That's a solid sign for Take-Two Interactive Software stock owners.

We like to invest in companies that grow their sales. A growing top line is a sign of a healthy business.

For now, Take-Two Interactive Software will continue to pull in revenue. So let's take a closer look at the company's total financial health.

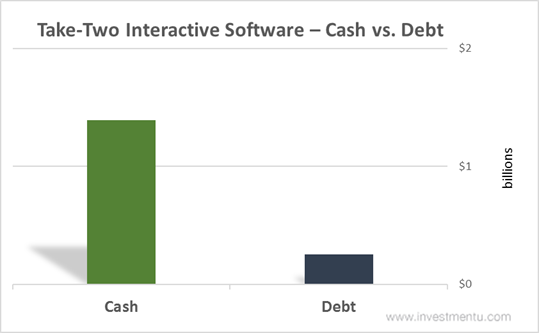

One of the best way to do that is by looking at its balance sheet... Take-Two Interactive Software's cash comes in at over $1 billion and the company's debt is only $252 million..

Take-Two Interactive Software's cash pile is larger than its total debt. The company is financially sound for now and can take on new projects.

What is Take-Two Interactive Software Stock Worth?

Let's look at a few key ratios to determine the value of Take-Two Interactive Software stock…

Price-to-Earnings (P/E): This ratio comes in at 100.92 for Take-Two Interactive Software. That's high. A high P/E ratio shows that investors are already expecting high earnings growth.

Price-to-Book (P/B): This ratio is a cornerstone for value investors. A lower number here indicates a better value play. And at 9.08, Take-Two Interactive Software looks reasonable… but P/B varies greatly based on the industry.

These are two great metrics to start with when valuing a company. But company analysis should go much further.

Keep an eye out for more of my analysis.