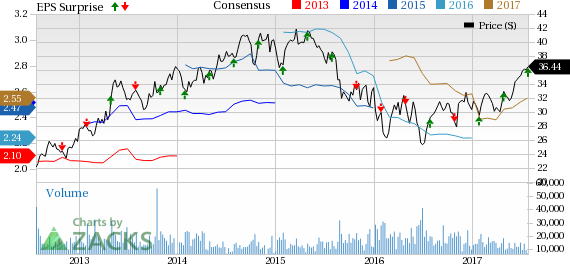

Invesco Ltd. (NYSE:IVZ) reported second-quarter 2017 adjusted earnings of 64 cents per share, surpassing the Zacks Consensus Estimate of 61 cents. Also, the bottom line came in 14.3% higher than the prior-year quarter.

Earnings were primarily driven by an increase in revenues. Further, the company reported a rise in assets under management (AUM). However, increase in operating expenses acted as a headwind.

On a GAAP basis, net income attributable to common shareholders came in at $239.6 million or 58 cents per share, up from $225.5 million or 54 cents per share a year ago.

Rise in Revenues More than Offsets Higher Costs

GAAP operating revenues for the quarter were $1.25 billion, up 5.5% year over year. However, the figure lagged the Zacks Consensus Estimate of $1.26 billion. Adjusted net revenue grew 5.8% year over year to $906.3 million.

Adjusted operating expenses were $549.8 million, up 4.5% from the prior-year quarter. The rise was due to an increase in all expense components.

Adjusted operating margin for the quarter was 39.3% compared with 38.6% a year ago.

Strong AUM

As of Jun 30, 2017, AUM grew 10.1% year over year to $858.3 billion. Average AUM for the quarter totaled $849.2 billion, up 8.2% from the year-ago quarter. Further, the reported quarter witnessed long-term net outflows of $0.6 billion as against inflows of $4.5 billion in the prior-year quarter.

Our View

Invesco remains well positioned to benefit from improved global investment flows, supported by a diversified footprint and product offering. The company is undertaking initiatives to transform key business support functions for boosting efficiency.

Currently, Invesco carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Asset Managers

BlackRock, Inc.’s (NYSE:BLK) second-quarter 2017 adjusted earnings of $5.24 per share lagged the Zacks Consensus Estimate of $5.39. Results were adversely impacted primarily by a rise in operating expenses and lower investment advisory performance fees. However, increase in investment advisory, administration fees and securities lending revenues, along with growth in assets under management acted as tailwinds.

The Blackstone Group L.P. (NYSE:BX) reported second-quarter 2017 economic net income of 59 cents per share, which lagged the Zacks Consensus Estimate of 62 cents. An increase in expenses was the primary reason for the lower-than-expected results. However, the quarter witnessed a rise in revenues.

Ameriprise Financial Inc.’s (NYSE:AMP) second-quarter 2017 operating earnings per share of $2.80 comfortably surpassed the Zacks Consensus Estimate of $2.62. Results benefitted from a rise in revenues along with lower expenses. Also, growth in AUM and assets under administration were on the positive side.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Invesco PLC (IVZ): Free Stock Analysis Report

AMERIPRISE FINANCIAL SERVICES, INC. (AMP): Free Stock Analysis Report

The Blackstone Group L.P. (BX): Free Stock Analysis Report

BlackRock, Inc. (BLK): Free Stock Analysis Report

Original post

Zacks Investment Research