The market stage is set with what ought to be a relatively positive outlook for equity markets. In Canada, stocks look cheap and bonds look expensive. Yet conviction is generally lacking. Today’s economic environment makes what should be a clear asset-allocation decision a somewhat vexing one.

North American equity markets look attractively valued by historical standards, with several ratios at levels inconsistent with an expanding economy. This at a time when monetary policy makers in both Canada and the U.S. continue to keep real policy rates highly stimulative. In addition the likelihood of recession is relatively low in both the U.S. and Canada which generally would lead to a positive environment for the equity market. However, worry about the European economy and rising uncertainty about whether debt-burdened euro countries can avoid additional bailouts are again weighing on animal spirits.

Troubles In Spain

Spain has been getting the lion’s share of media attention over the past few weeks because of its dire economic prospects. The country’s unemployment rate has jumped to 23.6%, with youth unemployment above 50%, at a time when its government continues to tighten the screws of austerity – an austerity that can only put more lead into an economy expected to contract at least 2% in 2012.

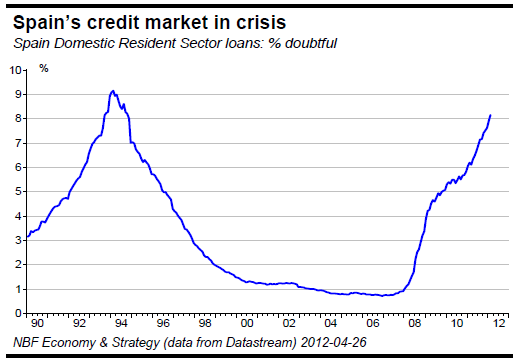

Current trends in the assets of Spanish banks, especially in domestic resident sector loans, put the country’s credit institutions in a grim position. Continuing deterioration of their loan books has brought doubtful loans to 8.2% of total domestic resident sector loans, a percentage unseen in 20 years.

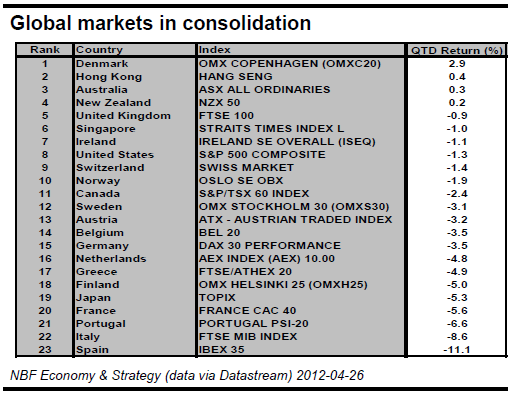

And in contrast to 1990-92, when the loan book was growing, total resident sector loans have declined to the lowest point since January 2008. This is why Spain’s equity-market index has lagged all other developed-country indexes year-to-date. More important, rising rates for the long-term Spanish government bonds will mean increased financial strain and uncertainty in eurozone financial markets. Unlike Greece, however, Spain is too big to fail.

Soft Global Cyclical Indicators

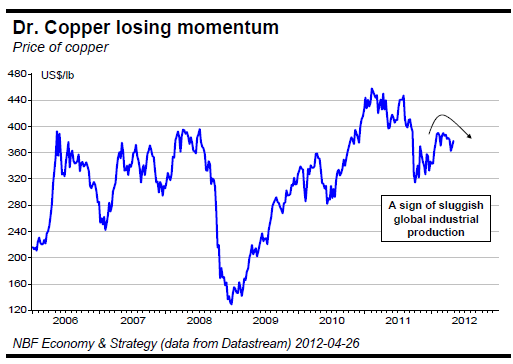

Key cyclical indicators currently signal sluggish global growth ahead. The price of copper, an indicator of global industrial activity, has made little headway since the beginning of the year. Its recent decline below the floor of its three-month trading range suggests that industrial production growth is slowing.

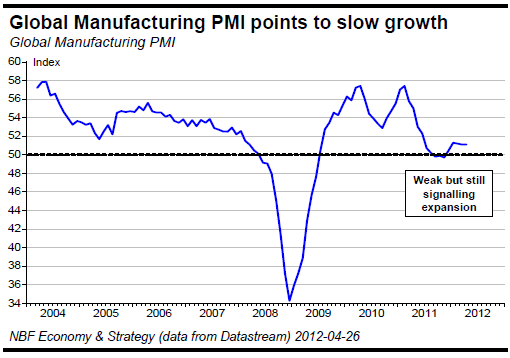

The global manufacturing PMI corroborates this picture of positive but soft global growth. It remains above 50, suggesting continued expansion, but has improved little over the last few months.

