- Markets continue in risk-off mode with strong declines in equities, bond yields and oil prices.

- Spanish and Italian bond yields rise sharply and stocks in both countries plunge.

- Rick Santorum suspends campaign leaving Mitt Romney as Republican candidate to run against President Barack Obama.

- Focus continues on developments in the Spanish and Italian bond markets.

Stock markets are sharply lower

led by Italian and Spanish stock markets falling 5.0% and 3.0% respectively yesterday. In the US S&P500 closed down 1.6% but the S&P future gained slightly overnight. Asian markets are all in red territory this morning with Japanese stocks hit the most.

Markets are in risk-off mode as the pressure is rising in Spain and Italy where bond yields continued to rise. Investors are once again shying away from these markets out of fear that the euro crisis will escalate following much focus recently on Spain’s problems to reach its budget goals. It seems rather sentiment-driven as there was no significant news out of Spain or Italy yesterday. Spain’s new budget cuts of EUR10bn in order to reach its budget goal of 5.3% this year have not been able to stop the flight out of Spain.

Republican Rick Santorum yesterday announced that he is pulling out of the race to become the republican candidate against President Barack Obama in the November election. This leaves Mitt Romney as the Republican candidate in the election. – see Bloomberg.

US bond yields have continued lower with 10-year yields going below 1.97% yesterday before rising a bit overnight to 2.0%, close to the closing levels in Europe.

Oil prices have also fallen further in response to the decline in risk appetite and Brent traded below USD120 late yesterday.

In the FX markets EUR/USD is broadly unchanged around 1.31, whereas JPY is strengthening further against USD. Japanese machinery orders released overnight were stronger than expected rising 4.8% m/m in February (consensus -0.8% m/m) following a 3.4% m/m rise in January. In Scandinavia both NOK and SEK have weakened due to the risk-off mode in the markets. Weak Swedish industrial figures yesterday also weighed on SEK.

In China Bo Xilai, a former top official in Chongqing, was suspended from his senior party posts and his wife was arrested on suspicion of murdering a UK citizen. – see Bloomberg.

Global Daily

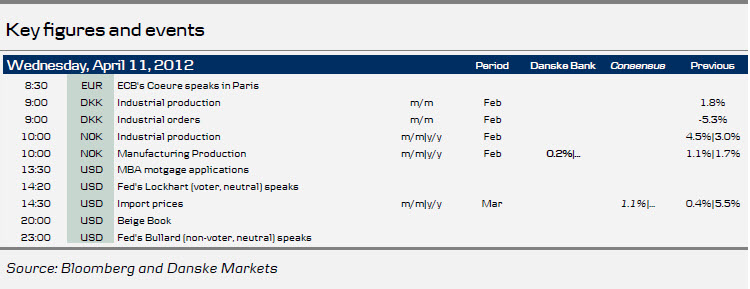

Focus today: There are no major data releases in today’s European session so the market is set to focus on news from the euro area periphery, as the risk of a severe re-escalation of the debt crisis is on the increase following the climb in sovereign bond yields yesterday. The Spanish 10-year government bond yield, which could break through the psychological 6% threshold today, will be followed particularly closely. This afternoon Atlanta Fed President Lockhart will speak and tonight St Louis Fed President Bullard is scheduled to speak. Fed will release its Beige Book report on the state of the economy this evening.

Fixed income markets: The sentiment in the European bond markets continues to worsen as in particular Spanish bond yields continue to rise sharply. Last night German bond yields were pushed to an all-time low. It thus appears that the markets are starting to price in that Spain will lose access to funding and therefore would need to seek help through EFSF/ESM. We know this pattern from earlier occasions during the euro debt crisis and we know that the dynamics tend to be self-fulfilling in the sense that once the snowball gets big enough it is hard to stop it.

The ECB is probably not that close to stepping in and start buying again. While it remains our main scenario that German bond yields will not move lower from the current levels, we would like to re-iterate that with the recent jitters in the market, the tail risks to our fundamental view have increased.

FX markets: Focus has returned to the European debt crisis and with global growth concerns re-emerging risky currencies continue to be under pressure across the board. EUR/USD is holding up surprisingly well, but if Spanish yields continue to rise today we should expect the cross the dip below 1.30. With concerns about the US recovery also haunting the market, the best way to position for a further weakening of the financial sentiment today would in our opinion be to sell EUR/JPY.

However, we do believe that markets have now priced in a quite negative global outlook and it might be time to consider positioning carefully for a rebound in the riskier currencies. Today the FX market will keep an eye on the Beige Book to see if the weakness in the labour market report is reflected on a broader base.

Scandi Daily

Norwegian manufacturing production is expected to rise a marginal 0.2% m/m in February even after the big jump in January of 1.1% m/m. The Norwegian PMI indicator points to a strong recovery in manufacturing in Q1.