The following are the intraday outlooks for EUR/USD, USD/JPY, AUD/NZD and EUR/CHF as provided by the technical strategy team at SEB Group.

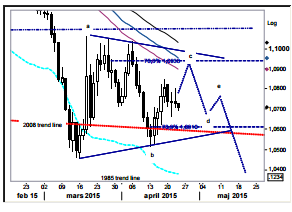

EUR/USD: Best fitted pattern is a triangle. The choppy price action of lately more than hints that we’re in a fourth wave triangle. Triangles are difficult periods were the market are thrown between hope and despair. When the five sub waves, a-e, has been traced out the trend will continue with a downside exit. So following the textbook the pair still should be heading for the low 1.09’s (wave c) where we would like to sell.

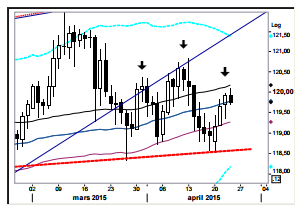

USD/JPY: A lower high? The past days bounce is now meeting headwinds in the upper end of the 55d ma band and ending today below 119.35 will create a bearish key day reversal. There’s also the possibility that a lower high will create a right hand shoulder of a head and shoulders top (which in turn might be the rhs of a larger head and shoulders top).

AUD/NZD: A double bottom! Yesterday’s question mark can now be straightened out to be an exclamation mark. Breaking above 1.0232 will further enhance upside potential and put the broader resistance zone in the limelight. An eventual dip back into the high 1.01’s should be seen as a buying opportunity.

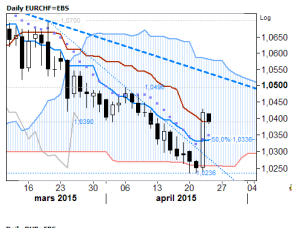

EUR/CHF: BIG SNB inspired reaction. The market already had problems breaking dynamic support at the lower end of the "Cloud". SNB’s decision to widen time deposits to be exposed to negative rates had major short-term impact and resistance at 1.0336 8now mid-body point support) and at 1.0390 were crushed. Expect a small correction lower, respecting support below and then another leg higher, targeting next resistance at the 1.05- mark.