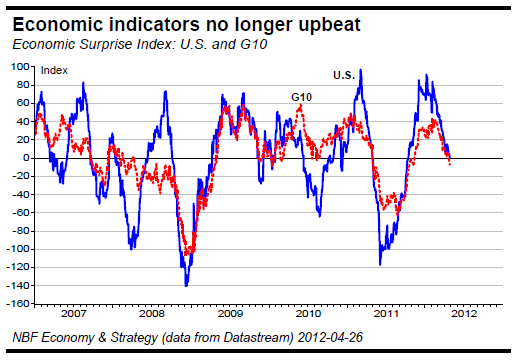

Moreover, economic surprise indexes in the U.S. and for the G10 as a whole are back near zero, a reading that historically has signalled fading momentum for equity market returns.

Good U.S. Earnings

At this writing, with more than 45% of S&P 500 companies reporting, Q1 earnings are running above expectations. EPS growth shows a 7.7% positive surprise. Breadth is solid with 76% of companies reporting better-than-expected results. Sales growth has also surprised on the upside, by about 2.1%. Results for nonfinancial companies are solid, with EPS advancing 7.1% and sales 6.6%. These results confirm that the profit growth of nonfinancials is being driven by sales growth.

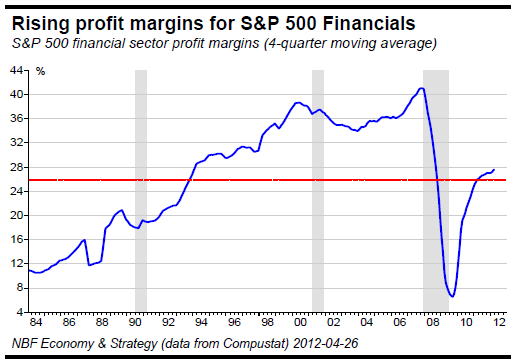

Among the reporting companies, Financials have shown very strong earnings growth of 11.4%, in large part a result of profit margin expansion. As the chart below shows, the margins of Financials, after nosediving to less than 8% in the great recession, are now just above their long-term average. Margins are expected to continue improving throughout 2012, though the sustainability of recent earnings growth will depend on the ability of financial companies to expand their balance sheets through credit expansion.

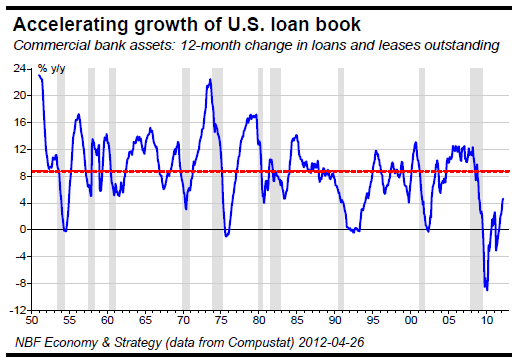

Though U.S. commercial bank credit – loans and leases outstanding – has been expanding since last September, its 12-month growth remains well below the long-term average (chart, below). A cyclical rebound in commercial-bank loan books would put a tailwind behind their profit margins and EPS growth in 2012.

Expectations For The S&P 500

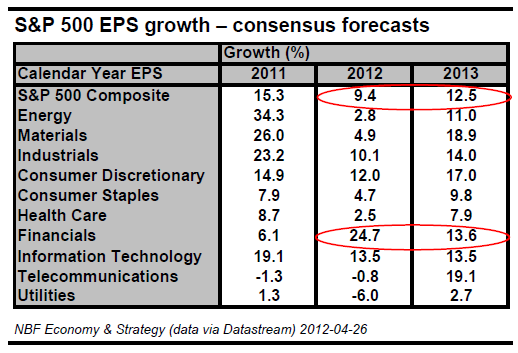

The analyst consensus sees the earnings of Financials surging 24.7% this year and 13.6% next year (table). Whether these expectations are met will depend a great deal on the expandability of loan books and profit margins.

The consensus outlook of 9.4% EPS growth for the index as a whole in 2012 is consistent with our view. For 2013, however, 12.5% is optimistic. We think 7% to 9% is a more likely range.

