Goldman Sachs (NYSE:GS) cut its forecast for US economic growth in this year’s second half, citing slower activity in the services sector and the potential headwind from the spread of the Covid-19 Delta variant. Managing growth expectations down aligns with a new metric developed by CapitalSpectator.com: the US Macro Trend Index (MTI).

MTI uses two business cycle indexes as inputs: ADS Index, published by the Philly Fed, and the Weekly Economic Index (WEI) via the New York Fed. Each index takes a different approach to monitoring US economic activity in real time, using a variety of indicators, some of which are published at daily and weekly frequencies. The goal with MTI is to quantify the degree of deceleration and acceleration in the overall macro trend via ADS and WEI. As such, MTI is not a measure of growth per se, but an indexing quantifying the strength or weakness of the overall trend.

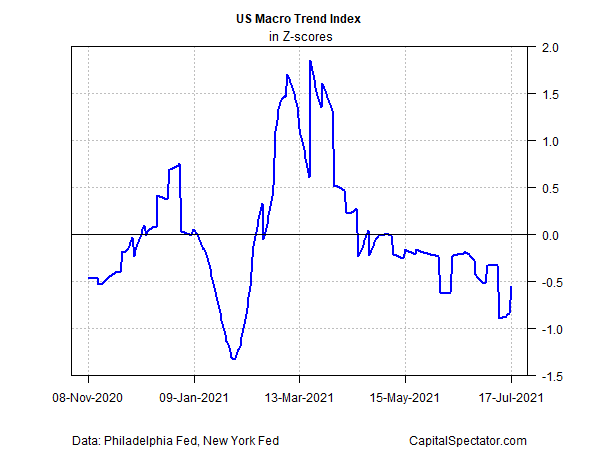

A brief description of MTI’s rules is outlined below. Meantime, here’s a quick summary of what MTI is telling us at the moment, based on the latest data, which runs through July 17.

As the chart below indicates, the trend in economic activity peaked in March and has been sliding ever since. In the last several months, the trend has turned moderately negative. Note that this is NOT an indicator that the economy is contracting. Rather, reading MTI in context with the latest values of ADS and WEI – both continue to reflect economic growth – tell us that a decelerating bias for the expansion prevails.

A negative value for MTI isn’t necessarily a warning sign for the economy. Every business cycle reaches a peak at some point and varying degrees of deceleration/acceleration in the post-peak phase are normal. What’s more, a post-peak expansion can run for years, delivering a healthy phase of expansion.

But it’s also possible that the deceleration trend deepens. A relatively steep, persistent dive in MTI would be a warning sign that contractionary risk is rising. For the moment, that risk remains low. Although MTI is negative, the sub-zero reading is mild and for now it doesn’t appear to be persistent. Combined with the still-positive readings for ADS and WEI indicate that MTI is reflecting slowing growth rather than a deepening contraction.

MTI is a tool for use in developing deeper context for assessing the overall strength or weakness of the current economic trend by way of ADS and WEI. On that front, the US economy’s growth bias is cooling. How far and how fast it cools, or rebounds, is unknown. Whatever comes, MTI will provide context for assessing the trend’s evolution and strength.

Finally, MTI is designed as follows:

1. Calculate the mean of the 1-, 2-, 5- and 10-period differences for ADS.

2. Calculate the mean of the 1- and 2-period differences for WEI.

3. Calculate the mean for 1 and 2; transform to Z-scores on a rolling 1-year basis.