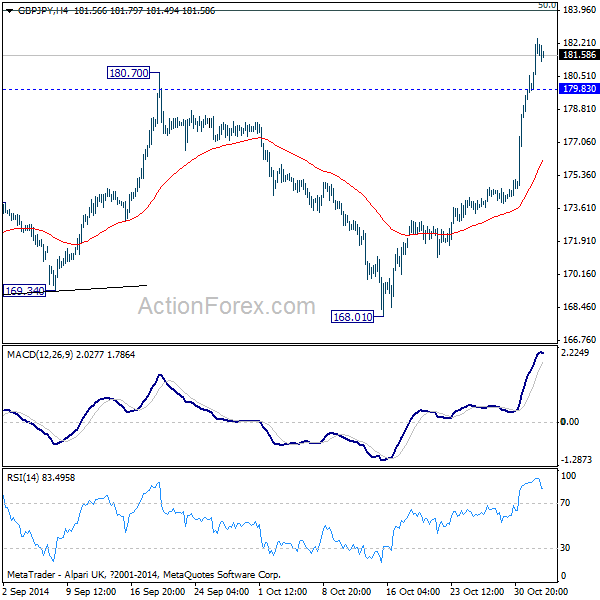

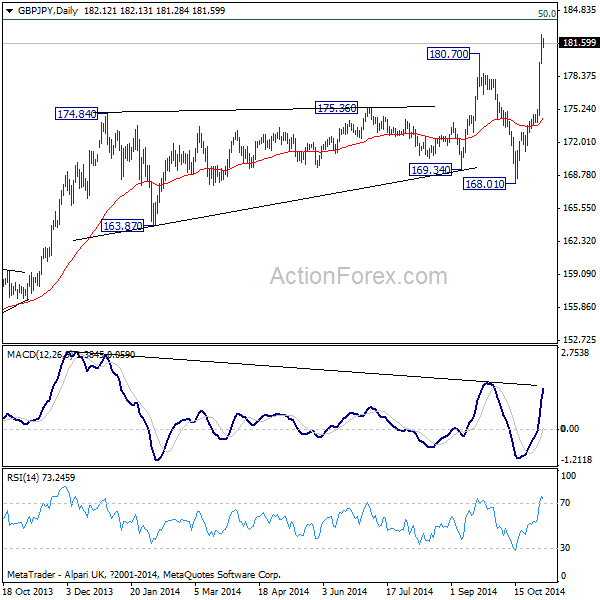

GBP/JPY Daily Outlook

Daily Pivots: (S1) 180.34; (P) 181.42; (R1) 183.20;

Intraday bias in GBP/JPY remains on the upside for the moment. The larger up trend from 116.83 has just resumed and is targeting next long term fibonacci level of 183.96. On the downside, below 179.83 minor support will turn bias neutral and bring some consolidations before staging another rally.

In the bigger picture, the strong support form 55 week EMA argues that up trend form 116.83 is still in progress. Break of 50% retracement retracement of 251.09 to 116.83 at 183.96 will pave the way to 61.8% retracement at 199.80, which is close to 200 psychological level. On the downside, nonetheless, break of 168.01 should now confirm medium term reversal.

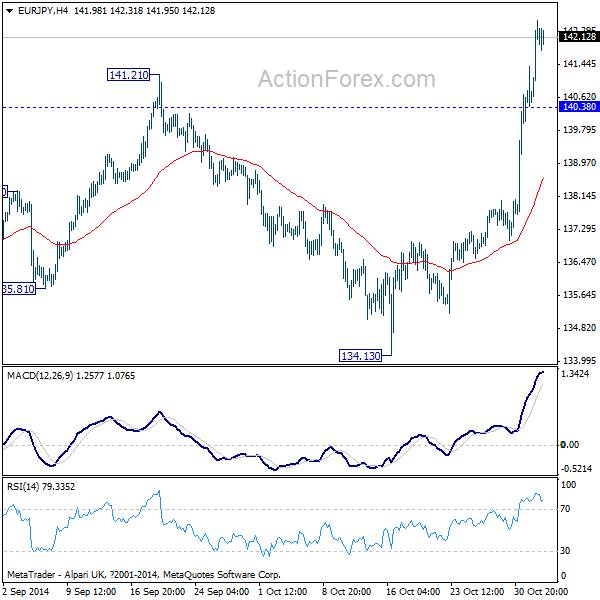

EUR/JPY Daily Outlook

Daily Pivots: (S1) 138.63; (P) 139.70; (R1) 141.74;

Intraday bias in EUR/JPY remains on the upside for the moment. As noted before, the consolidation pattern from 145.67 is finished at 134.13 already. Current rally should extend to retest 145.68 resistance next. On the downside, below 140.38 minor support will turn bias neutral and bring consolidations first before staging another rally.

In the bigger picture, the failure to sustain below 55 weeks EMA and last week's strong rebound argues that up trend from 94.11long term bottom is still in progress. And, it's possibly ready to resume too. Break of 145.68 will target 76.4% retracement of 169.96 to 94.11 at 152.59 next. Nonetheless, break of 134.13 support will extend the corrective pattern from 145.68 lower to 38.2% retracement of 94.11 to 145.68 at 125.98.