The latest retail sales report from the Census Department offers a fascinating look at Amazon.com's (NASDAQ:AMZN) impact on retailers if you dive into the details.

Retail sales are off to a poor start in the second quarter. April plus May growth is only up 1% in total, about 0.6% annualized.

Areas highlighted in yellow with blue boxes show retail categories where Amazon (NASDAQ:AMZN) has had a heavy impact. Sales from March through May of 2017 are up 4.4% vs. the same period a year ago but electronics, sporting goods, department stores excluding leased departments have been clobbered.

Amazon has little to no impact on food and drinking establishments, food and beverage stores, and gas stations.

Amazon’s Share of Online Business

Business Insider reports Amazon accounts for 43% of US online retail sales.

That 43% estimate is for 2016. It will rise.

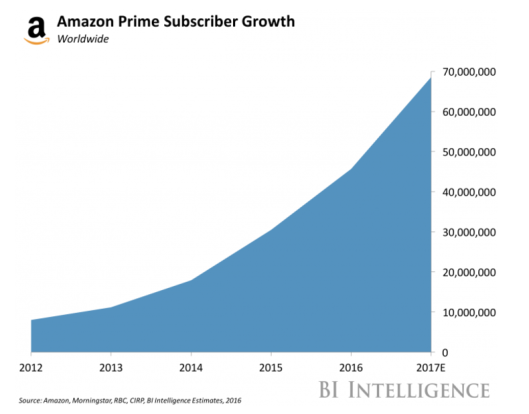

Amazon Prime Membership

Nonstore Retailers

The North American Industry Classification System (NAICS) describes Nonstore Retailers as follows:

Industries in the Nonstore Retailers subsector retail merchandise using methods, such as the broadcasting of infomercials, the broadcasting and publishing of direct-response advertising, the publishing of paper and electronic catalogs, door-to-door solicitation, in-home demonstration, selling from portable stalls and distribution through vending machines. Establishments in this subsector include mail-order houses, vending machine operators, home delivery sales, door-to-door sales, party plan sales, electronic shopping, and sales through portable stalls (e.g., street vendors, except food). Establishments engaged in the direct sale (i.e., nonstore) of products, such as home heating oil dealers and newspaper delivery service providers are included in this subsector.

Amazon accounts for an amazing 43% of online sales. It would be interesting to know Amazon’s percentage of Nonstore Retailer sales.

Competition

With Amazon’s purchase of Whole Foods, Amazon is now entering the food and beverage business directly.

I discussed Amazon’s purchase in “Major Deflationary Disruption” Says Cramer About Amazon Purchase of Whole Foods.

Store Expansion Impact

If you were Kroger (NYSE:KR), Costco (NASDAQ:COST), Target Corporation (NYSE:TGT), Dollar General Corporation (NYSE:DG), Macy’s Inc (NYSE:M), or any kind of general retailer, would you be expanding stores now? With Amazon taking business away? With minimum wages rising? Why?

By the way, when does Amazon start direct car sales?