Intuit Inc. (NASDAQ:INTU) just released its first-quarter fiscal 2018 financial results, posting adjusted earnings of $0.11 per share and revenues of $886 million. Currently, Intuit is a Zacks Rank #3 (Hold), and is down 1% to $156.10 per share in after-hours trading shortly after its earnings report was released.

Intuit Inc. (INTU):

Beat earnings estimates. The company posted earnings of $0.11 per share, beating adjusted earnings estimates of $0.05 per share.

Beat revenue estimates. The company saw revenue figures of $886 million, topping our consensus estimate of $854.98 million.

Intuit’s first-quarter revenues jumped 14% year-over-year. The company added 170,000 online QuickBooks subscribers to bring the total to 2.55 million, which marked a 56% surge from the year-ago period. This helped the company increased its online ecosystem revenue by 35%.

The company’s Q1 adjusted, non-GAAP earnings soared 83%. However, Intuit posted a quarterly GAAP loss of $0.07 per share. On top of that, Intuit reported a $57 million operating loss.

Intuit now expects to post Q2 EPS in the range of $0.31 to $0.34. The company projects to post second-quarter revenues in that range from $1.16 billion to $1.18 billion, which would mark up to 16% growth.

“We are off to a strong start growing first-quarter revenue 14 percent and exceeding our overall financial targets,” CEO Brad Smith said in a statement.

“QuickBooks Online subscriber growth continues at a rapid pace and online ecosystem revenue is accelerating for small business and self-employed. Gearing up for the tax season, we are focusing on delivering an outstanding end-to-end customer experience for the do-it-yourself taxpayers while rolling out new solutions to our customers.”

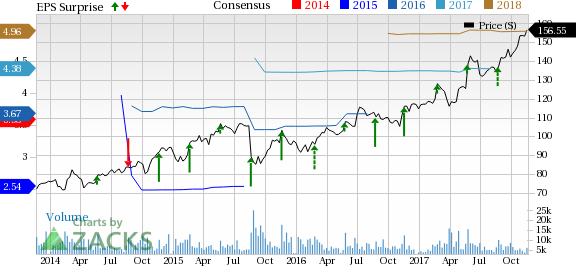

Here’s a graph that looks at Intuit’s Price, Consensus and EPS Surprise history:

Intuit's mission is to revolutionize how people manage their financial activities. The company's objective is to greatly expand the world of electronic finance. Electronic finance encompasses three types of products and services: desktop software products that operate on customers' personal computers to automate financial tasks; products and services that are delivered via the Internet; and products and services that connect Internet-based services with desktop software to enable customers to integrate their financial activities.

Check back later for our full analysis on Intuit’s earnings report!

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius. Click for details >>

Intuit Inc. (INTU): Free Stock Analysis Report

Original post

Zacks Investment Research