The following are the intraday outlooks for EUR/USD, EUR/CHF, and EUR/GBP as provided by the technical strategy team at SEB Group.

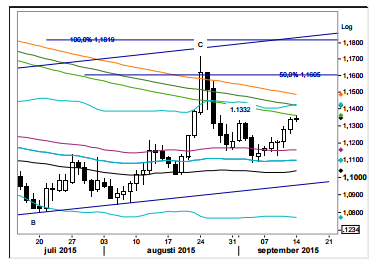

EUR/USD: Still on a rising path. The break above 1.1332 indicates that the week will begin with the pair edging higher still (the next resistance of interest is 1.1400, the 50% correction point of the entire Aug/Sep decline). So look for buying to level off closer to 1.14 and thereafter a new attempt to end the correction.

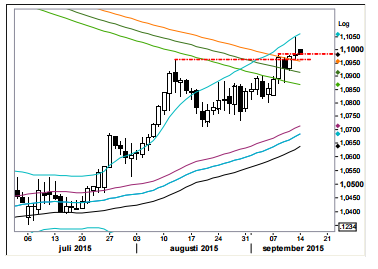

EUR/CHF: Failed above the prior tops. An attempt higher on Friday (moving to the highest level since the day the peg broke down) seems to have failed with an up-thrust top put in place. The false break higher indicates that there’s now a high risk for continued selling near term and a close below 1.0969 today will add to that view by creating a bearish engulfing candle.

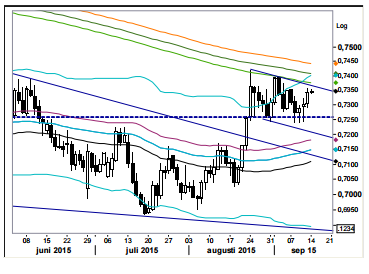

EUR/GBP: Bull flag in progress. Firstly the rise from the July low doesn’t look completed in wave terms and secondly the past weeks consolidation looks (and should be treated) as a bull flag as long as not falling beneath 0.7240. A break above, which we find likely, 0.7395 should at least call for a revisit at the May top, 0.7482.