- Equity markets and bond yields lower on weak US job data.

- Chinese CPI higher than expected at 3.6% (consensus 3.4%). China trade balance turns to surplus again.

- Oil price at one-month low on growth worries and higher US stocks.

- Focus this week will be on Chinese activity data and US CPI. The pressure on Spain and Italy also continues to be in the spotlight.

Friday’s US job report disappointed sharply by only rising 120k in March versus consensus 205k. The key disappointment was in private service employment that only rose 90k, whereas manufacturing showed a decent rise of 37k. Despite the disappointing outcome we doubt that the state of the labour market is really that bad as other indicators still point to a robust labour market– see Flash Comment US: Weak Job Report – But Probably Too Weak, dated 9 April 2012.

The recent softness in payrolls is more likely to be the result of seasonal distortions (see Research US: Seasonal Factors Distorting Data, dated 9 March 2012 ) and normal volatility in the data but it does increase market concern over the strength of the recovery and US equities fell around 1% yesterday (markets were closed on Friday).

Asian Markets

Asian markets also mostly traded in red this morning. Chinese inflation for March released yesterday disappointed by rising 3.6% y/y (consensus 3.4% y/y) up from 3.2% y/y in February. The upward surprise was mainly due to a renewed rise in food prices to 7.5% y/y from 6.2% y/y – see Flash Comment China: Increase In Inflation Should Prove Temporary, dated 9 April 2012. The Chinese trade balance turned to a surplus again of USD5.35bn as import growth was lower than expected while exports surprised to the upside – see Bloomberg.

US

US bond yields have continued slightly lower after the initial drop following the US job report. The US 10-year yield is now back close to the 2% level as markets are again pushing out the expected first hike to autumn 2014. The likelihood of another round of bond buying from Fed also increased with Friday’s job data. We still believe Fed will stay on hold, though, as the labour market data is expected to improve again during spring.

Forex

EUR/USD has recovered somewhat as speculation over new stimulus from Fed increased. EUR/CHF briefly traded through the 1.20 limit yesterday but quickly rose back above the cap set by the Swiss central bank. Both NOK and SEK have regained some ground overnight after weakening in response to a decline in risk appetite.

Oil

The oil price has fallen to a one-month low at USD122 per barrel (Brent) as weaker data and higher US stocks weigh on the market. US stocks last week showed the biggest two-week rise since March 2001.

UK RICS House Survey

The Uk RICS House Survey surprised to the upside this morning rising to -10 from -13.

Global Daily

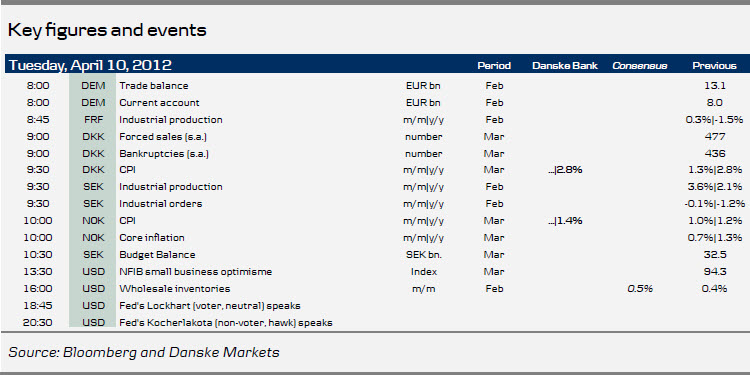

Focus todayThis morning we will receive a bunch of numbers that will help us determine whether the euro area is moving out of recession; including German foreign trade data for February with exports likely to show a setback after a strong January reading, French industrial production data for February that should show some progress after two months of weak data and the Sentix investor confidence indicator for April, which normally does not attract much attention but is nevertheless a useful early indicator for the more important German ZEW index that will be released next Tuesday. In the afternoon we will get UK house prices and the NFIB small business confidence indicator out of the US. Tonight Fed’s Fisher, Lockhart and Kocherlakota will speak.

There will be a lot of interesting data releases in Scandinavia today: Danish inflation data, bankruptcies and foreclosures, Norwegian inflation data and Swedish budget data, industrial orders and production.

Fixed Income Markets

Thin Easter markets, a soft payrolls report and concerns about Spain sparked a rally in the safe-haven fixed income markets during the holidays. US 10yr bond yields broke below 2.10% into the old 1.90-2.10% trading range. From a market perspective we are more concerned about the renewed pressure on Spain and Italy, than we are about the payrolls report, which was not unusual in any terms.

There are small signs of stress showing up in the market: the decline in Euribor fixings has slowed down, swap and credit spreads are widening and European banks’ equities are underperforming. This could push safe-haven rates even lower. That said, the Bunds future is already trading close to an all-time high and German government bonds look very expensive in our view. Our main view remains that bond yields in the US, Germany and Denmark are going to rise over the coming six to 12 months but with the recent jitters in the market, the tails risks to that view have increased.

FX Markets

While most G10 pairs continue to range-trade, it has been an eventful Easter. The SNB's 1.20 minimum target on EUR/CHF has been tested for the first time since it was introduced; a weak nonfarm payrolls report has added to recent dollar strength (showing that the US recovery remains pivotal to the improved global growth expectations since Q4) and JPY has regained some of its recent losses after the BoJ kept rates unchanged and no policy maker proposed additional stimulus.

We still expect the SNB to be successful in defending the 1.20 floor (at least throughout Q2) and see a high probability of increased verbal intervention to trigger temporary spikes in EUR/CHF. We continue to expect EUR/USD to range trade around our 1.32 3M forecast but the coming earnings season will be important to follow. We continue to expect JPY to correct slightly higher again before the next BoJ monetary policy meeting - which could trigger new upside in USD/JPY and EUR/JPY.

Scandi Daily

In Norway, the most important release this week is March inflation data. Norges Bank’s renewed focus on using monetary policy to push inflation up towards 2.5% has brought increased interest in the CPI. While NOK’s appreciation last year probably put downward pressure on inflation through falling import prices, higher petrol prices can be expected to feed through gradually into transport prices and so lift core inflation. We therefore predict a moderate rise in core inflation to 1.4% y/y, which is roughly in line with the central bank’s projections in the January monetary policy report and will not trigger any reaction in the markets.

Sweden

SCB will report February industrial production and order data. Production showed an unexpected strong increase (3.6% m/m) in January after several months of rather tame data. A small correction (-0.3%) is expected for February.