Stock investors were not impressed when Warren Buffett's Berkshire Hathaway Inc, (BRKa) recently announced it had taken a sizable position in energy giant Exxon Mobil Corporation, (XOM).

Many commentators shrugged and some even tweeted out things like "yawn" in response to Berkshire adding the Dow component to its portfolio.

That's because it joins a bunch of other Dow Industrial companies already in the Berkshire portfolio.

At the end of the third quarter, Berkshire had $104.9 billion invested in equities. Its top 4 holdings reads like a who's who of the Dow Industrials: American Express Company, (AXP), Coca-Cola Company, (KO), International Business Machines, (IBM) and Wells Fargo & Company, (WFC). Just those four positions, alone, account for $58.4 billion of the portfolio.

Berkshire disclosed its Exxon position was 40 million shares for $3.4 billion. It's another sizable large cap position.

Berkshire Is Too Big

Berkshire Hathaway has a market cap of $282 billion. It owns over 80 companies and invests in dozens more. But when you have a portfolio that is over $100 billion, you can't just buy any small cap stock that stokes your fancy.

The larger you are, the more likely you are to invest in mid-to-large cap companies. Investing in dozens of small cap companies with $500 million market caps won't make a dent a portfolio that is worth $100 billion. For example, even if that $500 million doubles in value and becomes a $1 billion company, that's still just a drop in the bucket for a $100 billion portfolio.

That's why Berkshire is now saddled with numerous well known Dow component companies and owns no shares in companies with market caps under $1 billion.

Small is King

If you want growth, you buy small cap companies. Those are companies whose market cap is under $1.5 billion. Earlier in his career, before Berkshire grew into a billion dollar behemoth, Buffett used to buy obscure small cap companies and ride them higher to great returns.

If you really want to invest like Buffett, invest like the young Buffett. Forget all of Berkshire's recent purchases. Look for small cap companies that Buffett would have liked to own if he could he still buy small caps.

I did a screen for small cap stocks with Zacks Rank #1 (Strong Buy) and (Buy) stocks that also were value stocks, either through P/E, P/B or P/S, or a combination of those.

And then I asked: Would a young Buffett have bought this stock?

3 Stocks That a Young Buffett Would Have Loved

1. Haverty Furniture

2. Salem Communications

3. The Andersons

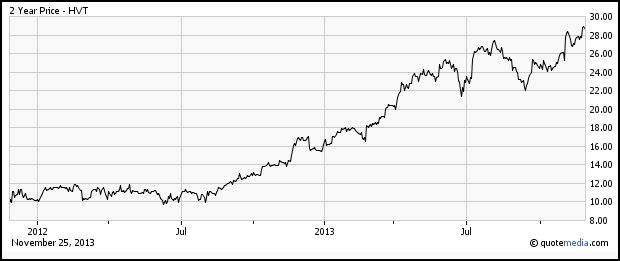

1. Haverty Furniture (HVT)

Buffett is a lover of furniture companies. Berkshire Hathaway owns several, including Jordan's Furniture, a furniture retailer founded in 1918 in Massachusetts. But one of his more famous investments was the 1983 purchase of Nebraska Furniture Mart. Headquartered in Omaha, Nebraska, it was started in 1937 by Rose Blumkin who sold it to Buffett with a handshake deal.

It has three stores, including one in Omaha, one in Kansas City and one in Des Moines, Iowa. Expansion into Northern Texas is expected in the next several years.

Haverty Furniture fits within Buffett's model. Founded in 1885, and public since 1929, it is headquartered in Atlanta and still has Havertys working in the management team. The company has now grown to over 119 stores in 16 states.

On Oct 30, the company reported a record third quarter as it blew by the Zacks Consensus Estimate by 24%. Earnings of $0.42 were up 180% compared to the year ago quarter as the company cut expenses.

Sales rose 11.6% with same-store-sales jumping 11.8%. The average ticket gained 5.6%.

The company finished the third quarter with $79.1 million in cash and NO debt.

Valuations are still attractive even though the shares are at 2-year highs. Havertys is benefiting from the housing market recovery. Earnings are expected to rise 98% in 2013 and another 16% in 2014.

