The following are the intraday outlooks for EUR/USD, EUR/JPY, EUR/GBP, and AUD/NZD as provided by the technical strategy team at SEB Group.

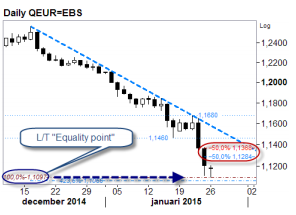

EUR/USD: Testing a long-term 'Equality point'. The correctional rally will likely be sold. The Greek election kicked the euro into a marginally fresh low where a long-term (2011-2014) 'Equality point' likely inspired some buying - no wonder with short-term conditions are stretched as they currently are. But it's less likely that this is enough to scale down further expanded spec shorts (IMM). The near-term rebound faces daily & weekly mid-body points at 1.1285 & 1.1370.

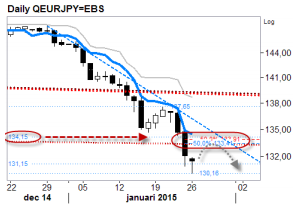

EUR/JPY: Could recheck the mid/high 133s. Too low too fast? - Possibly... The move above local resistance at 132.95 could trigger some light profit-taking and thus set in motion a short-lived reaction to test offers at resistance (133.40/134.15) before selling resumes. Current intraday stretches are located at 130.50 & 133.20.

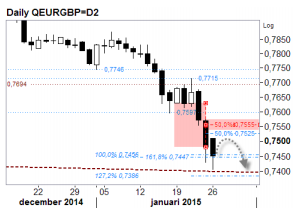

EUR/GBP: Some support at a L/T trendline. A descending 2010-2012 trendline ought to inspire some profit-taking when conditions are so short-term stretches as they currently are. But the bounce may become both short & shallow with daily and weekly mid-body points at 0.7525/55 providing presumed resistance.

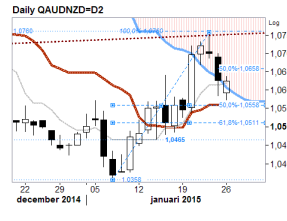

AUD/NZD: Buyers respond to healthy correction. A short-term 'Equality point', long-term trendline recheck and the bearishly tilted short-term 'Cloud' triggered an earlier correction lower which seems to be fading at a short-term 50% retracement ref and the Fibo-adjusted 'Tenkan-Sen' in the mid-1.05s. Buyers' initiative over Fri's 1.0660 mid-body point would once again expose the 1.0760 ref. Additional supports are located at 1.0510 & 1.0465.