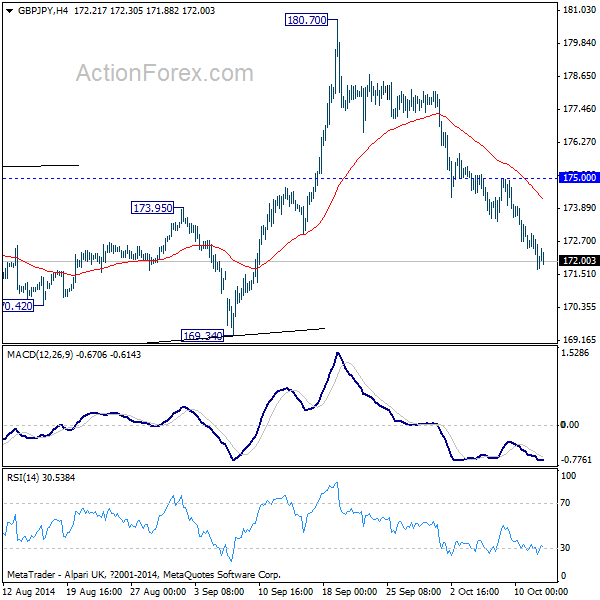

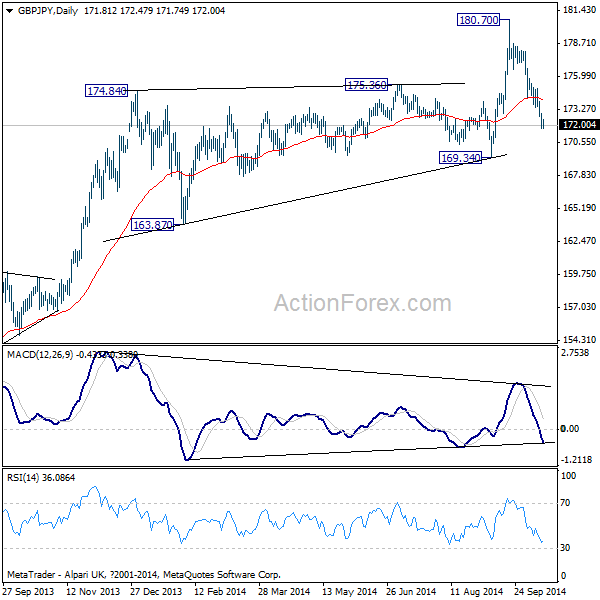

GBP/JPY Daily Outlook

Daily Pivots: (S1) 171.37; (P) 172.18; (R1) 172.66;

Intraday bias in GBP/JPY remains on the downside for 169.34 key support level first. Decisive break there will indicate larger trend reversal and turn outlook bearish. On the upside, above 175.00 minor resistance will turn bias back to the upside for 180.70 instead.

In the bigger picture, there is no clear sign of reversal yet and up trend from 116.83 low is still in progress. Such rise could target 50% retracement retracement of 251.09 to 116.83 at 183.96 and possibly further to 61.8% retracement at 199.80. However, break of 169.34 key support level will confirm medium term topping and turn outlook bearish for pull back.

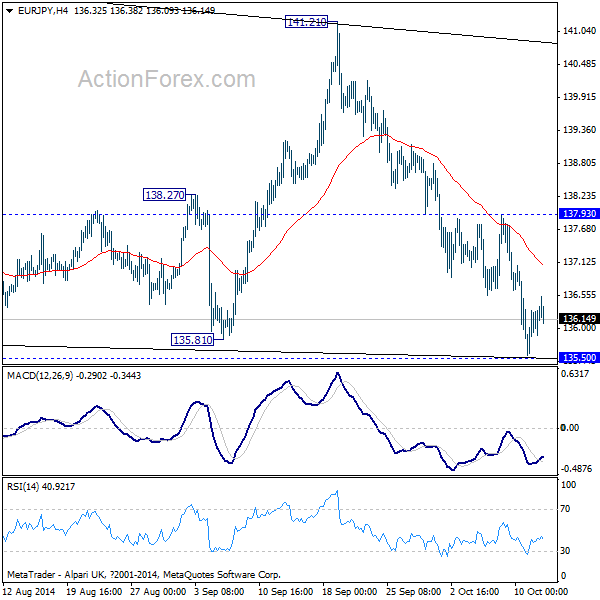

EUR/JPY Daily Outlook

Daily Pivots: (S1) 135.73; (P) 136.02; (R1) 136.49;

With 4 hours MACD crossed above signal line, intraday bias in EUR/JPY is turned neutral first. Price actions from 145.68 is probably developing into a triangle pattern with fall from 141.21 as the last wave. Break of 137.93 resistance will indicate near term reversal and turn bias back to the upside for 141.21 resistance. However, sustained break of 135.50 key support level will carry larger bearish implications.

In the bigger picture, EUR/JPY is back pressing 55 weeks EMA for the moment. But still with 135.50 support intact, the up trend from 94.11 long term bottom is still in progress. Break of 145.68 will target 76.4% retracement of 169.96 to 94.11 at 152.59. On the downside, again, sustained break of 135.50 key support level will confirm medium term reversal and would target 124.95 support and below.