Rockwell Automation (NYSE:ROK) stock had a calm day in the market on Tuesday September 26...

Shares moved -0.39% and closed the day at $176.98. They're now trading 1.03% below their 52-week high of $178.82.

With today's drop, Rockwell Automation now has a market cap of $23 billion. That makes it a large cap company. The business operates in the industrial automation industry and employs 22,000 people. Its shares trade primarily on the New York stock exchange.

Rockwell Automation has 128.36 million shares outstanding and 611,375 traded hands for the day. That's above the average 30-day volume of 580,595 shares. The amount of Rockwell Automation stock is also dropping as the company buys back its own shares. In the last 12 months, it repurchased $432 million worth.

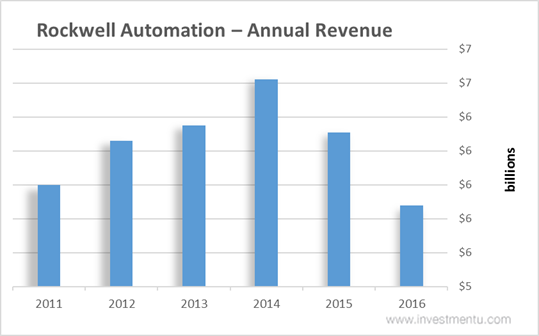

Over the last five years, Rockwell Automation's revenue is down by -2.01%. You can see this drop in annual revenue chart below...

In the last year alone, Rockwell Automation's revenue has dropped by -6.79%. That's not a good sign for Rockwell Automation stock owners. We like to invest in companies that grow their sales. A growing top line is a sign of a healthy business.

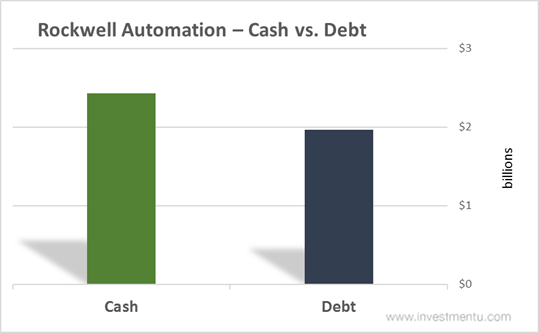

For now, Rockwell Automation will continue to pull in revenue. So let's take a closer look at the company's total financial health. And the best way to do that is by looking at its balance sheet... Rockwell Automation's cash comes in at $3 billion and the company's debt is $2 billion...

Rockwell Automation's cash pile is larger than its total debt. This and a steady cash flow has allowed the company to buy back shares.

The business is financially sound and will continue operating. Even with the recent downturn, the company has a bright future as industrial automation expands.

P.S. Rockwell Automation stock had a calm day in the market... but is it a great time to buy? That's the billion dollar question. One that we've spent well over a million dollars answering. The Oxford Club's research team has developed a system that pinpoints stocks set to soar...