Below follows an excerpt of the 16-paged interview.

English: http://www.rockstone-research.de/research/Interview_with_David_C_Mathewson_2013.pdf

BACKGROUND - From Hunting to Catching Invisible Elephants in Nevada

In early 2011, we did our first interview with senior geologist David C. Mathewson, Vice President of Exploration with Gold Standard Ventures Corp. (GSV). Almost 3 years later, we could not hold our horses any more to ask some of the many newly emerged questions that rush into mind when reading through the news that this second-to-none exploration company released since then. Dave's answers are fascinating to say the least and uncurtain the kind of once-in-a-lifetime opportunity that investors are exploring for so desperately, especially since the last couple of years.

Gold Standard Ventures Corp. is a company that was founded and is managed by two outstandingly smart entrepreneurs, namely Jonathan Awde and Luke Norman, who both deserve endless credit for their brave vision and hard work to perfectly coalescing a public company with the prospects of the Railroad property. This was uniquely achieved thanks to both their one-of-a-kind vision and conceptualized mission, experience and expertise, as well as delicate and fair negotiation skills, having all resulted in successfully consolidating and acquiring the Railroad District besides delivering the results to the market in such a prudent and wise fashion that other exploration companies can take a leaf out of their book. The shareholder structure of the company, that both are responsible for, speaks for itself and is a prime example and the result of how a public exploration company should be run.

The whole corporate and exploration team behind this company is a seemingly inimitable textbook-like example of how a junior exploration company should be shaped, yet we are sanguine that they are merely paving the pioneer way of becoming the "gold standard" for the mining industry of tomorrow on how to venture a prospective guess.

The company's stock just started thriving despite precious metal prices correcting once again. We expect this outperformance to the general mining market to remain open-ended and don't even dare to imagine how the share price may bloom during booming metal prices.

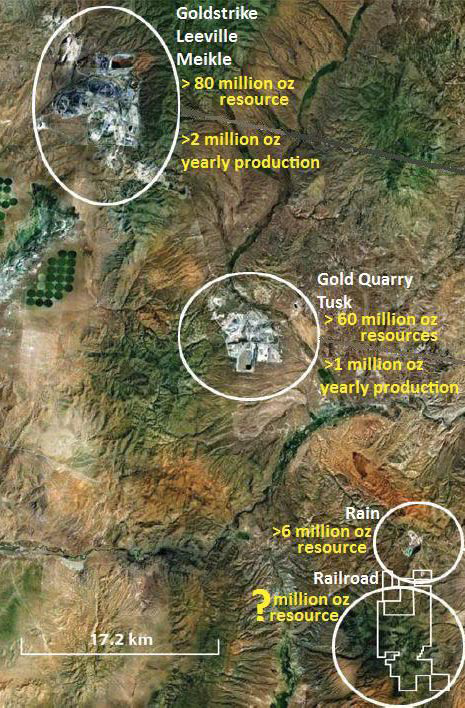

Since our last interview, Dave and his team not only discovered the North Bullion deposit - that is likely to turn out to be larger than Newmont's Rain Mine (+6 million gold ounces) in operation only a stone's throw away - but they have recently unleashed the vast potential of soon discovering several other gold deposits, just like North Bullion, on their +10 km long Bullion Fault Corridor:

On October 2, the company reported highly important drill results from the center of its large Railroad property, also known as the Central Bullion target area or more specifically the Bald Mountain dome, where gold and copper were encountered in two separate zones of mineralization indicating the presence of a mineralized porphyry intrusion that is outcropping at surface. This central area may not only represent a separate mineable deposit in completely oxidized rock (faster and cheaper to mine besides easier to permit) with potentially several polymetallic deposits surrounding it, but this large porphyry intrusion seems to have supplied the necessary heat and fluids to be the engine behind mineralizing distal gold deposits, just like North Bullion, so richly.

"We consider Railroad to be one of the few quality Tier 1 (+20moz potential) drill hole plays in the market." (Macquarie Capital Markets Canada Ltd. on October 3, 2013)

Live Chart: http://scharts.co/19TrOx6

INTRODUCTION

David Mathewson is one of the most renowned and respected geologists when it comes to Nevada - not only because he was the Head of Exploration for Newmont in Nevada and now already having an experience of +35 years focusing on this single US state. Numerous discoveries (+25 million gold ounces) on the Carlin Trend are credited directly to his hands-on work and knowledge. He also developed the famous and now commonly-used "Rain Model" on the prerequisites for the existence of Carlin-type gold deposits.

