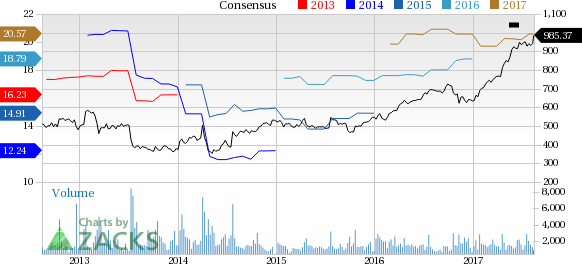

Share price of Sunnyvale, CA-based Intuitive Surgical Inc (NASDAQ:ISRG) scaled a new 52-week high of $990.14 on Aug 15, eventually closing a bit lower at $985.42. The company has gained 15.8% over the last three months, much better than the S&P 500’s 4.6% rise and the broader industry’s gain of 1.4%. Taking the stable performance of the stock into consideration, we expect Intuitive Surgical to scale higher in the coming quarters. The company’s positive long-term growth of 9.1% also holds promise.

Average volume of shares traded over the last one year was remarkable at approximately 344.3K. The stock has a market cap of $36.60 billion. Over the last 30 days, two analysts have raised their earnings estimates for the current year, while one has slashed the estimate. The net effect has taken the Zacks Consensus Estimate for the current quarter from $20.16 per share to $20.58.

Catalysts

The market is upbeat about Intuitive Surgical’s licensing agreement with JustRight Surgical. The deal enables Intuitive Surgical with a global license to JustRight Surgical’s intellectual property in energy-based vessel sealing and tissue stapling technologies for use in the robotics field. Joint product development and an equity financing arrangement are also part of the agreement.

Also, the company posted an impressive second quarter. Both earnings and revenues registered a year-over-year increase in the quarter. The company also witnessed growth in all the segments. The international performance was also encouraging.

We believe that the growing adoption of Intuitive Surgical’s da Vinci system among physicians for general surgery, oncology, urology and gynecology procedures is a key catalyst. Moreover, increasing procedural volumes outside the United States open up considerable opportunities for the company.

The company is further putting efforts in product innovation through research and developments. In this regard, the recent FDA approval for da Vinci X instils confidence in investors.

This apart, the company is expected to gain prominence in Europe and Asia by enhancing its organizational capabilities, which should further drive its stock price.

Zacks Rank & Key Picks

Intuitive Surgicalcurrently carries a Zacks Rank #3 (Hold). A few better-ranked medical stocks are Edwards Lifesciences Corp. (NYSE:EW) , Lantheus Holdings, Inc. (NASDAQ:LNTH) and Align Technology, Inc. (NASDAQ:ALGN) . Edwards Lifesciences and Align Technology sport a Zacks Rank #1 (Strong Buy), while Lantheus Holdings carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. The stock has gained around 2.7% over the last three months.

Align Technology has a long-term expected earnings growth rate of 26.6%. The stock has rallied roughly 30.8% over the last three months.

Lantheus Holdings has a long-term expected earnings growth rate of 12.5%. The stock has gained 6.7% over the last three months.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post