Chinese equities have underperformed other regional indices

Source: Short Side of Long

Source: Short Side of Long

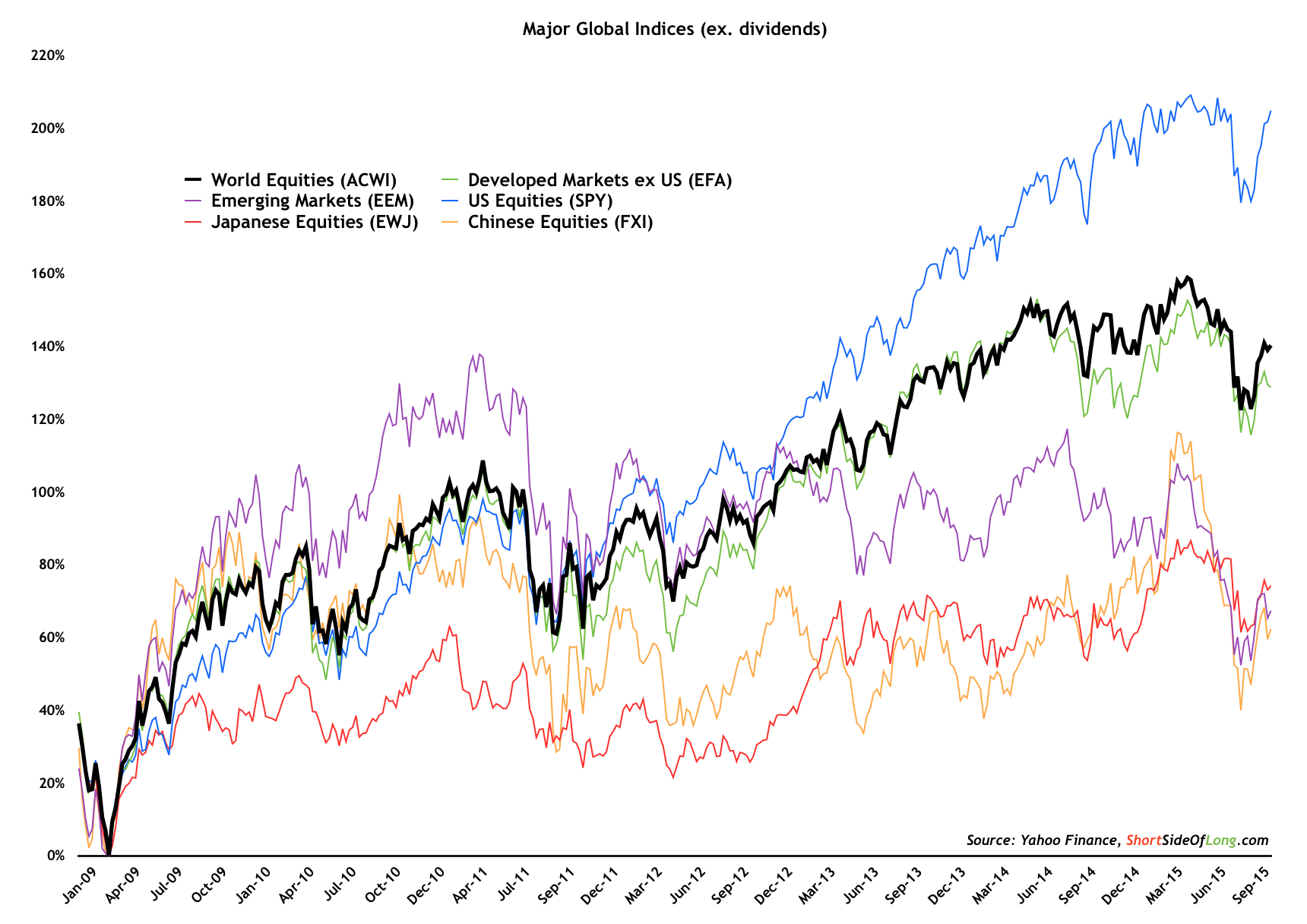

The current investment cycle started in March 2009. Just about all major asset classes, and to that degree regional equity indices around the world, bottomed out on this important inflection point.

If we look at the chart above, we can see that the MSCI All-Country World Equity Index (via iShares MSCI ACWI (O:ACWI)))—excluding dividends—has managed to return up to 140% over the last six and half years. Definitely an impressive performance. Having said that, the majority of the strength has come from the US region, where the equity index has outperformed the whole world since at least 2011/12, tripling in value.

