The AUD/USD is heading towards the 0.9282 key support level.

The dollar was higher against all its G10 counterparts during the European morning. The main losers were the AUD, SEK and NZD with the former depreciating the most. Sweden’s better-than-expected unemployment rate didn’t manage to drive the USD/SEK lower. The SEK strengthened after the release, but lost all its gains, and even more, immediately thereafter. Preliminary Q3 GDP releases for Germany, Italy and Eurozone as a whole came out in line with expectations. Only France’s figure came out less than expected. No major move was recorded from the euro. GBP declined after UK retail sales for October unexpectedly fell more than forecast (-0.6% mom actual vs -0.1% mom est.). USD/JPY reached 100.00 as Japanese stocks surged.

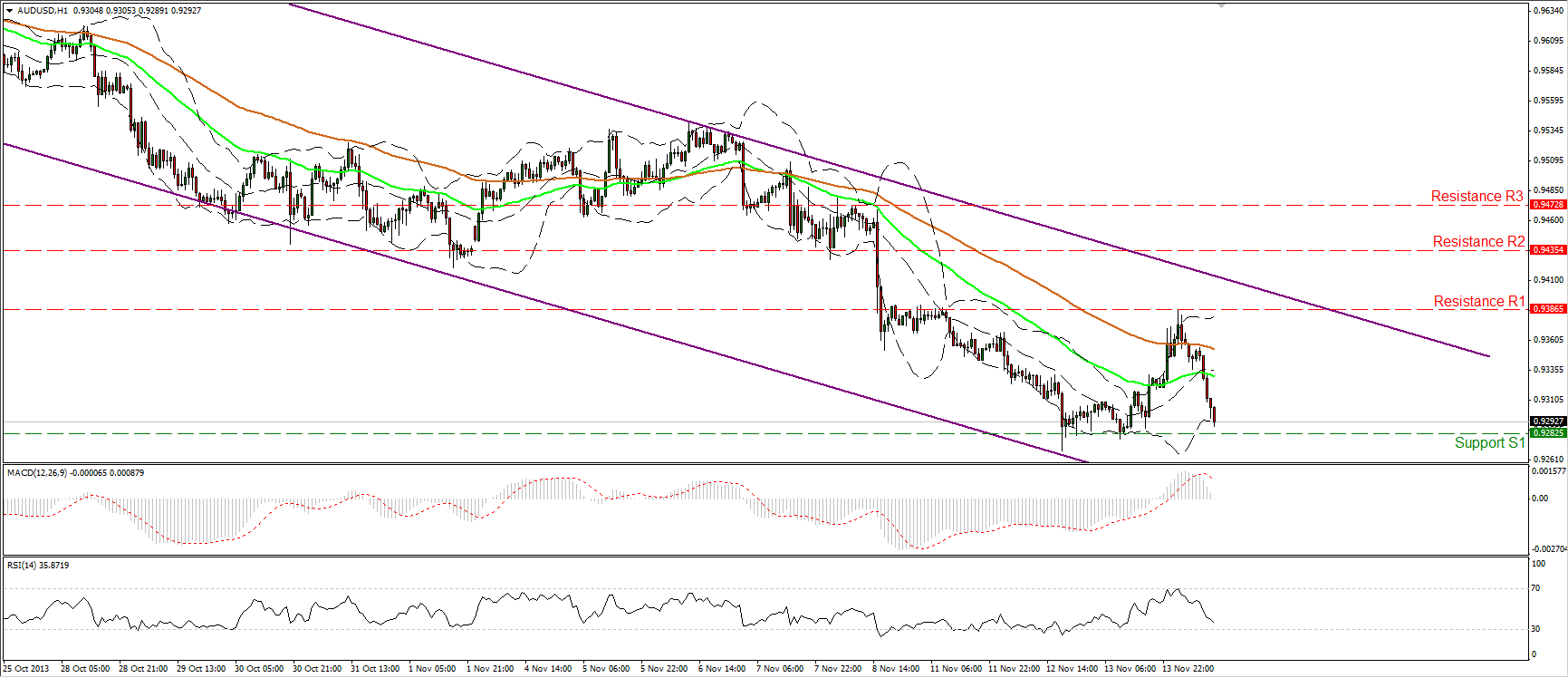

The AUD/USD moved significantly lower during the European morning and is currently heading towards the 0.9282 (S1) key support level. The last time we had a daily close below that barrier was back on the 13th of September. The overall trend of the pair is a downtrend as indicated by the purple downward sloping channel, and in my opinion we should wait to see if the bears are strong enough to overcome the aforementioned hurdle in order to make any assumptions for the continuation of the trend.

• Support: 0.9282 (S1), 0.9223 (S2), 0.9167 (S3)

• Resistance: 0.9386 (R1), 0.9435 (R2), 0.9472(R3) AUD/USD Hour Chart" title="AUD/USD Hour Chart" width="1732" height="748" />

AUD/USD Hour Chart" title="AUD/USD Hour Chart" width="1732" height="748" />

Disclaimer: This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients’ orders. This material is just the personal opinion of the author(s) and client’s investment objective and risks tolerance have not been considered.

IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited. Risk Warning: Forex and CFDs are leveraged products and involves a high level of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent advice if necessary. IronFx Financial Services Limited is authorised and regulated by CySEC (Licence no. 125/10). IronFX UK Limited is authorised and regulated by FCA (Registration no. 585561). IronFX (Australia) Pty Ltd is authorized and regulated by ASIC (AFSL no. 417482)