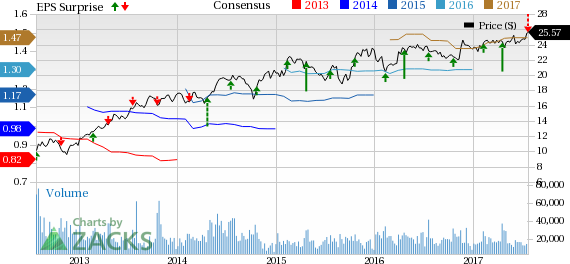

The Interpublic Group of Companies, Inc. (NYSE:IPG) reported dismal second-quarter 2017 results with GAAP earnings of $94.7 million or 24 cents per share, down from $156.9 million or 38 cents per share in the year-earlier quarter. The year-over-year decrease was primarily due to lower revenues.

Adjusted earnings were $107.8 million or 27 cents per share compared with $137.2 million or 33 cents per share in the year-ago quarter. Adjusted earnings also missed the Zacks Consensus Estimate of 34 cents.

Revenues

Revenues for the reported quarter were $1.88 billion, down 1.7% from the prior-year period. The decrease was due to negative foreign currency translation effect of 1.1%. Also, net divestures negatively impacted revenues by 1%. Quarterly revenues missed the Zacks Consensus Estimate of $1.96 billion.

Geographically, Interpublic reported revenues of $1.16 billion in the U.S., a decline of 0.7% and $0.72 billion in international markets, a fall of 3.3%.

Margins

Operating income decreased to $206.5 million from $224.3 million in year-ago quarter, due to increase in salaries and related expenses. Operating margin declined to 11% from 11.7% in the prior-year quarter. It also decreased 70 basis points (bps) year over year. Total operating expenses in the quarter were $1,678.4 million compared with $1,693.6 million in the year-ago quarter, due to higher office and general expenses.

Balance Sheet

As of Jun 30, 2017, cash, cash equivalents and marketable securities were $660.8 million compared with $675.4 million in the year-ago period. Total debt was $1.82 billion as of Jun 30, 2017.

Share Repurchase/Dividend

During the second quarter, the company repurchased 2.5 million shares for $60 million.

Interpublic paid a dividend of 18 cents per share for a total consideration of $70.5 million during the reported quarter.

Outlook Reaffirmed

For 2017, the company reaffirmed its guidance. It continues to expect organic growth in the range of 3–4%, with a 50 bps improvement in operating margins.

Zacks Rank & Stocks to Consider

Interpublic currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the industry include Omnicom Group Inc. (NYSE:OMC) , Publicis Groupe S.A. (OTC:PUBGY) and WPP (LON:WPP) plc (NASDAQ:WPPGY) . All three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1(Strong Buy) Rank stocks here.

Omnicom has a long-term earnings growth expectation of 7.5% and is currently trading at a forward P/E of 16.18x.

Publicis Groupe has a long-term earnings growth expectation of 12.9% and is currently trading at a forward P/E of 13.83x.

WPP plc has a long-term earnings growth expectation of 9.8% and is currently trading at a forward P/E of 12.69x.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.

Omnicom Group Inc. (OMC): Free Stock Analysis Report

WPP PLC (WPPGY): Free Stock Analysis Report

Publicis Groupe SA (PA:PUBP) (PUBGY): Free Stock Analysis Report

Interpublic Group of Companies, Inc. (The) (IPG): Free Stock Analysis Report

Original post

Zacks Investment Research