Similarly, MSCI EAFE developed markets (Europe, Australasia and Far East via iShares MSCI EAFE (N:EFA)) are also in line with MSCI ACWI returns. However, one should also be able to observe that this MSCI index has now been underperforming ever since 2014. This trend is most likely linked to the ongoing strength of the US dollar over the last couple of years. On the other hand, Japanese and Chinese equity indices have dramatically underperformed during the current investment cycle. Both of these indices, together with the MSCI Emerging Markets Index, are barely up 60% over the same period (via iShares MSCI Emerging Markets (N:EEM)) —excluding dividends.

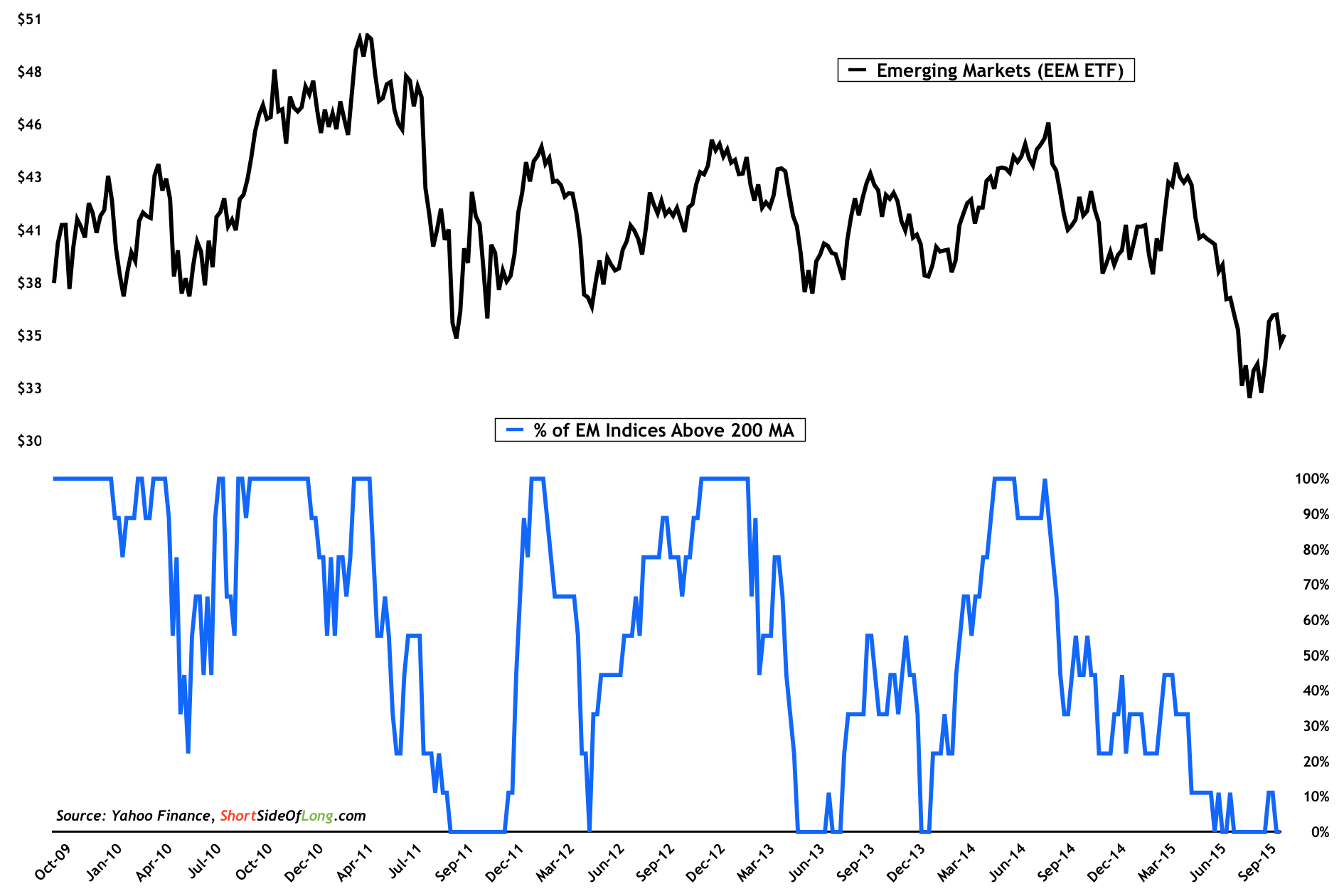

Finally, breadth within the Emerging Markets still remains at rock bottom levels. Bulls would claim that the index is still very much ripe for a rebound, similar to other oversold periods in the current investment cycle. Contrasting this view, bears view the current low participation as a sign of a more protected downtrend, which should eventually make lower lows.

All EM equity indices are still trading below their respective 200 day MA

Source: Short Side of Long

Source: Short Side of Long