The following are the intraday outlooks for the USD Index, EUR/USD, EUR/JPY and EUR/CAD as provided by the technical strategy team at SEB Group.

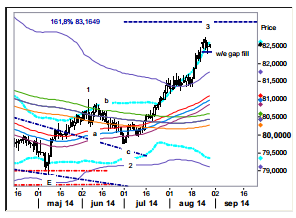

US Dollar Index: Filled the weekend gap. The weekend gap (82.33-58) was yesterday filled and the buyers were returning at the low end of it hence preventing a sell signal to be triggered. The behavior leaves us in kind of a stalemate where the overbought and stretched conditions continues to warn of a coming setback whereas the price action at 82.33 suggests continued buying up to the theoretical wave three target, 83.16 (and then beginning the more profound correction).

EUR/USD: So far not much of a reaction. Yesterday’s initial attempt higher stalled already at 1.3222, hence not even filling the weekend gap to 1.3240. The reasons (see yday’s TA) for a bit more profound upward reaction however prevails so we still recommend shorts to trim down positions and especially so if a marginally new low will be traced out.

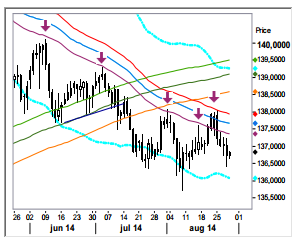

EUR/JPY: Small rebound then lower. The recent upward attempt, like many others, again ended in the bearishly sloped 55d ma band and after Monday’s bearish key day reversal the pair has traded lower each and every day. Yesterday however a minor reaction higher begun and we primarily sees it ending at 136.95. The awaited selling response will be interesting to follow as a close today below 137.00 will create a weekly bearish engulfing candle and if ending below 136.82 a bearish key week reversal will be put in place. Both outcomes strongly argue for lower levels in the month to come.

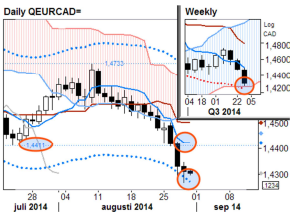

EUR/CAD: Time to deal with the stretches. Both in the dailies (short-term) and in the weeklies (medium-term) the cross has come a long way now and support and stretches in those timeframes ought to have impact. Trend-following tools point lower, but a healthy rebound to at least 1.4410 would be welcome to clean out a few late and vulnerable shorts.