The international community ended 2016 on solid footing. China has continued to avoid the predictions of some of a hard landing while the EU had some of its best post-Great Recession manufacturing and service numbers. The UK continues to avoid the much prophesized post-Brexit recessive while Canada has more likely than not emerged from its energy-induced recession.

Chinese news was positive. The Markit composite number rose to a 45-month high of 53.5. Thanks to rising new orders, the services index increased to its strongest level in 17 months. The manufacturing index had its strongest production reading in 6 years while output growth posted a 71 month high. The reports only negative point was the increase in price pressures. The combination of these bullish reports led to a reversal of the yuan’s sell-off; the currency had been dropping for several months thanks to rising U.S. interest rates and increasing Chinese capital controls.

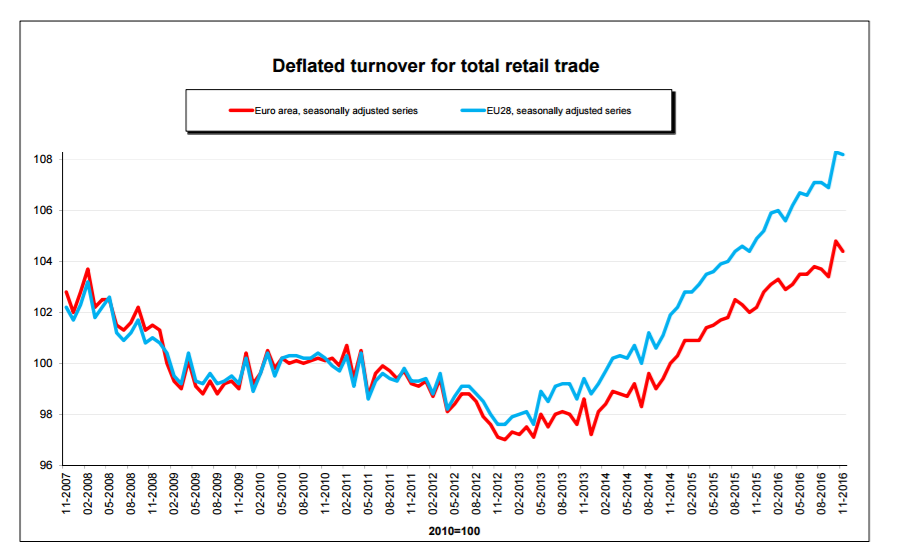

The EU ended the year strongly. Markit’s composite reading was 54.4 – the highest level in 67 months.The largest 4 economies were all growing. The service reading was 53.7, a slight decline from November’s 53.8. The manufacturing reading was 54.9 – the best reading since 4/11. Germany’s reading was the strongest in 3 years; France’s index was the best in 69 months. And on Friday, Eurostat reported that retail sales increased 2.3% Y/Y, furthering that statistical series impressive 3-year series of increases:

Finally, EU inflation is now increasing, largely due to energy prices. The overall index rose 1.1% while producer prices were positive (.3%) for the first time in over three years.

