Silver

The dollar traded unchanged, or lower, against its other G10 counterparts during the European morning as investors reversed the recent risk-off trades. It depreciated against the NOK, SEK, EUR, AUD and GBP, while it remained near its opening levels against NZD, CAD, CHF and JPY.

The story that ended, or at least paused, the risk-off trades was the report that President Putin ordered an end of military exercises. Gold, silver, and oil responded to the news and fell sharply. Furthermore, all the European stock markets were higher and the Eastern European currencies (RUB, PLN and HUF) that had suffered recently were the main gainers among the EM representatives.

Once again the economic indicators were left on the sidelines. GBP did not respond to the larger-than-expected fall in the UK’s construction PMI for February, while EUR ignored the miss in the Eurozone PPI for January.

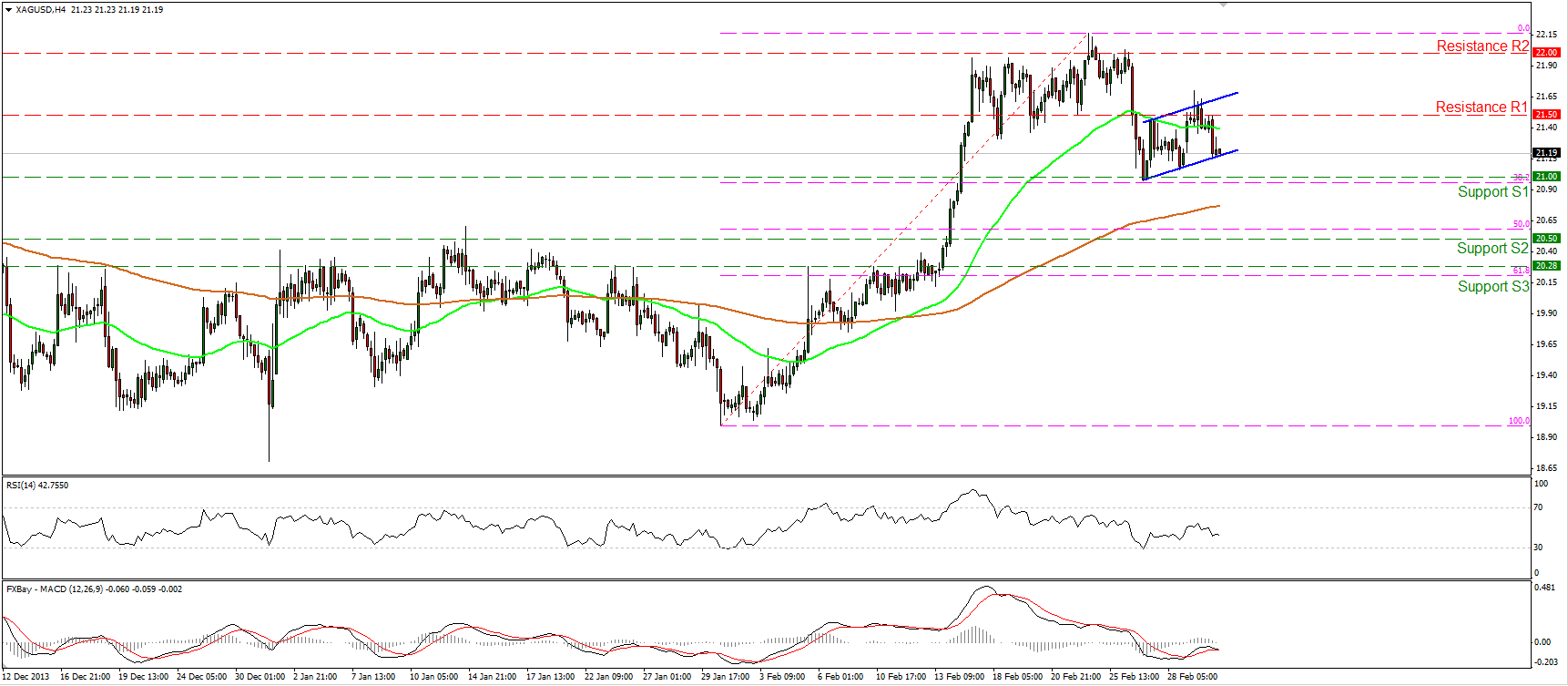

Silver seems to be trading within a bearish flag formation. A clear dip below the lower boundary of the possible flag and the strong support of 21.00 (S1), which coincides with the 38.2% retracement level of the 3rd -24th Feb. rally, may pave the way towards the 50% retracement barrier near the hurdle of 20.50 (S2). The MACD, already in its bearish territory, seems ready to cross below its signal line, confirming the recent negative momentum of the white metal.

Support: 21.00 (S1), 20.50 (S2), 20.28 (S3)

Resistance: 21.50 (R1), 22.00 (R2), 23.00 (R3)