Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

This is the first episode of “We Eat Dollar Weighted Returns.” Here’s the twist: investors in some bond ETFs have done better than those who bought at the beginning and held.

Now, all of this is history-dependent. The particular bond funds I chose were among the largest and most well-known bond ETFs -- HYG (iShares iBoxx $ High Yield Corporate Bd), JNK (SPDR Barclays Capital High Yield Bond) and TLT (iShares Barclays 20+ Year Treas Bond).

As bond funds go, these are relatively volatile. TLT buys the longest Treasury bonds, taking interest rate risk. HYG and JNK buy junk bonds, taking credit risk.

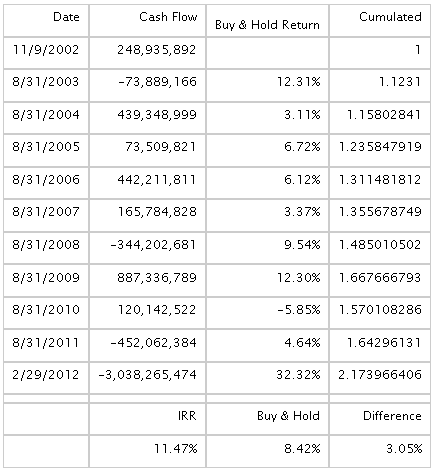

Let’s start with TLT:

I analyzed this back in June, saw the anomalous result and decided to sit on it until I had more time for analysis. The way to think about it is that investors reached for yield at a time when stocks were in trouble and guess what? Rates went lower. The average investor beat buy-and-hold by 3%.

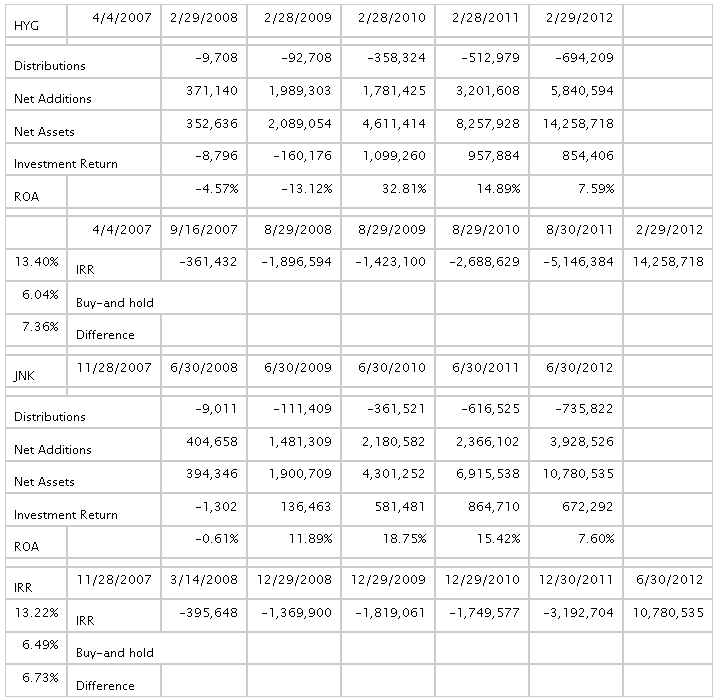

Here are the results for the junk ETFs:

Both funds were small in advance of the credit crisis, and investors bought into them as yields spiked, then bought even more as income opportunities diminished, largely due to the Fed’s low-rate monetary policies. The average investor beat buy-and-hold by 6%+.

Now, the junk funds were small during default, and grew during the boom, amid unprecedented monetary policy from the Fed. As an aside, I believe that Bernanke will rank below Greenspan in the history books, and that both will be judged to be horrendous failures. It is better to let things fail, and clear out the bad debt, rather than continue malinvestment. We need fewer banks, houses, and auto companies, among others. The government, including the Fed and the GSEs, should not be in the lending business. Lending should be unusual, and applied mostly to financing short-term assets. Long-term assets should be financed by equity, or at worst, long-dated debt.

Yield Frenzy

For all three funds, we have the historical accident that the Fed dropped Fed funds rates to near zero, leading to a yield frenzy. But what happens when defaults spike? What happens when no one want to buy long dated Treasuries at anything near current levels?

I think bond investors are more rational than stock investors; they have more rational benchmarks to guide them. Bond investors have cash flows to analyze against EBITDA (earnings before interest, taxes, depreciation and amortization). Stock investors wonder at earnings, which are easily gamed.

The real question will come with the next credit crisis. How many holders of HYG or JNK will run then? Or when inflation starts to run, and the Fed stops buying long Treasury bonds, and even starts to sell them, what will happen to dollar-weighted returns then?

These are interesting times for bond assets in a bull market. Still, we need to see bear market results to truly understand what is going on.

Full disclosure: long TLT for myself and clients.