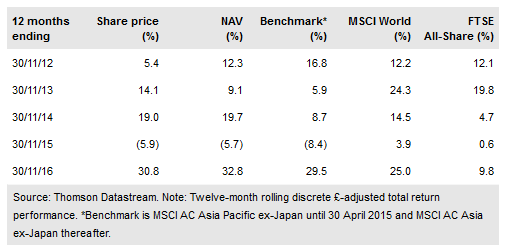

Invesco Asia Trust (LON:IAT) aims to generate long-term capital growth from investment in Asia ex-Japan equities across the capitalisation spectrum. The portfolio of c 60 stocks is diversified by sector and geography. IAT’s NAV total return has outperformed its iShares MSCI AC Asia ex Japan (HK:3010) benchmark over one, three, five and 10 years. Near-term absolute returns have been particularly strong, having been enhanced by a fall in the value of sterling. IAT’s board actively manages the share price discount to ex-income NAV via tender offers and share repurchases. Annual dividends have been maintained or increased every year since 2001; the current yield is 1.6%.

Investment strategy: Seeking undervalued companies

Manager Ian Hargreaves conducts in-depth, bottom-up research, aiming to identify companies with attractive fundamentals that are trading at a discount to the expected value of their underlying businesses. Currently c 25% of the portfolio is in small-cap (sub-$2bn) companies. Stock selection also takes into account the manager’s top-down views. He is able to draw on the resources of the Invesco Perpetual Asia-Pacific team; all five members regularly travel to Asia and meeting company managements is a key element of the investment process. Gearing of up to 25% of net assets is permitted, but in practice is between 0% and 5%.

To read the entire report Please click on the pdf File Below