At the macro level, the IMF lowered their global growth outlook. The first quarter slowdown in the developed world (largely the US but to a lesser extent Canada) led to decreased 2H15 projections, while the commodity slowdown will negatively impact the developing world. As further evidence of this, note that Latin American currencies are broadly selling off. Low inflation gives central banks plenty of policy room. The wild cards continue to be the cumulative impact of the Chinese slowdown along with certain geopolitical factors such as the Middle East turmoil and Greek situation.

The Reserve Bank of Australia released their latest meeting minutes last week, which contained the following overview of the Australian economy:

Members noted that output had increased by 0.9 per cent in the March quarter and by 2.3 per cent over the year. Resource exports had made a significant contribution to growth, reflecting better-than-usual weather conditions in the quarter. Dwelling investment had remained strong and while consumption growth had picked up over the past year or so, it had remained below average. Business investment had contracted in the quarter and there had been little growth in public demand. More recent economic indicators suggested that domestic demand had continued to grow at a below-average pace over recent months, but that labour market conditions had continued to improve.

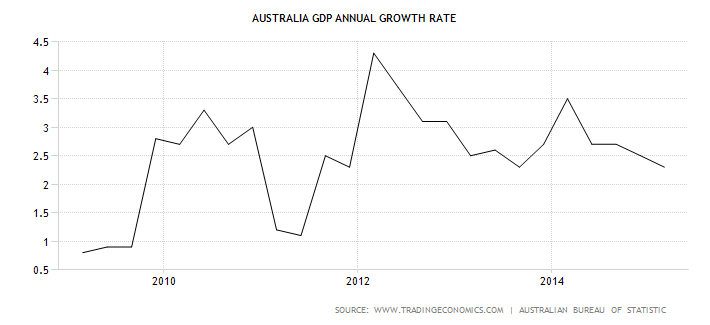

While the country is still growing, there has been a marked decrease in the annual growth rates since 2014:

The RBA classified this growth as below trend:

Although output growth in the March quarter had been stronger than expected, growth over the year remained below average and early indications were that the strength in the March quarter had not carried through to the June quarter.

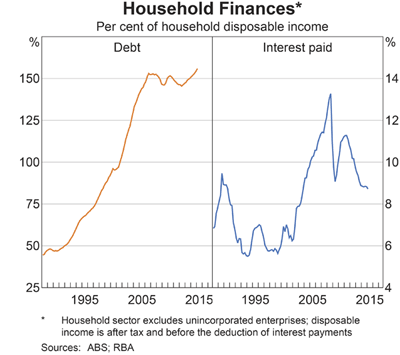

Consider the following charts in relation to Australia’s “below average” consumption growth. Overall household debt levels are still high.

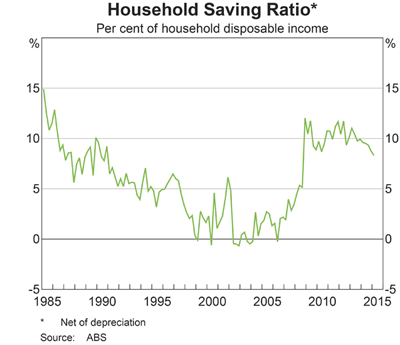

Debt payments are lower due to lower interest rates. But the Australian economy didn’t experience a serious contraction in 2008-2009 like the US (China’s stimulus led to an increase in Australian exports), so the Australian consumer didn’t de-leverage. Australians are a bit more cautious which is shown in the marked increase in the savings ratio:

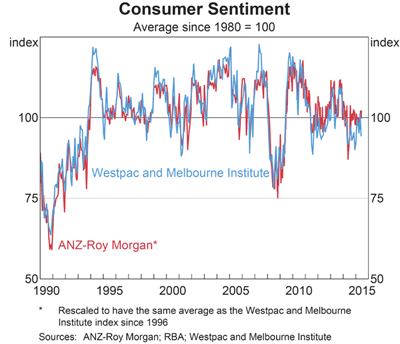

This is also reflected in the lower consumer sentiment reading:

While these readings are certainly not fatal, they also do not show a consumer who will be a primary driver of growth.