Canadian Equities Exposed To A Softening Global Backdrop

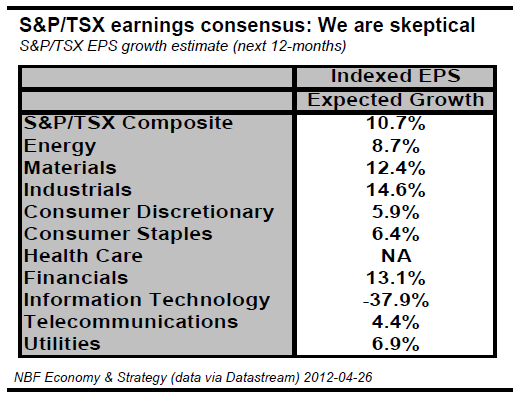

The Canadian market has lagged behind other developed country equity indexes so far in 2012. Among the reasons are significant downward revisions of future earnings and the current disfavour of resource producers, which account for 45% of the S&P/TSX Composite. Energy and Materials have been among the worst-performing sectors of the index.

Lack Of Enthusiasm For Gold Stocks

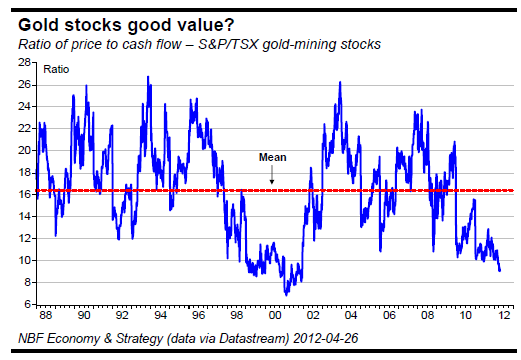

A -13.6% year-to-date fall in the stock prices of gold mines, the largest industry in the Materials sector, has weighed on TSX performance. However, the decline has left the industry with a price-to-cash-flow ratio that is attractive by historical standards (chart).

Continuing positive fundamentals for bullion support our view that the multi-year uptrend of its price remains intact. First, a continuing need for monetary stimulus in developed economies will keep real policy rates negative for quite some time. Second, demand for nonfinancial safe-haven assets will remain strong for the duration of sovereign-debt problems, which will take time to resolve.

However, though support for the commodity means support for its producers, the industry faces headwinds. Among these are fuel costs, which especially in the last six months have been rising faster than the price of bullion, and direct competition for investment dollars from ETFs holding the precious metal.

Energy Stocks: A Solution In The Pipeline?

Energy equities have also underperformed so far this year despite rising prices for crude oil. Canadian oil prices including Edmonton Par and Western Canada Select are at unusual discounts to both WTI and Brent. This is in part because of oversupply at key hubs. Bottlenecks are expected to remain a problem at least until the end of the second quarter.

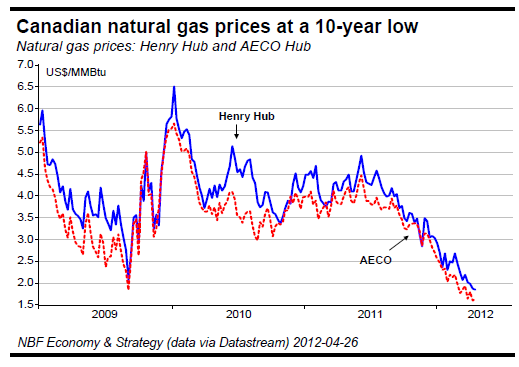

Adding to the woes of the energy sector is the waterfall decline of natural gas prices as of Q4 2011. The unusual mildness of the past winter has amplified the effect of abundant supply of this fuel. While we expect prices to stabilize, at this point we see the consensus year-end estimate of $4.00/MMBtu as over-optimistic.

Attractive Valuations

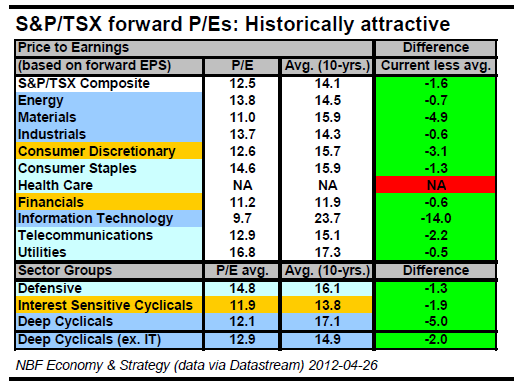

Though we are entering what tends to be seen as a season of quieter trading, value bugs need to pay close attention to the Canadian market. Its weakness over the last few months has improved the valuation of most S&P/TSX sectors.

