Happy Memorial Day. I shall again try to squeeze some blood from the stone known as a 3-day weekend and offer up a thought or two. These charts are intraday graphs of a few ETFs I find intriguing.

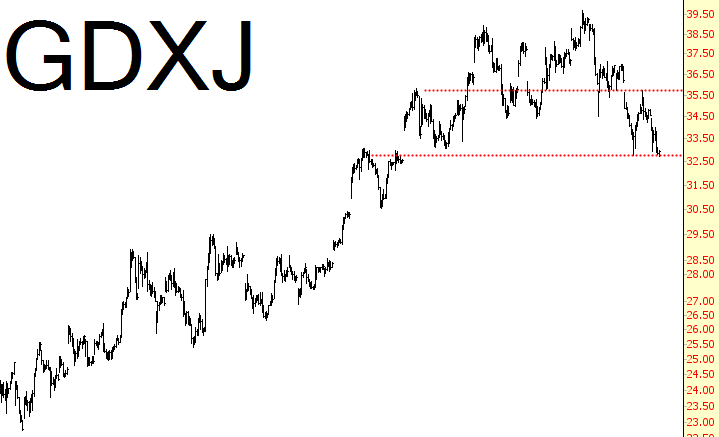

First up is the junior miners (MX:GDXJ), which look just about ready to break lower. Precious metals have been a mess lately, and the chart below looks poised to break down to about $27.

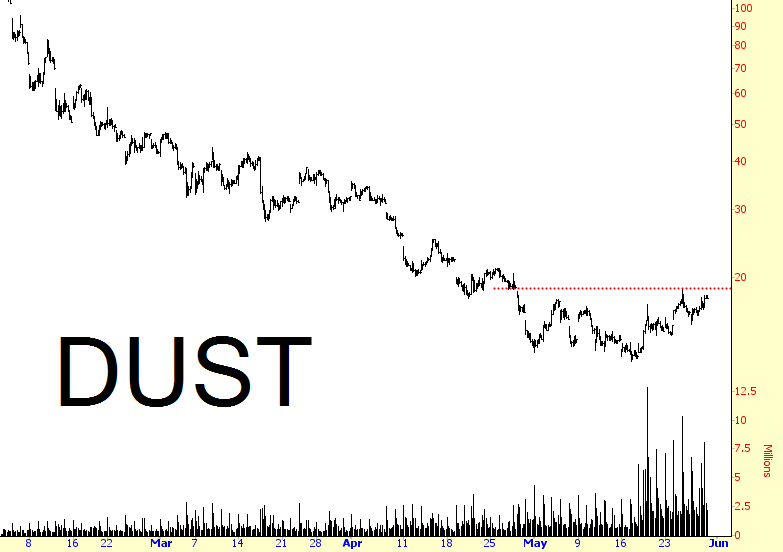

Similarly, the triple-inverse fund on miners (NYSE:DUST), shown below, looks ready to roar higher. Indeed, take a good look at the volume lately. People are falling all over themselves to get into being a mining bear, and I think the crowd is right.

There has been a huge bull market is self-assurance lately. The NASDAQ:XIV, which is volatility’s inverse, has been steadily surging from the February 11th lows, having more than doubled in price already. The XIV is making obscene gestures at the bears and screaming we are all hand-wringing, chicken-little-imitating idiots.

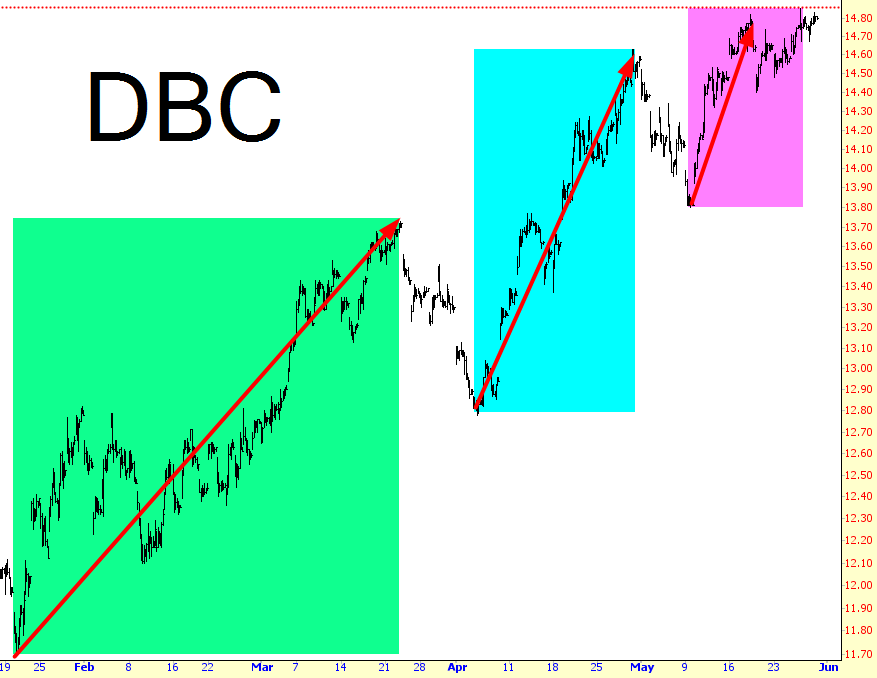

Commodities (NYSE:DBC), too, have been strong for months now, but please take note of the diminishing verve. Each successive lurch higher has been weaker and shorter-lived than the one prior. I think (or at least hope) that energy in particularly is done with its springtime ascent.