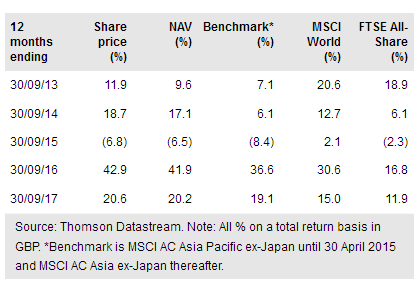

Invesco Asia Trust (LON:IAT) seeks capital appreciation from a diversified portfolio of Asian equities across the market cap spectrum. Despite a re-rating of global equities, the manager is still finding attractive investment opportunities across a variety of sectors and geographies. IAT is benchmarked against the MSCI AC Pacific Ex Japan index; its NAV total return has outperformed over one, three, five and 10 years. It has also outperformed peers over these periods, ranking first over five years. The board actively manages the share price discount to ex-income NAV via share repurchases. Despite the focus on capital growth, IAT’s annual dividends have increased or been maintained every year since 2001.

Investment strategy: Investing across cap spectrum

IAT is managed by Ian Hargreaves, who follows an unconstrained, bottom-up process, investing across the market cap spectrum (c 20% of the portfolio is below $3bn); sector and geographic exposures can vary significantly from the benchmark. He seeks companies with strong fundamentals that are trading at a discount to the value of their underlying businesses and is able to draw on the ideas of the well-resourced Invesco Perpetual Asia-Pacific team. Gearing of up to 25% of net assets is permitted, but in practice is between 0% and 5%.

To read the entire report Please click on the pdf File Below: