Invesco Ltd. (NYSE:IVZ) is slated to release second-quarter 2017 results on Jul 27, before the market opens. Its revenues and earnings are projected to grow year over year.

Last quarter, the company’s adjusted earnings surpassed the Zacks Consensus Estimate. Results were primarily driven by an increase in revenues, partially offset by higher expenses. Improvement in assets under management (AUM) was another positive.

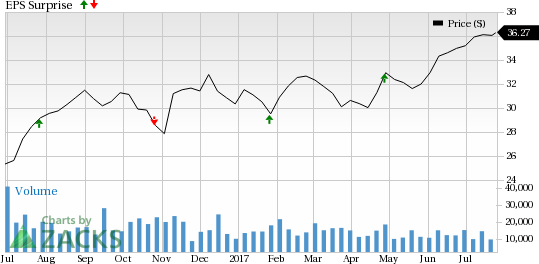

Invesco has a decent earnings surprise history, with the company surpassing the Zacks Consensus Estimate in three of the trailing four quarters, with an average beat of 3.2%.

These earnings beats supported a 19.6% year-to-date rally of the stock, marginally outperforming the 19.1% growth of the industry it belongs to.

Will the rally in stock price continue post Q2 earnings? It depends on the company’s ability to impress the market with an earnings beat and improved financials.

Our proven model cannot conclusively predict if Invesco will be able to beat the Zacks Consensus Estimate this time around. This is because it does not have the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: The Earnings ESP for Invesco is 0.00%. This is because the Most Accurate estimate of 61 cents matches the Zacks Consensus Estimate.

Zacks Rank: Invesco’s Zacks Rank #2 (Buy) increases the predictive power of ESP. However, we also need a positive Earnings ESP to be confident of an earnings beat.

Factors to Influence Q2 Results

Invesco’s expenses in the quarter are likely to increase. Management expects property, office and technology expenses to increase to $88 million, owing to the large, technology-related projects that would come into service, including investments around data and cyber security.

On the revenue front, management expects performance fees to be around $5–$7 million, down year over year.

Because of continued pressure on short-dated equity UITs as a result of the early adoption of Department of Labor (DOL) rules and a structural change in the pricing of real estate products, other revenues are also expected to fall.

However, Invesco’s activities during the quarter encouraged analysts to revise estimates upward. As a result, the Zacks Consensus Estimate increased 1.7% over the last 30 days to 61 cents.

Stocks to Consider

Here are a few finance stocks you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around.

Banc of California, Inc. (NYSE:BANC) is scheduled to release results on Jul 26. It has an Earnings ESP of +8.33% and a Zacks Rank #3.

Hilltop Holdings Inc. (NYSE:HTH) has an Earnings ESP of +2.33% and a Zacks Rank #2. The company is slated to release results on Jul 27.

Franklin Resources, Inc. (NYSE:BEN) is slated to release results on Jul 28. It has an Earnings ESP of +1.37% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Banc of California, Inc. (BANC): Free Stock Analysis Report

Invesco PLC (IVZ): Free Stock Analysis Report

Franklin Resources, Inc. (BEN): Free Stock Analysis Report

Hilltop Holdings Inc. (HTH): Free Stock Analysis Report

Original post