Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

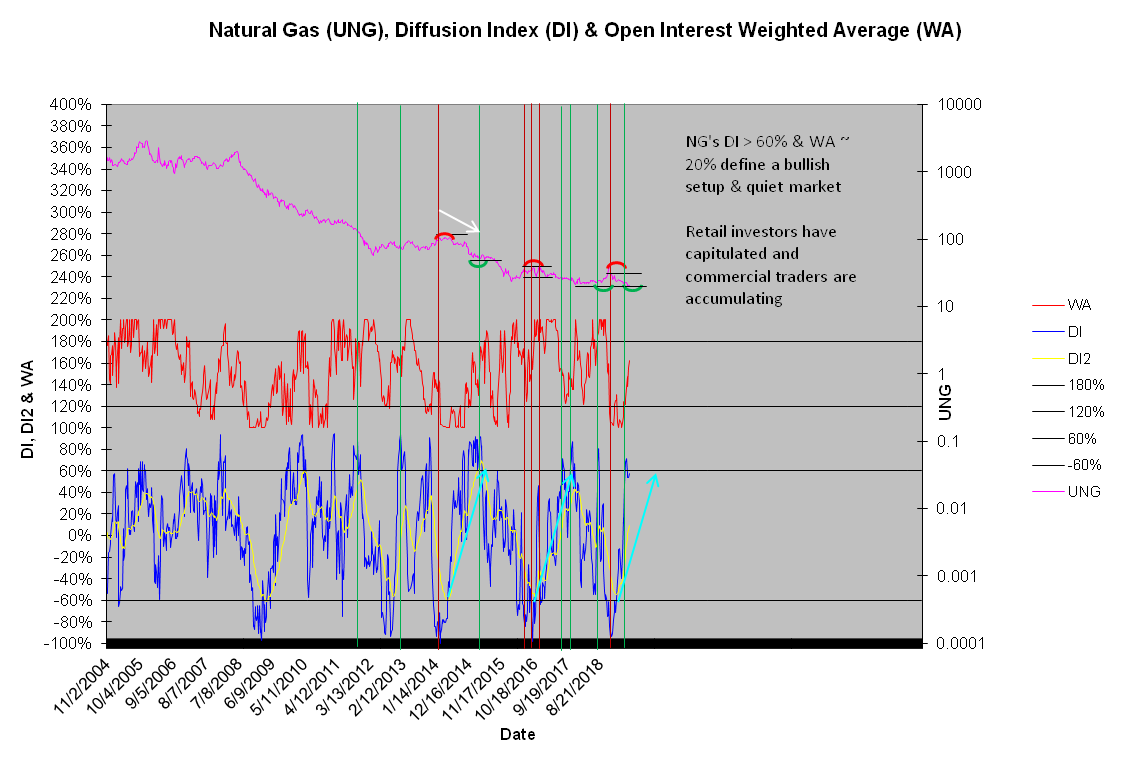

Natural gas's DI near 60% is bullish, but it still has a fair amount of work to do. DI2 just recently climbed to 9%. This defines persistent accumulation by strong hands. DI2 readings above 40% are not uncommon at turning points, so the process will take time. It will take time to reverse triple downside alignment, a trend displayed for the past 10 days. The bullish narrative should not be rushed or pushed.