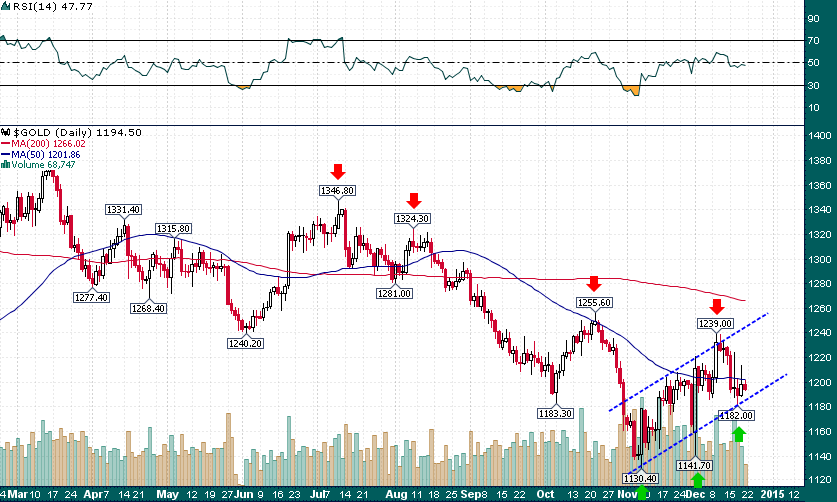

Gold enters the final ten days of 2014 in a very interesting, and far from clear, position. Some observations in no particular order:

- Gold in US dollar terms is down slightly less than 1% year to date while it has actually had a very good year when priced in other currencies

- There is a great deal of confluence around the $1200 level (50-day simple moving average, 2013 closing = $1204.80, important break-even level for many gold producers, etc.)

- Gold has made 3 successive lower highs since topping at $1346.80 during the summer

- A constructive uptrending channel has formed since the November low at $1130.40

- The final days of the calendar year are fairly weak historically for the yellow metal

The larger downtrend is powerful and unmistakable – from my vantage point it will take a decisive rally above $1250 to shift the technical structure of the gold chart bullish on short/medium term time frames. It is anyone’s guess what gold will do during the final days of 2014, however, some modest weakness between now and New Year’s followed by a January rally is our baseline scenario.

As a side note, several mid-tier/junior gold producers were sold down pretty aggressively on Friday (Endeavour Mining Corporation (TO:EDV), Lake Shore Gold Corp. (TO:LSG), Oceanagold Corporation (TO:OGC), etc.) primarily as a result of rebalancing by the Market Vectors Junior Gold Miners ETF (ARCA:GDXJ). (Notice the extremely heavy volume in many of these names during Friday’s trading session). This rebalancing, combined with year end tax-loss selling looks to offer a tremendously attractive buying opportunity in select gold producers/explorers over the coming days.