Forward P/E ratios for most sectors are below their 10-year averages, with Materials trading at the biggest discount to its average.

That said, our concern with current valuations is that earnings are at risk in an environment of slower-than-expected domestic and international economic growth. This is especially true of resource stocks, whose analysts remain rather optimistic about commodity prices over the next four quarters. Bottom line: the current estimated EPS growth of 10.7% is attainable but at the high end of our comfort zone.

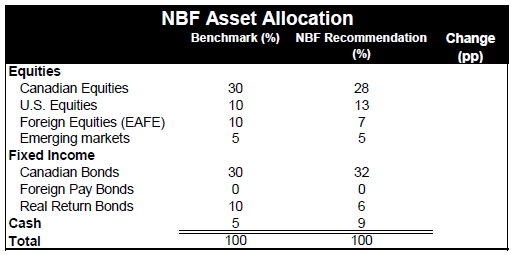

Asset Allocation

Global equity markets have been moving to a different beat since the beginning of Q2. So far this quarter, most major indexes have been consolidating.

At this writing, the correction remains relatively modest for most indexes after the pronounced rise of the previous two quarters. The outlook is very much dependent on unfolding events in the eurozone, political as well as economic. Are there catalysts that could turn the Canadian market around? Potential triggers include a strong stimulus push from Beijing and economic developments that would weaken the greenback.

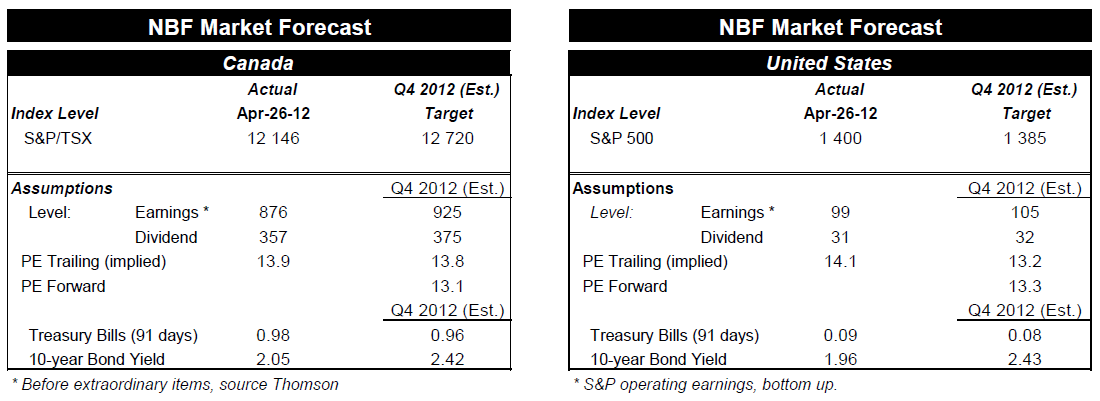

We see Canadian and U.S. equity prices as close to fair value at present. We do see upside, but the pace of gains may be slow over the next few months. Our current year-end target for the S&P/TSX Composite is 12,720, about 13.8 times our target calendar-year EPS of 925. For U.S. stocks, we see a better showing in the near term, due partly to solid earnings growth and anticipation of gains from U.S. dollar appreciation. We have increased our S&P 500 year-end target to 1385 due to an upward adjustment in EPS estimates from 104 to 105 for the 2012 calendar year. Our portfolio recommendations are unchanged this month.

Sector Rotation

This month we are making some minor changes to our sector rotation as a result of anticipated changes in future interest rate trends. The Bank of Canada in its latest policy meeting press release became more upbeat on economic conditions and noted that “some modest withdrawal of the present considerable monetary policy stimulus may become appropriate.” We concur with the idea that rates are very low in Canada and believe that the perception of a rate hike is currently taking place in the financial markets. With the possible rise of interest rates in the next 9-12 months, we believe it prudent to increase exposure to the insurance industry whose performance tends to be positively correlated to changes in interest rates.

With rates now excessively low, the risk-return environment warrants increasing the insurance industry to neutral from underweight. We do maintain our preference for defensive sectors with large dividend yields, particularly Telecoms and Utilities for now. However, as we get closer to a point of changing interest rate dynamics, this position will be re-evaluated.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

International Uncertainty A Strain On Canadian Equity Markets

Published 04/30/2012, 12:30 AM

Updated 05/14/2017, 06:45 AM

International Uncertainty A Strain On Canadian Equity Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.