The following are the intraday outlooks for EUR/USD, EUR/JPY, EUR/CHF, and GBP/USD as provided by the technical strategy team at SEB Group

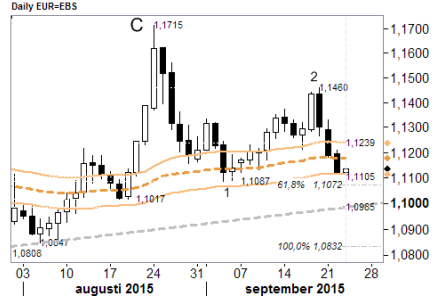

EUR/USD: Taking on support around 1.11. A 3rd consecutive lower was added yesterday, putting pressure on supports in the 1.1105/1.1072-zone. Below those would move the target cursor further down towards 1.1017/1.0985. Current intraday stretches are located at 1.1055 & 1.1225.

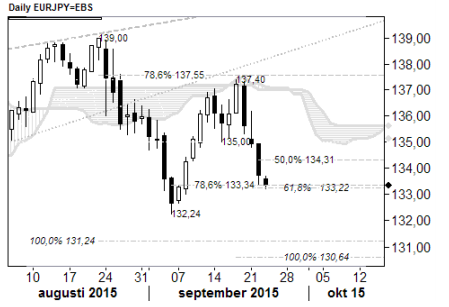

EUR/JPY: Challenging a prior 132.24 low. The pair is falling hard and it seems like supports at 133.34/22 has a chance as bigas an ice cube in hell to withstand pressure. This puts the early Sep low of 132.24 in harm's way - under which extension should be penciled in towards objectives at 131.24 & 130.64. Mid-body resistance at 134.31. Current intraday stretches are located at 132.75& 134.75.

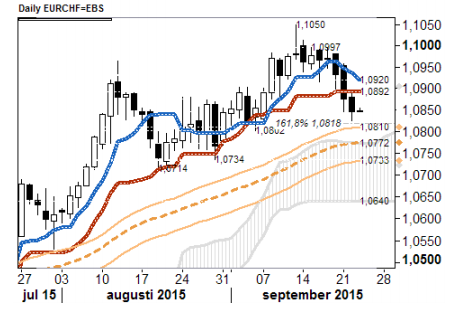

EUR/CHF: Seeking a 1.0818/772 correctional low. The euro got it on the chin here too again yesterday and this puts Fibo/dynamic support at 1.0818/1.0772 under some pressure, but buyers ought to find this area interesting enough to be able to shore up losses to prevent a full fledged test of supports at 1.0734 & 1.0714. A move through dynamic resistance at 1.0892920 and later also 1.0997 is 1,0600 however needed to show renewed buyers' initiative.

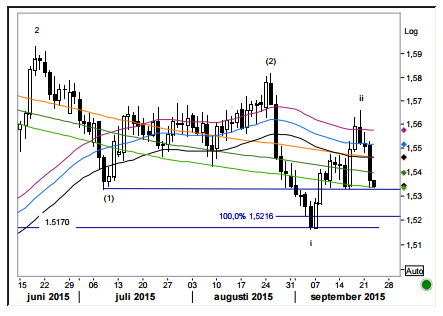

GBP/USD: Breaking 1.5330 could be violent. The pair continues to build downside pressure and after yesterday's impulsive decline prices are only a whisker away from the important 1.5330 support. With the wave build-up of a series of 1-2's (1-2, (1) -(2) and i, ii) a break of 1.5330 could very well trigger a rather impulsive selloff (with the next key support at 1.5170).