The following are the intraday outlooks for: EUR/USD, EUR/JPY, GBP/USD, and AUD/NZD as provided by the technical strategy team at SEB Group.

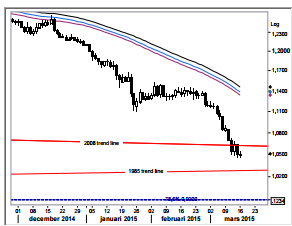

EUR/USD: Another minor bounce. The minor correction higher (triggered by the early Thursday false break below 1.0511) was confirmed completed by the move back below 1.0580. Accordingly prices thereafter continued to decline printing a new trend low at 1.0457. The now broken, rechecked and validated 2008 trend line has paved the way for a go at the 1985 (Plaza accord) trend line which is running at ~1.0290. The current minor bounce will be confirmed completed below 1.0480 but will probably initially try to push somewhat higher (1.0565? 89?) before stalling.

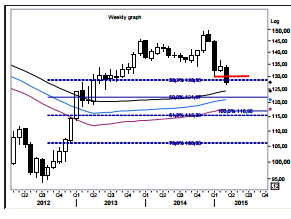

EUR/JPY: An important weekly downside break. The break and weekly close below 130.16 made us pass another milestone in this bear move (also the passing of the 38.2% Fibo reaction point highlights more downside potential). The next major point of attraction will now be the 50% Fibo reaction point, 121.97 and/or the 2013 correction low area, 119.12/118.74.

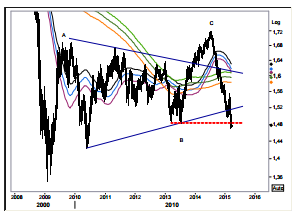

GBP/USD: An important junction passed. The successful passing of the 1.4814 (2013 low point) was a very important step in the development of the bear trend originating from the end of wave C (1.7192). The break not only confirm a continued move lower (on a medium – long term basis) to 1.4228 but also confirms that the 2009 low point, 1.3500 will be passed in due time.

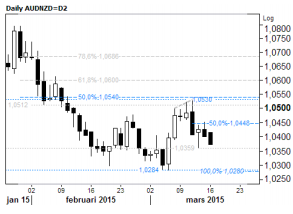

AUD/NZD: Loss of 1.0360 would target Sellers seem to control the cross again and a loss of support at 1.0360 would be a sell for, at least, 1.0280 – if it’s protected with a buy-stop over 1.0450. Current intraday stretches are located at 1.0330 & 1.0455.