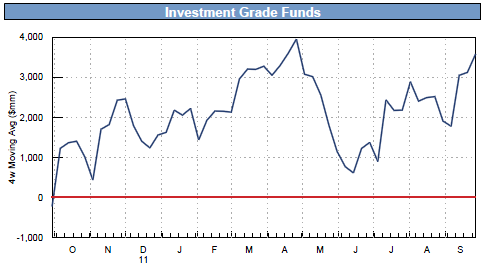

Investment grade (IG) corporate bonds continue to attract investment dollars. The latest fund flows show about half a billion inflows into IG ETFs (like LQD) and $1.8 billion into IG mutual funds.

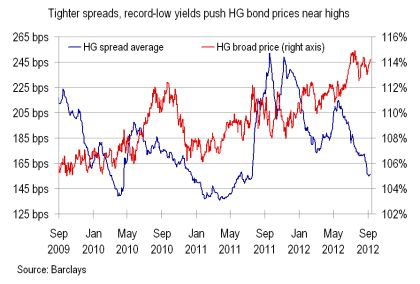

While junk bonds were impacted by the recent downward adjustment, investment grade bonds did not respond the same way. Even though investment grade spreads widened, the corresponding decline in treasury yields provided an offset. That kept the overall yield (treasury yield + bond spread) stable - it's a bit of a "self-hedging" product.

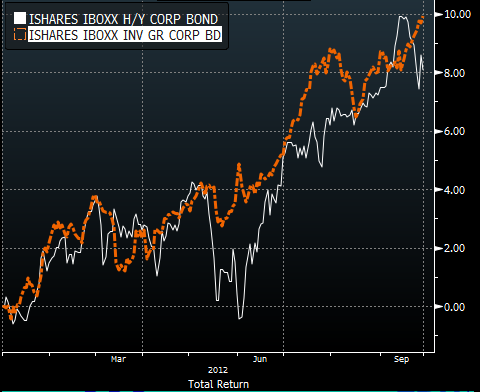

Year to date LQD (investment grade ETF) has outperformed HYG (high yield ETF) by about 2% as the two diverged recently.

With the Fed taking investment grade MBS paper out of the market, the bid for strong credits has risen. But IG corporate bonds are now "priced to perfection."

Companies have flooded the market with new supply during the third quarter.

LCD: ... the third quarter is on track for at least $215 billion of new supply placed to ravenous demand, more than 43% above issuance volume over the same period last year, according to LCD data that excludes sovereign, supranational, split-rated, and preferred-stock issues.

All this makes corporate bonds increasingly vulnerable to risks in the eurozone, particularly if spreads widen more than treasury yields decline.

LCD: After corporate credit spreads trended steadily tighter through a robust slate of new-issue supply over the third quarter, flat progressions for spreads over the last several sessions may be at risk as the high-grade market drifts into the fourth quarter against the backdrop of unrest in Europe, trade data show.

Even as cash bond levels held steady in recent sessions, derivative indications flashed warning signals for spreads. Along with a material rise in the VIX index, the CDX IG 19 index continued 2.5 bps higher this morning in an approach to 105 bps, marking a fifth-straight push higher for the index as U.S. markets opened. [see discussion]

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Investment Grade Corporate Bonds Are Priced To Perfection

Published 10/01/2012, 01:47 AM

Investment Grade Corporate Bonds Are Priced To Perfection

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.