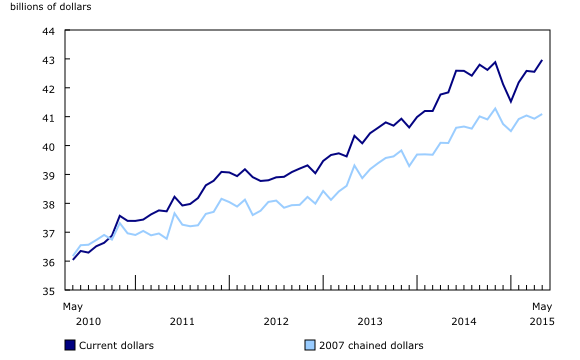

Canadian retail sales increased 1%. The strongest part of the report was the 1.2% increase in auto sales, indicating recent economic weakness at the national level has yet to negatively impact consumer sentiment. As this graph from the report shows, retail sales dropped sharply at the end of last year, but have since rebounded, rising to new highs:

On Friday, the Financial Times reported the loonie reached an 11-year low and was the third worst performing currency versus the dollar this month. The five-year CAD/USD chart shows the depth of the recent sell-off:

Japanese exports increased to a 5 month high of 9% last week.This figure was boosted by the weak yen, which is trading near five-year lows versus the dollar and yuan.

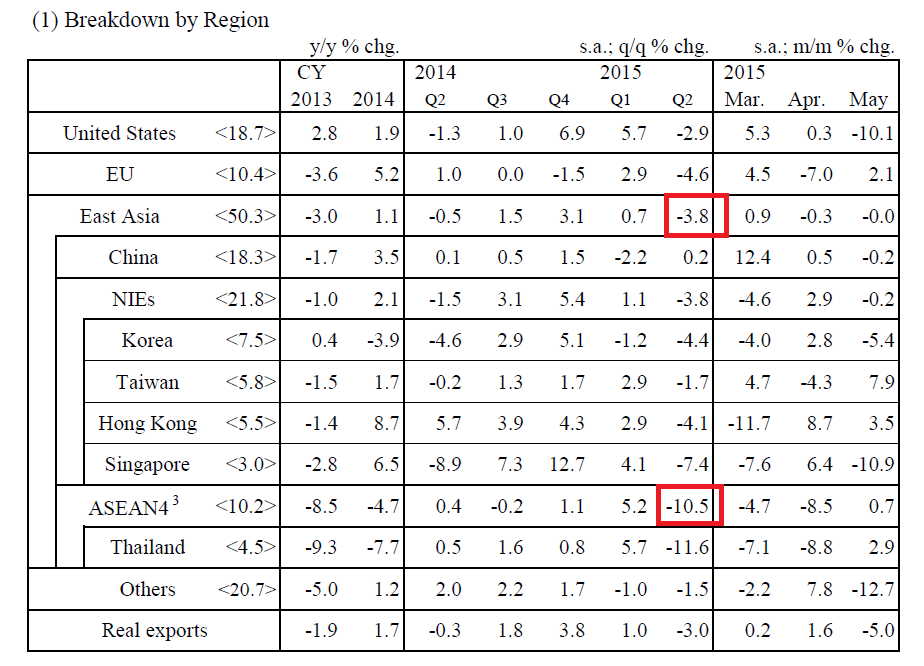

The latest BOJ Minutes were generally positive. Exports are “picking up” due to a weaker yen; business investment is showing a “moderate increasing trend,” and private consumption is “resilient.” However, there are several potential issues on the horizon. The Chinese slowdown is now seeping into other Asian economics, lowering Japanese regional exports:

Exports to East Asia were down 3.8% in the 2nd quarter, while those to ASEAN countries were off a very large 10.5%. The Asian slowdown has negatively impacted industrial production. As noted in the BOJ’s monthly statistical release:

