The following are the intraday outlooks for EUR/USD, GBP/USD, AUD/USD and EUR/CHF as provided by the technical strategy team at SEB Group.

EUR/USD: Reaction already completed? The overlapping of 1.0620 was certainly not what we was looking for and the move down to 1.0613 has clearly damaged the case for a continued upward correction. To reinstate a correction case the pair must return above 1.0796 and as long as not doing so a neutral/bearish view persists.

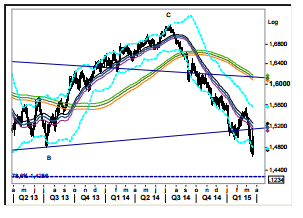

GBP/USD: Rechecked the former triangle floor. The Wednesday spring bottom at least led to a recheck (and validation?) of the previously broken B-wave triangle floor. We should perhaps expect to see some further consolidation between the recent low point and the triangle floor i.e. within Wednesday’s range (1.4635-1.5155) before continuing the descent towards next the 1.40-area (long term key support).

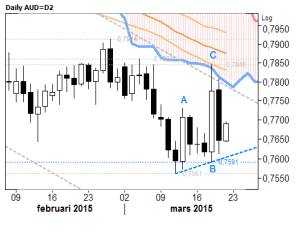

AUD/USD: Keep a close eye on the 0.7591 low. With overhead dynamic resistance (55day exponentially weighted moving average band & low end of the Fiboadjusted "Cloud"), it looks like an admittedly volatile, but still corrective structure up from the Mar11 low. In this perspective the intermediate low at 0.7591 becomes a "Bwave low" which if broken would spell fresh lows – initially towards a long-term "Equality point" at 0.7510, but in the weeklies more ambitious targets can be traced out in the lower 0.73s.

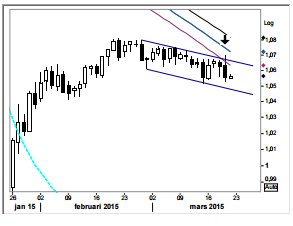

EUR/CHF: The key day reversal points lower. Yesterday the pair made a false break higher, was rejected from the bearishly sloped 55d ma band and ended the day with a bearish key day reversal. In the hourly chart there’s also a completed (given the violation of 1.0561) three wave corrective pattern higher. The conclusion must hence be that the pair now will be making an attempt to push lower during the coming days and that at least a test in the 1.0470-area will be seen. GBP/CHF also seems to be turning the corner to the downside.