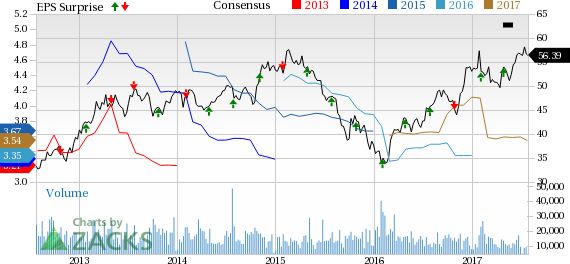

Paper and packaging firm International Paper Company (NYSE:IP) reported relatively healthy second-quarter 2017 results with adjusted operating earnings of $270 million or 65 cents per share compared with $379 million or 92 cents per share in the year-ago quarter. Although operating earnings declined year over year, it exceeded the Zacks Consensus Estimate by a penny.

GAAP earnings for the quarter were $80 million or 19 cents per share compared with $40 million or 10 cents in the year-ago quarter, primarily driven by top-line growth.

Net sales improved to $5,772 million in the reported quarter compared with $5,322 million in the year-ago quarter and exceeded the Zacks Consensus Estimate of $5,678 million. The year-over-year increase was primarily due to benefits from the pulp business that was acquired in late 2016.

Total business segment operating profit in the reported quarter was $129 million compared with $627 million in second-quarter 2016. The significant year-over-year decrease in operating profit was attributable to the adverse impact of the Kleen Products settlement

Segment Performance

Industrial Packaging: Sales from this segment increased to $3,706 million from $3,520 million in the year-ago period. Operating profit decreased to $50 million from $458 million in the year-ago quarter, owing to $354 million in charges to settle the Kleen Products legal case. In North America, sales price increase realizations for containerboard and boxes and strong demand for U.S. kraft linerboard exports were partially offset by higher mill outage expenses and OCC (old corrugated containers) costs.

Printing Papers: Sales from this segment were $1,017 million in the reported quarter versus $1,012 million in the year-earlier quarter. Operating profit for the segment was $86 million versus $117 million in the year-ago quarter due to lower sales volumes, heavy maintenance outage expenses and unfavorable mix, partially offset by higher export sales volume from Brazil.

Consumer Packaging: Sales from this segment decreased to $474 million from $501 million in the prior-year quarter. Operating loss was $14 million compared with operating profit of $73 million in the year-ago quarter due to annual outage expenses and reliability issues at the Augusta, GA mill.

International Paper combined its legacy pulp business with the acquired pulp business to form a new business segment called Global Cellulose Fibers. Sales from this segment were $612 million compared with $259 million in the prior-year quarter due to record fluff pulp sales volume as global demand remained strong. Operating profit was $7 million compared with operating loss of $21 million a year ago, largely driven greater synergy benefits, favorable pricing, lower manufacturing costs and lower planned maintenance outage expenses.

Balance Sheet

As of Jun 30, 2017, cash and temporary investments aggregated $1,041 million while long-term debt was $10,392 million. Cash flow from operating activities for the first six months of the year was $1,278 million compared with $1,225 million in the prior-year period. Free cash flow for quarter was $355 million compared with $527 million in the prior-year period, bringing the respective tallies for the first half of 2017 and 2016 to $614 million and $838 million.

Moving Forward

Management expects strong second half results, as well as positive momentum entering 2018. The company is likely to generate significant year-over-year earnings growth and continued strong cash flow in 2017. International Paper expects solid traction in the future with price increases, acquisition synergies and significantly lower outage expenses, thereby remaining confident to achieve its full year earnings target.

International Paper currently holds a Zacks Rank #3 (Hold). Some better-ranked stocks in the industry include Clearwater Paper Corporation (NYSE:CLW) , Domtar Corporation (TO:UFS) and Fibria Celulose S.A. (NYSE:FBR) , each carrying Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Clearwater Paper has a long-term earnings growth expectation of 5%.

Domtar has a long-term earnings growth expectation of 3% and has beaten earnings estimates thrice in the trailing four quarters for an average surprise of 67.3%.

Fibria Celulose has a long-term earnings growth expectation of 18.4%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

International Paper Company (IP): Free Stock Analysis Report

Clearwater Paper Corporation (CLW): Free Stock Analysis Report

Domtar Corporation (UFS): Free Stock Analysis Report

Fibria Celulose S.A. (FBR): Free Stock Analysis Report

Original post

Zacks Investment Research