International Flavors & Fragrances Inc. (NYSE:IFF) reported impressive results for the fourth quarter of 2017, delivering a positive earnings surprise of 7.7%. This result is the company’s third consecutive quarter with better-than-expected results.

Adjusted earnings in the quarter came in at $1.40 per share, surpassing the Zacks Consensus Estimate of $1.30. Also, the bottom line grew 14.8% from the year-ago tally of $1.22.

On a constant currency basis, the company’s adjusted earnings increased nearly 16% year over year. The bottom-line results benefitted costs and productivity measures and synergistic benefits from acquired assets.

For 2017, the company’s adjusted earnings per share were $5.89, above the Zacks Consensus Estimate of $5.78. Also, the result increased over the year-ago tally of $5.51.

Solid Segmental Results and Buyout Gains Drive Revenues

International Flavors’ revenues in the fourth quarter totaled at $854.6 million, reflecting a growth of 12% over the year-ago tally. Gains from acquired assets added 3% to sales growth. On a constant currency basis, revenues climbed 10% from the prior-year period.

Also, the top line surpassed the Zacks Consensus Estimate of $832.3 million by 2.7%.

Geographically, revenues generated from the North American operations grew 17% year over year, while revenues in Europe, Africa and the Middle East were up 12% or grew 7% on a constant currency basis. Revenues from Latin American operations increased 10% year over year, while those from Greater Asia increased 8%, 7% on a constant-currency basis.

The company operates in two segments: Flavors and Fragrances.

Revenues generated from the Flavors business were $401.9 million, increasing 6.4% year over year. On a constant currency basis, revenues grew 5% year over year. It represented 47% of the quarter’s revenues.

The Fragrances business’ revenues were $452.7 million, rising 17.6% year over year. It accounted for 53% of revenues in the quarter. On a constant currency basis, revenues grew 15% year over year.

Margins Weak

In the quarter, International Flavors’ cost of sales grew 14% year over year to $496.9 million. Adjusted gross profit increased 9.3% year over year to $365.5 million, while the adjusted margin of 42.8% was below 43.9% in the year-ago quarter.

Research and development expenses, as a percentage of revenues, increased 50 basis points (bps) to 8.8%, while adjusted selling and administrative expenses decreased 90 bps to 15.9%.

Adjusted operating margin was 16.9%, compared with 17.8% in the year-ago quarter. Interest expenses increased 28% year over year to $15.8 million.

Balance Sheet and Cash Flow

Exiting the fourth quarter, International Flavors & Fragrances’ cash and cash equivalents were $368 million, up 16.5% from $316 million in the preceding quarter-end. Long-term debt inched up 0.4% sequentially to $1,632.2 million.

In 2017, the company generated net cash of $390.8 million from its operating activities, down roughly 29% year over year. Capital spending grew 2% year over year to approximately $129 million.

During the year, the company paid dividends of approximately $206.1 million, while purchased treasury stocks worth $58.1 million.

Outlook

For 2018, International Flavors & Fragrances anticipates gaining from its acquired businesses as well as from its multi-year productivity program, enabling it to check on costs, make strategic investments and expand businesses globally.

Net sales in the year are projected to grow in a range of 6-8% or increase 3-5% on a constant currency basis. Likewise, operating profit will increase within 6.5-8.5% range or 5-7% on a constant currency basis and earnings per share will grow 5.5-7.5% or 4-6% on a constant currency basis.

The tax rate for the year is predicted to be approximately 21%.

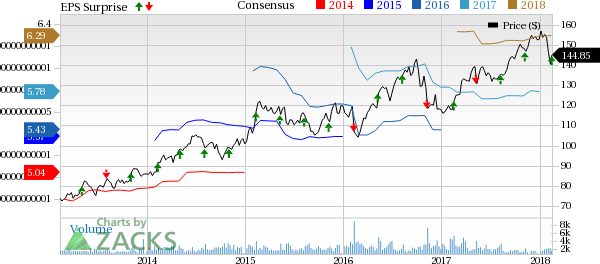

Internationa Flavors & Fragrances, Inc. Price, Consensus and EPS Surprise

Valvoline Inc. (VVV): Free Stock Analysis Report

Versum Materials Inc. (VSM): Free Stock Analysis Report

Internationa Flavors & Fragrances, Inc. (IFF): Free Stock Analysis Report

CSW Industrials, Inc. (CSWI): Free Stock Analysis Report

Original post

Zacks Investment Research