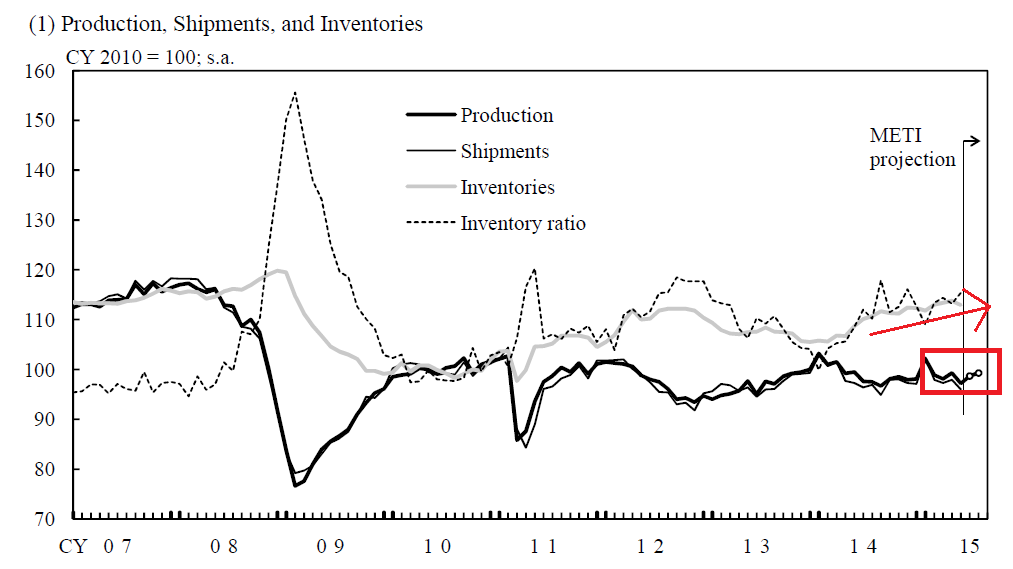

Industrial production has been picking up, albeit with some fluctuations. Industrial production dropped in April-May compared with the first quarter, after increasing for two consecutive quarters in the fourth quarter last year and in the first quarter. Firms' production activity appears to have picked up from a somewhat longer-term perspective, against the backdrop of moderate increases in demand both at home and abroad, but it has recently shown sluggishness, mainly due to the effects of the slowdown in overseas economies during the first quarter as well as to inventory adjustments of small cars.

This graph from the monthly report places the excerpt in context:

Finally, the IMF made the following statement in their latest global growth outlook regarding Japanese growth:

In Japan, growth in the first quarter of 2015 was stronger than expected, supported by a pickup in capital investment. However, consumption remains sluggish and more than half of quarterly growth stemmed from changes in inventories. With weaker underlying momentum in real wages and consumption, the pickup in growth in 2015 is now projected to be more modest.

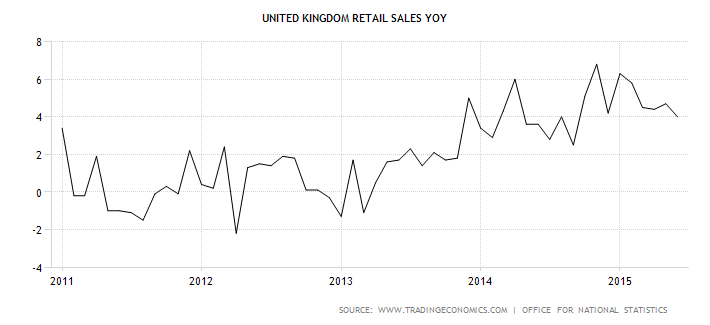

UK retail sales increased at a 4% Y/Y clip. The market viewed this as a miss. As this chart shows, this figure has been trending lower since the first of the year:

The Bank of England released their minutes as well, which offered the following description of the UK’s economy:

As expected, the ONS had revised UK GDP growth in 2015 Q1 up slightly, to 0.4%. Upward revisions to previous quarters had been larger, meaning that four quarter growth to Q1 was now estimated to have been 2.9%, rather than 2.4%. The bulk of the revisions to output had come from the construction sector. On the expenditure side, there had been revisions to a number of components. Consumption growth in Q1 had been revised up to 0.9%, indicating that the boost to real incomes from the past reduction in oil prices might have begun to feed through to spending at the start of the year. Business investment growth had been revised up Bank of England Minutes of the Monetary Policy Committee Meeting ending 8 July 2015 4 to 2.0%. Net trade had detracted from growth by less than in the previous estimate, while the contribution from stockbuilding had been large and positive

The UK economy is one of the best performing developed economies over the last 12-18 months, which has sent the sterling higher verses most majors (especially the euro and yen) save the dollar.

I’ll cover US data in more detail in the weekly US Equity and Economic Review. Housing news was mixed. Existing home sales increased to their highest level in 8 ½ years. New homes sales, however, decreased to a 7-month low. The leading economic indicators were up .6%, largely due to the third straight month of increasing building permits.

Markit’s flash estimate of EU data was the only major news from that region. The EU composite was 53.7, with manufacturing at 52.8 and services at 53.8.

While most central banks are using synonyms for "moderate" to describe the overall macro environment, it's beginning to feel more like a "slog." Just when it seems the global economy is starting to advance at a faster pace, something happens to slow growth prospects.

The latest events are the Chinese slowdown and Greek situation. The former is cratering commodity prices and commodity exporting currencies while the latter is potentially slowing the forward progress made by the EU economy over the last 6 months. It's very much a "two steps forward, one step back" situation.