Price Follows Hash Rate Claim

Max and I agree on some things and disagree on others.

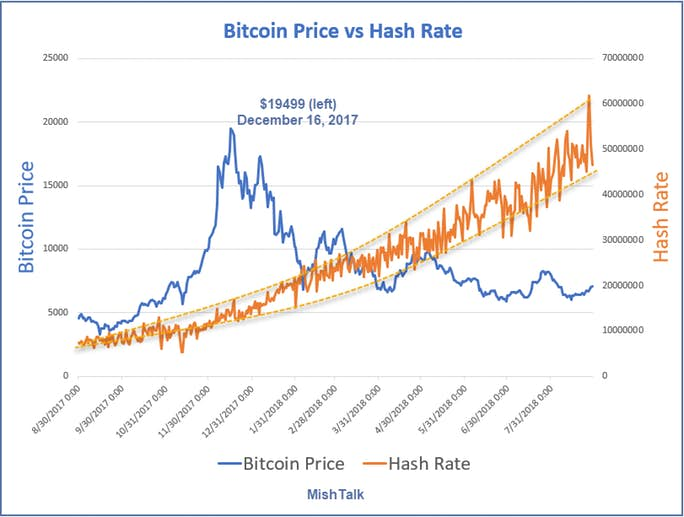

Place that Hash Rate Tweet into our bucket of disagreements as the following chart clearly demonstrates.

Data for the above chart from Blockchain Charts.

They have a huge error on the Blockchain download app in that it only provides one year of data no matter what timeframe one selects. There are other issues with the charts they produce, but the above chart is accurate.

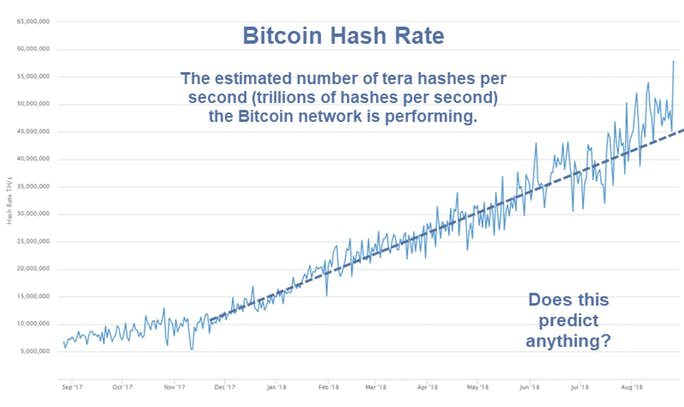

Here's the important fact: The hash rate of Bitcoin is on an exponential trend path (for now) with increasing volatility.

The price of Bitcoin does not remotely compare to the hash rate on any time frame that I can find after October of 2017 or so.

Here's an amusing article written May 26: PRICE WILL CATCH UP TO BITCOIN’S RECORD HASHRATE BY Q3: ANALYST.

According to Aslam, bitcoin price will soon begin to reflect network growth. He predicts a convergence between fundamentals and market indices by the third quarter of 2018. If that is the case, then the number one crypto could be set for another moonshot.

Here's the chart Aslam noted.

The hash rate soared to 61.87 EH/s on August 27. Wow! However, the price of Bitcoin on August 27 fell to $6719. UnWow!

We were supposed to see Bitcoin following the Hash Rate "by" the third quarter. By the third quarter?

The third quarter is almost over. The fourth quarter starts in in a month.

The article states "It is proof that miners have full confidence in the crypto. Thus, they are willing to ignore the market indices by contributing more resources to mine bitcoin."

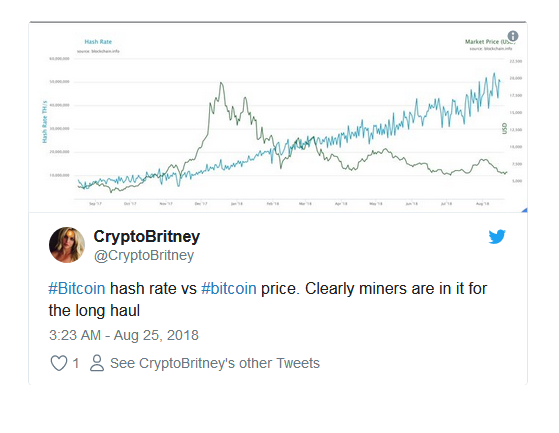

Here is a similar Tweet from another person.

Long Haul

Wrong!

The miners have confidence if they are holding Bitcoins rather than selling them for profit. Are they?

If miners sell the bitcoins they harvest (as I suspect) it actually shows a complete lack of faith the price is headed higher.

We will not have a true picture until the price of Bitcoin falls beyond maintenance costs or running a mining operation.

Curiously, fanatics have told me that the cost to mine Bitcoin "cannot" fall below the mining cost.

Wrong Again!

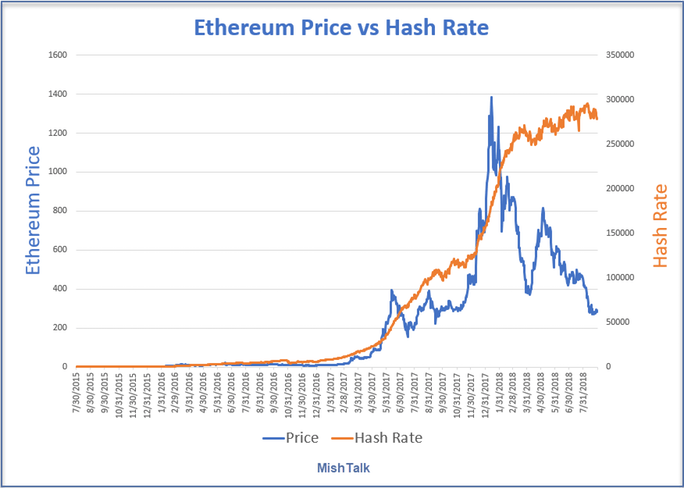

The price of Ethereum fell below mining costs, so clearly it can with Bitcoin.

And what would happen then?

It depends on how long miners are willing to lose money.

Ethereum vs Hash Rate

Data for the above chart from Etherscan.

I would have shown the same timeframe for Bitcoin (with a similar amusing look) but the Bitcoin download is messed up, only returning one year of data, as shown above.

Hash Rate Leads Price - Not

The charts I posted show the complete silliness of the idea, "hash rate leads the price".

People who claim to know where Bitcoin and other cryptos are going and in what timeframe are charlatans.

If you believe hash rate leads price, look again. The claim is nothing but hype to get you to buy or "hodl".