Stocks as an asset class have shrugged off a wide variety of risks throughout the year. Sequestration failed to derail equity enthusiasm. The May-June interest rate spike did little to deter dip-buyers. And I suspect that any actual downside for the markets in October, whether caused by political strife or disappointing economic data, will ultimately be viewed as yet another buying opportunity. Indeed, investors are confident that the Federal Reserve is looking out for them.

The general trend notwithstanding, several ETFs categories defy a simplistic tip of the hat to the Fed’s zero-interest rate policy or its quantitative easing (QE) experiment. In essence, some areas have been rocketing on an entirely different kind of fuel.

So what kind of energy can spark faster price growth than a speeding bullet train from Los Angeles to San Francisco? What sort of propellant might ignite an ETF industry group to leap gargantuan debt ceilings in a single trading session? The answer is “perceived demand.” Not actual demand necessarily… but a demographic-based perception about future mega-trends.

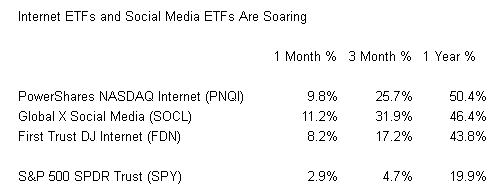

For example, advertisers on both radio and television covet the all-important 25-54 adult demographic. Someone, somewhere, determined that this classification represents the most important group of consumers. By the same token, these adults with money and jobs are increasingly using social media and/or going online. It follows that, regardless if the valuations of online/net-oriented companies make sense today, the demographic-based perception of social media demand and online activity bolsters Internet ETFs.

I am not suggesting that the perception will last indefinitely. Alan Greenspan, the previous chairman of the Fed, discussed the “irrational exuberance” of market-based securities in 1996. Yet the dot-com bubble did not burst until 2000. In other words, “new tech” ETF investing may continue winning for a whole lot longer than fundamental value folks would have you believe.

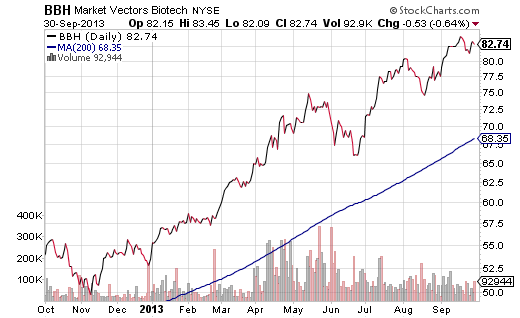

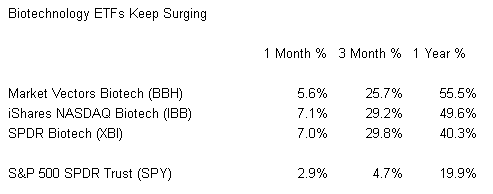

In a similar vein (pun definitely intended), there are plenty of reasons to eschew biotechnology ETFs. Price-to-fair value estimates are unfavorable. Legislative uncertainty presents hazards for pharmaceutical research and development. And the current price on many biotech stocks, as well as biotech funds like Market Vectors Biotech (BBH), are more than 20% above a 200-day moving average; a tendency for stocks to revert to their trendlines would certainly be painful.

Whereas the Internet ETFs benefit from a younger demographic (25-54), biotech ETFs benefit from increasing longevity. Not only is most of the wealth in the U.S. controlled by folks who are 55+, but investors perceive those individuals as having the capacity and desire to spend money to prolong/enhance their lives. Here again, a demographic-based perception is fueling investor demand beyond levels that normal valuations might justify.

For my own clients, I have been far more conservative over the last year. I have maintained an overweight towards technology and health care, though I have primarily done so with exchanged-traded funds like Vanguard Information Technology (VGT), First Trust Technology Dividend (TDIV), SPDR Health Care (XLV) and PowerShares Pharmaceuticals (PJP). Moreover, it would be awfully difficult for me to recommend the sexier funds in the tables above without a substantive price pullback as well as a rationale beyond the demographic-based theme.

Granted, momentum investors may like biotech and “new tech” right now. As long as those who choose to ride a wave today know exactly when to hop off a surfboard, I see nothing wrong with the initial buy decision. Just make certain to implement a plan for leaving, whether your plan involves hedges, options or trailing stop limit orders.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Internet, Social Media ETFs Are Soaring

Published 10/01/2013, 03:59 AM

Updated 03/09/2019, 08:30 AM

Internet, Social Media ETFs Are Soaring

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.