The following are the intraday outlooks for USD, EUR/USD, USD/JPY and AUD/NZD as provided by the technical strategy team at SEB Group.

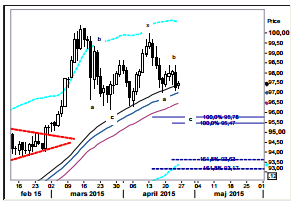

DOLLAR INDEX: A bit more complex reaction. Instead of the triangular consolidation that €/$ is tracing out the $ index seems to be following the path of a so called double zigzag (two upon each other following a-b-c corrections) and as such probably is targeting the 95/96- area (where the bull trend is seen resuming). A move below 97.00 will further enhance such an outcome. An alternative outcome is of course that we will remain in the current range hence creating a bull triangle.

EUR/USD: Following the triangle path. After an initial dip the pair continued to trade higher (within wave c of the triangle). The bullish key day reversal candle (here seen as an upside continuation pattern) argues for more buying within shortly so look for a similar price action as yesterday with an initial dip (i.e. intraday traders should be looking to pick up a few euros on this dip 1.0789-75) and thereafter another move higher. The triangle scenario calls for the move higher to stall in the 1.0940-area.

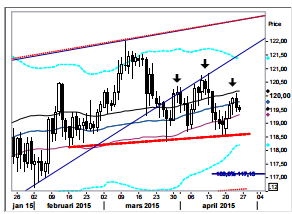

USD/JPY: An increasing downside risk. With yesterday’s bearish engulfing candle it now appears as we’ve got a lower high. The downside pressure should hence be increasing calling next for an attempt to move below the 119.35 support. Ultimately the pair should be falling down below 118.33 (and preferably to 117.15) before the correction possible completed.

AUD/NZD: Targeting 1.034060 next. The cross has entered dynamic resistance in the 55day exponentially weighted moving average band (1.02601.0340) and the upper end of this zone coincides with an earlier high, so this level works well as the next objective above together with the low end of the "Cloud" and a short-term 161.8% Fibo projection ref at 1.0360. Prior resistance at 1.0220 should attract bids as should levels at 1.0185/65.