"I helped found and committed to become part of Gold Standard Ventures when it was evident that we were going to be able to acquire the Railroad district property. The Railroad district is located immediately south and adjacent to the Rain district on the Carlin Trend. I have many times referred to them both as "sister" districts because of their proximity to each other and their almost identical geological characteristics. In the past, Railroad has been very underexplored with none of the tools or ideas that worked so exceptionally well in the Rain District ever having been applied to Railroad. From 1992 through 1994, I worked the Rain district for Newmont and was responsible for discovering several new gold deposits, comprising 4 to 5 million ounces. During this time and later while with Newmont, I tried several times to acquire Railroad on behalf of Newmont for the purpose of exploring what I recognized many years ago as a very high potential district. At that time, the economic encumbrances of excessive gross royalties, in places exceeding 10%, could not be overcome. Gold Standard Ventures acquired the property in 2009 with very reasonable underlying royalties." (David C. Mathewson in an interview on February 19, 2011)

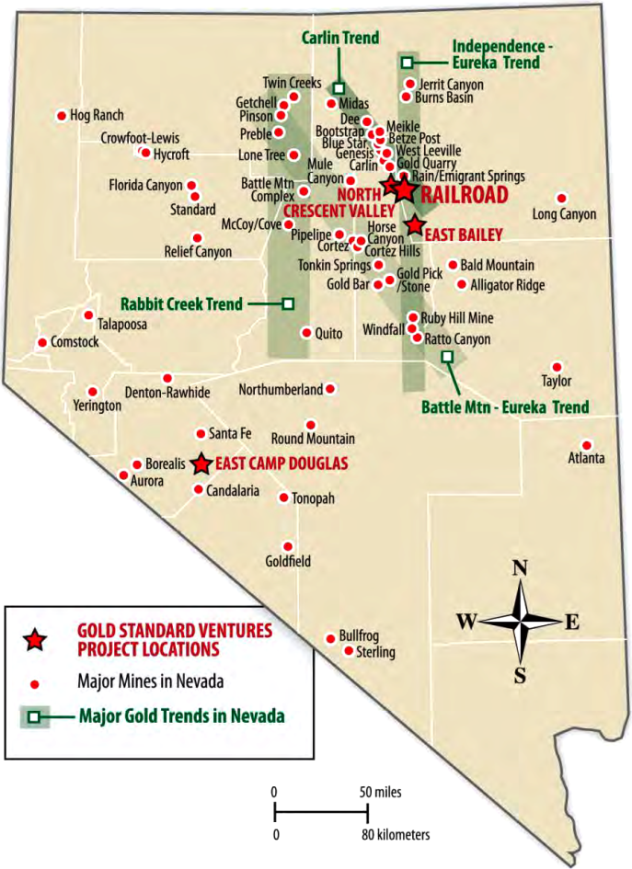

Interestingly, the Railroad district - which today is almost completely controlled by GSV - represents the last vastly underexplored district on the "Carlin Trend" that was once even called the "Railroad-Pinion Trend". This is due to the fact that Railroad was not available to companies as strong hands held it until GSV successfully acquired and consolidated this district for their shareholder's sole benefit.

The rich and large Carlin-style gold deposits of Nevada were once overlooked by the 49ers in the late 1800s when rushing along Nevada's Emigrant Trail to the gold fields of California. It was not until 1961 when commercial production started from Carlin-type gold mines. Both is due to the fact that Carlin-style gold occurs microscopic - only a few microns in size and thus invisible to the naked eye. While the gold grades at many Carlin-type deposits is extraordinarily high, no metal detector can notice micron-sized gold particles. Not even a gold pan can capture these. Only fire assay of sampled or drilled rock can reveal the gold without any difficulty. The obscure gold particles on the Carlin Trend were deposited so quickly near surface that they had no time to grow larger. While the gold is not visible, the deposits are typically located along several trends that constitute the world's second largest concentration of gold, after the Witwatersrand Gold-Uranium Reef in South-Africa.

