Focused portfolio unconstrained by benchmark

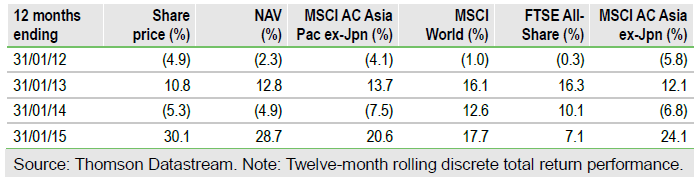

Invesco Asia Trust (LONDON:IAT) is a specialist, actively-managed closed-end fund that aims to achieve long-term capital growth through investing in a diversified portfolio of companies in the Asia-Pacific region excluding Japan. Sector and geographic allocations are not constrained by the benchmark, which will change in May 2015 to an index excluding Australia, reflecting IAT’s historical underweight to that market. Performance has been ahead of the benchmark over one, three, five and 10 years and IAT’s 1.8% yield is above average among peers focused on capital growth.

Investment strategy: Stock picking in Asia

The manager combines bottom-up and top-down approaches, using in-house and external research, to construct a portfolio of c 60 stocks identified as having a strong competitive advantage and considered to be undervalued relative to their medium- to long-term growth prospects. Investment decisions are based on the strength of the investment case for individual stocks and the manager’s level of conviction. Regular visits are made to the Asia-Pacific region to meet the management of existing and potential investee companies. Stock selection is not constrained by benchmark weightings and the prospective change in benchmark to exclude Australia will not change the investment approach or exclude future investments in this market.

Outlook: Grounds for optimism

Although near-term global economic growth expectations have been declining recently, growth prospects for emerging Asian economies remain significantly ahead of those for advanced economies. Macroeconomic uncertainties remain, with the potential for further economic slowdown in China a key concern, but signs of economic reform across the Asian region provide grounds for optimism on a medium- to long-term view. A more modest re-rating of Asia ex-Japan markets compared with world markets over the last three years has left valuations similar to historical average levels. Expected superior economic growth and lower relative valuations suggest greater scope for Asian markets to move higher than many developed markets due to a combination of re-rating and earnings growth.

Valuation: Above-average discount and yield

Although IAT’s share price discount to NAV (excluding income) has been trending gradually lower over the last two and a half years, at 10.7% it currently stands at the higher end of its 12-month range and remains wider than average among the peer group. Within a peer group of Asia-Pacific ex-Japan funds primarily focused on capital growth, IAT has a higher than average, 1.8%, dividend yield.

To Read the Entire Report Please Click on the pdf File Below