Do you know Seth Klarman?

Klarman is founder of Baupost Group and is widely considered to be one of the greatest value investors in history. In 30+ years from 1982 to 2015, he only had three losing years, and is believed to have averaged returns of 16%.

Bear in mind, he did this while keeping 30%-50% in cash at all times.

Put simply, Klarmen’s returns on invested capital are simply astonishing. To be able to churn out those types of returns while being that risk-averse borders on the impossible.

Which is why when Seth Klarmen and his team warns of a potential Crash, you need to listen.

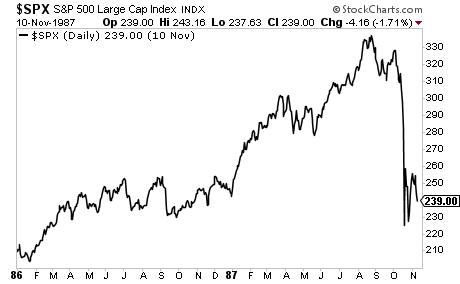

On that note, Klarmen’s top advisor for publicly traded investments recently noted precisely what we’ve been warning about for weeks: that automated trading in risk-parity funds is going to cause a potential 1987-type Crash.

In the Baupost Q2 Letter, Mooney estimates that investments linked to volatility:

“likely runs in the hundreds of billions of dollars,” a fact that could propel a market crash once the snowball starts running down the hill. “Any spike in equity markets realized volatility, even to historical average levels, has the potential to drive a significant amount of equity selling (much of it automated),” which would create a self-fulfilling feedback loop that only builds upon itself.

Source: ValueWalk

We’ve been noting for weeks that the markets are being rigged by risk-parity funds. All told these funds manage some $500 billion in assets. And they are mindlessly buying stocks based on automated triggers, NOT sound judgment.

This works great when the market is rallying. But what happens when those same automated systems get hit with “sell orders” and some $500 billion in capital (the real amount is even larger as many of these funds are leveraged) hits “SELL”?

The markets had a similar experience with automated trading programs in 1987. It wasn’t pretty.

A Crash is coming…

And smart investors will use it to make literal fortunes.