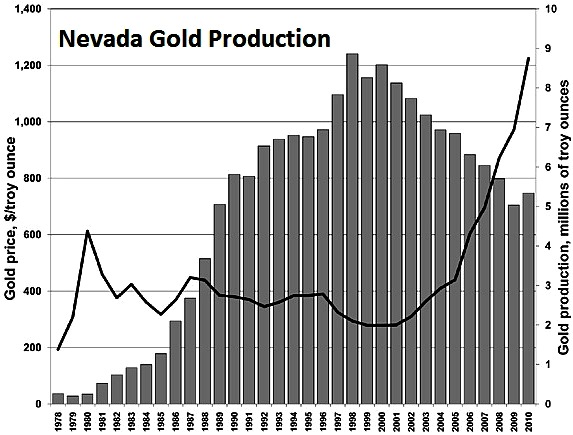

Carlin-type deposits dominate US gold production and have been responsible for the position of the United States as a leading gold producer. With around 6% of global mine output, Nevada even ranks among the Top-10 largest gold producing countries. However, on an acre-per-acre basis, the north-eastern quadrant of Nevada, where 85% of the state's output comes from, is the most productive gold mining area on the planet.

More than half of Nevada's annual production originates from the Carlin Trend, where more than 40 deposits have been discovered and developed into mines since 1961, when the Carlin deposit was found. Since then, more than 100 geologically similar Carlin-type deposits containing +200 million ounces (6,000 tons) of gold have been identified in Nevada. Most of these deposits occur in a few linear-occurring districts, known as trends. Although a number of deposits around the world are described as Carlin-type, no district outside Nevada contains similarly large and numerous gold deposits.

Nevada has become to gold what Saudi Arabia is to oil with the difference that a lot of gold remains to be discovered. Nevada's total gold output over the last 160 years is greater than any other American gold rush, even California; yet this was achieved predominantly during the last 30 years.

On a per "Dollar spent on exploration" basis, Nevada is the cheapest place in the world to find gold and has the world's highest success rate for new gold discoveries. Discovery rates have averaged 7 million gold ounces per year during the last 30 years. Until today, seven gold deposits with +20 million ounces have been identified in Nevada. Between 1835-2008, some 150 million gold ounces were mined in the "Silver State". In 2011 alone, Nevada's mine output exceeded 6 million gold ounces representing 83% of total US mine output . The biggest Nevada miners are Barrick and Newmont, whereas 22 major processing facilities are currently in operation. In 2011, the Carlin Trend accounted for 43% of Barrick's and 34% of Newmont's worldwide gold production - it was Carlin-type deposits that made Barrick and Newmont the world's biggest gold miners as this region hosts many of the largest and most profitable gold deposits of the world.

"With a long history of mining, land ownership has changed significantly and advances in geological models have created opportunities in areas where historical exploration had not identified the potential for significant mineralization-especially blind deposits… It is rare for a junior precious metals explorer to secure a prospective, large, 100%-controlled land position in a productive gold trend, let alone the Carlin Trend. If Gold Standard Ventures can document a significant gold system then we believe the seniors will look to consolidate the Railroad project as it could become highly strategic to Nevada growth prospects, especially for the producers with processing facilities." (Macquarie Capital Markets Canada Ltd. on August 2, 2012)

THE INTERVIEW

Stephan Bogner (SB):

Please explain the significance of the North Bullion (NB) deposit discovery and the potential of numerous other gold deposits like NB along the +10 km Bullion Fault Corridor (BFC).

David C. Mathewson (DCM):

The North Bullion (NB) deposit is the first major north Carlin-style discovery in the Railroad District although hints of similar-style deposits were indicated by the small POD deposit and somewhat, but not so much, the Pinion deposit. Only a small portion, i.e. 1 km of the +10 km Bullion Fault Corridor (BFC) has received any prior drilling specific to targets along the BFC. The discovery of the NB deposit, that is still being expanded by drilling, was what may be considered a "breakthrough" discovery. The deposit is the biggest discovered to date in the district and has all the characteristics of the bigger and richer of Carlin-style deposits in Nevada. Interestingly, essentially every gold district in Nevada has had a history of the smaller deposits being discovered first because they are located and sometimes exposed within the ranges. The larger deposits are generally discovered later because they are under cover within big structural zones that tend to flank the ranges.

The complete interview is available in English and as a German translation with the following links:

English: http://www.rockstone-research.de/research/Interview_with_David_C_Mathewson_2013.pdf

German: http://www.rockstone-research.de/research/Interview_mit_David_C_Mathewson_2013.pdf

If interested to read the first interview we did in 2011, please click here for the German or English version.

Disclaimer: Please read the disclaimer within the PDF or visit www.rockstone-research.com

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Interview with Gold Standard Ventures’ Chief Geologist

Published 10/22/2013, 12:49 PM

Updated 07/09/2023, 06:31 AM

Interview with Gold Standard Ventures’ Chief Geologist

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.