- Forward P/E = 21.7

- P/B = 2.3

- P/S = 0.9

- Zacks Rank #2 (Buy)

- Market Cap: $650 million

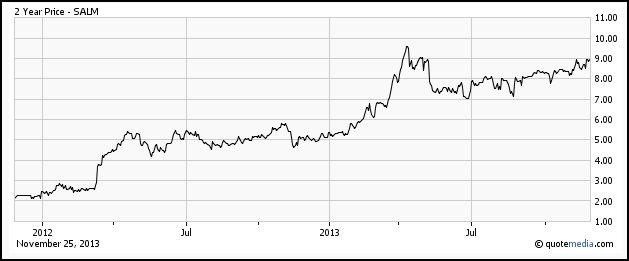

2. Salem Communications Corporation (SALM)

Buffett has always had a thing for media companies, especially newspapers. Berkshire Hathaway still owns the Buffalo News, which Buffett purchased in 1977.

But if Buffett were young today, he may be more interested in other media platforms, including the Internet.

Salem Communications is the largest Christian and conservative radio broadcaster in America. Founded in 1986, it operates 101 radio stations in 39 markets. It also operates an Internet and publishing divisions, including Christianity.com, Jesus.org and Christian videos at GodTube.com. It's publishing division includes FaithTalk Magazine and Preaching and Townhall Magazine.

On Nov 5, it reported third quarter results which saw revenue rise 3.1% to $58.5 million. Radio revenue increased just 0.3% but that was because the heavy political ad buying of last year was absent. In it's fourth quarter guidance, the company also cited the loss of political ads as a drag on revenue.

But Internet sales were the big driver for the quarter, rising 20.4% to $9.4 million from $7.8 million.

While the company is expected to lose $0.21 a share this year, earnings are forecast to soar by 397% to $0.63 in 2014.

The company has no forward P/E due to the expected loss in 2013. But its other valuation metrics are still attractive. Salem also pays a dividend, currently yielding 2.5%, which is rare for a company of its size.

- Forward P/E = N/A

- P/B = 1.1

- P/S = 0.9

- Zacks Rank #2 (Buy)

- Market Cap: $224 million

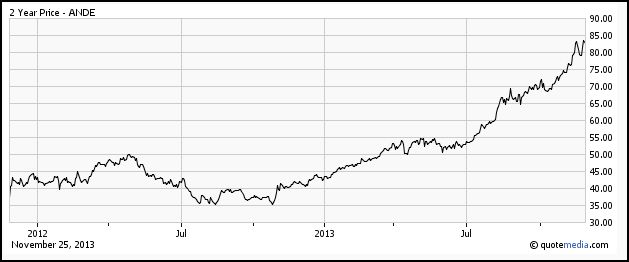

3. The Andersons (ANDE)

Buffett likes "old" industry companies like railroads and chemicals. These are companies which are the building blocks of the economy.

It's surprising, then, to see that Berkshire Hathaway doesn't own any agribusinesses outright.

The Andersons was founded in 1947 by Harold and Margaret Anderson as a single grain terminal in Ohio with the purpose of helping farmers get their corn to market. It has grown into a 6 division business with grain, plant nutrients, railcar leasing and repair, industrial products formulation, turf products, retail and ethanol operations.

On Nov 6, The Andersons posted a monster 50% beat as earnings were $0.91 compared to the Zacks Consensus Estimate of just $0.61. Ethanol and the Rail Group led the quarter, with the Grain Group also solid.

The company had been cashing in on higher fertilizer prices the last few years when that was hot but now it is Ethanol that has taken that position. However, one thing to watch is that the EPA has issued a Proposed Regulation which will change ethanol requirements in 2014.

Investors don't seem worried about the impact on The Andersons as shares have barely budged from their 2 year high.

The Andersons is expected to grow earnings by 10% in 2013 and another 23% in 2014. Despite trading near its multi-year high, there's still value in these shares.

- Forward P/E = 18

- P/B = 2.3

- P/S = 0.3

- Zacks Rank #1 (Strong Buy)

- Market Cap: $1.5 billion

Disclosure: The author of this article has owned XOM since 2000.

Original post