Technology stocks are anticipated to display a lackluster performance this earnings season, primarily owing to softness in the semiconductor space. However, an uptick in the Internet stocks is likely to have offered a relief.

A number of notable Internet-based companies have already reported quarterly releases. F5 Networks (NASDAQ:FFIV) , which provides products and services to manage Internet traffic worldwide, reported fourth-quarter fiscal 2019 results wherein both earnings and revenues beat estimates.

Furthermore, PayPal's (NASDAQ:PYPL) third-quarter results surpassed estimates, reflecting an uptrend in net new active accounts, strengthening customer engagement on its platform and providing a portfolio boost.

Meanwhile, although Twitter (NYSE:TWTR) missed estimates in the third quarter, the company’s initiatives to add features and focus on effectively tackling abuse issues helped it expand monetized user base.

Factors to Impact Internet Stocks’ Q3 Earnings

The business prospects of Internet companies are boosted by their capabilities to deliver innovative solutions for addressing the evolving consumer preference, which is driven by the need for convenience and easy accessibility. This trend has most likely continued in the third quarter.

Improving Internet speed and penetration, rapid adoption of 4G Volte technology and accelerated deployment of 5G technology are key drivers, which might get reflected in the industry players' quarterly numbers.

Growth in digital advertising, fast uptake of online payment methods, cloud computing and cloud-based gaming as well as expanding online delivery modes are some major catalysts for Internet stocks. All these are expected to have been constant tailwinds to the stocks' performance in the quarter to be reported.

Moreover, increasing demand for cloud infrastructure monitoring, web-based application performance management, human capital management (HCM) and cyber security software are boosting growth prospects of Internet-based entities. This upside is likley to reflect on the companies' impending quarterly results.

Let’s see how the following internet stocks are placed ahead of third-quarter earnings releases on Oct 29.

Our quantitative model predicts an earnings beat for the company with a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) as this combination increases its chances of beating estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

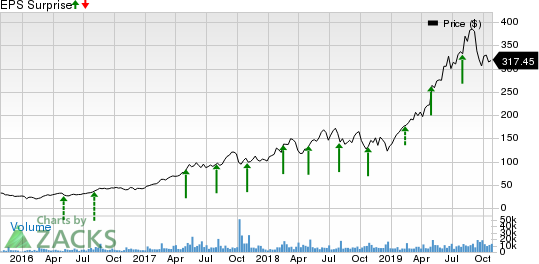

Shopify (NYSE:SHOP) third-quarter 2019 results are likely to reflect increasing adoption of merchant-friendly applications amid stiff competition and higher spending.

However, this Zacks Rank #3 stock is unlikely to deliver a positive earnings surprise because it has an Earnings ESP of 0.00%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Notably, the Zacks Consensus Estimate for earnings has been stable over the past 30 days at 11 cents. (Read more: Shopify to Report Q3 Earnings: What's in the Offing?)

Paycom’s (NYSE:PAYC) third-quarter results are likely to reflect new business wins for human capital management (HCM) solutions, and improvement in sales productivity.

However, this Zacks #3 Ranked player is unlikely to beat on earnings because it has an Earnings ESP of 0.00%.

Notably, the Zacks Consensus Estimate for earnings has been constant over the past 30 days at 69 cents. (Read more: Paycom to Post Q3 Earnings: What's in the Cards?)

Zendesk’s (NYSE:ZEN) third-quarter results are likely to have benefited from strong demand for its products across both small and mid-size businesses. Moreover, the introduction of products and offerings is expected to have boosted results.

Although Zendesk has a Zacks Rank of 3, its Earnings ESP of 0.00% makes surprise prediction difficult.

Notably, the Zacks Consensus Estimate for earnings has been steady over the past 30 days at 6 cents. (Read more: Zendesk to Report Q3 Earnings: What's in the Cards?)

Grubhub (NYSE:GRUB) third-quarter results are likely to have gained traction from the momentum in gross food sales and active diner base. Its efforts to enhance delivery network and strengthen alliance with new quality-focused restaurant partners bode well. However, a sequential decline of Daily Average Grubs in the third quarter makes us apprehensive.

Grubhub is unlikely to beat estimates because it has an Earnings ESP of 0.00% and a Zacks Rank #4 (Sell).

The company’s earnings surpassed the Zacks Consensus Estimate in two of the last four quarters and missed the mark twice, the average negative surprise being 3.1%. (Read more: Grubhub to Report Q3 Earnings: What's in the Cards?)

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Shopify Inc. (SHOP): Free Stock Analysis Report

Paycom Software, Inc. (PAYC): Free Stock Analysis Report

F5 Networks, Inc. (FFIV): Free Stock Analysis Report

Twitter, Inc. (TWTR): Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL): Free Stock Analysis Report

Zendesk, Inc. (ZEN): Free Stock Analysis Report

Grubhub Inc. (GRUB): Free Stock Analysis Report

Original post

Zacks Investment Research