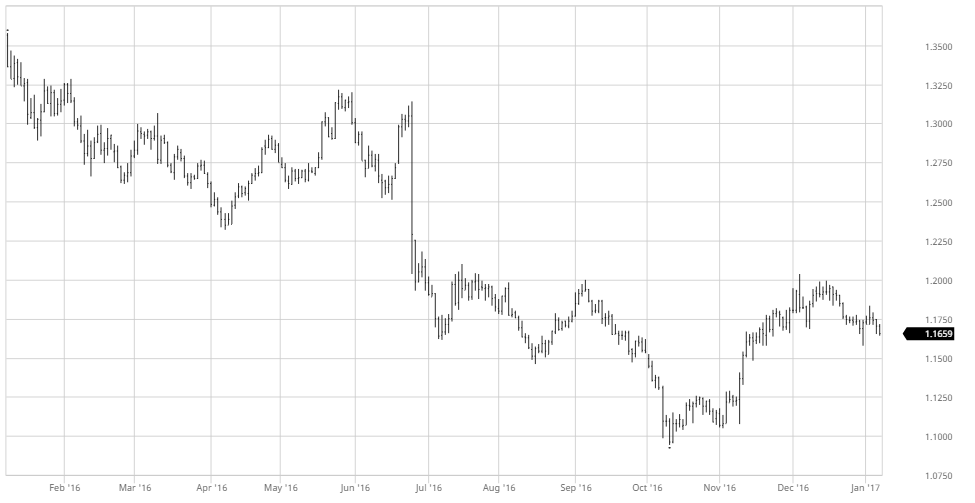

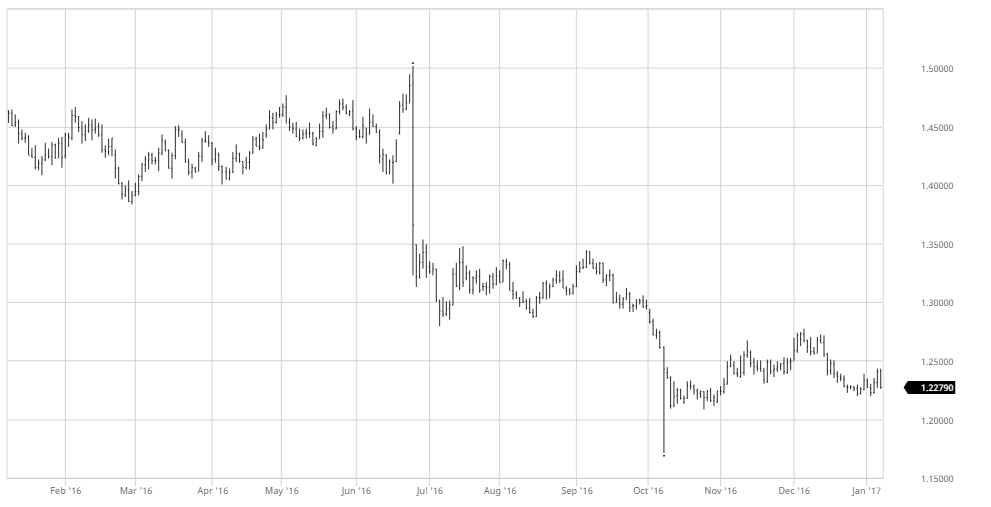

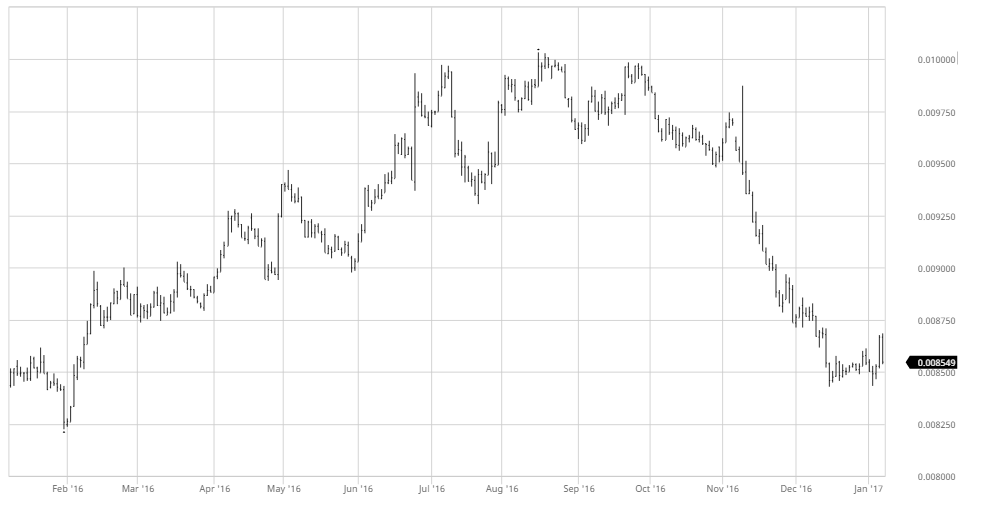

According to this week’s trio of Markit releases, the UK also ended the year on a strong note, bucking predictions of a post-Brexit slowdown. The manufacturing index increased to 56.1, a 30-month high. Production and new business orders increased in consumer, investment and intermediate goods. The services number registered a 5th month of expansion with a headline number of 56.2. Like the manufacturing report, new service orders were positive. And the construction index was higher, printing at 54.2. This was the highest reading since January, 2016. All three reports discussed the impact of higher prices from the lower sterling, which dropped after the Brexit vote and remains at lower levels:

1-year Chart of the GBP/EUR

1-year Chart of the GBP/USD:

Finally, Bloomberg reported that UK consumer borrowing was the highest in 11-years:

U.K. consumers borrowed at the fastest pace in more than 11 years in November, a sign that households continued their spending spree in the wake of last year’s Brexit vote.

Net consumer credit was 1.9 billion pounds, the most since March 2005, according to Bank of England data published on Wednesday. Credit surged almost 11 percent year on year, also the most in more than a decade.

UK retail sales have been strong; the latest released reported a 5.9% Y/Y increase. The increase in consumer borrowing should bolster that number in the coming months.

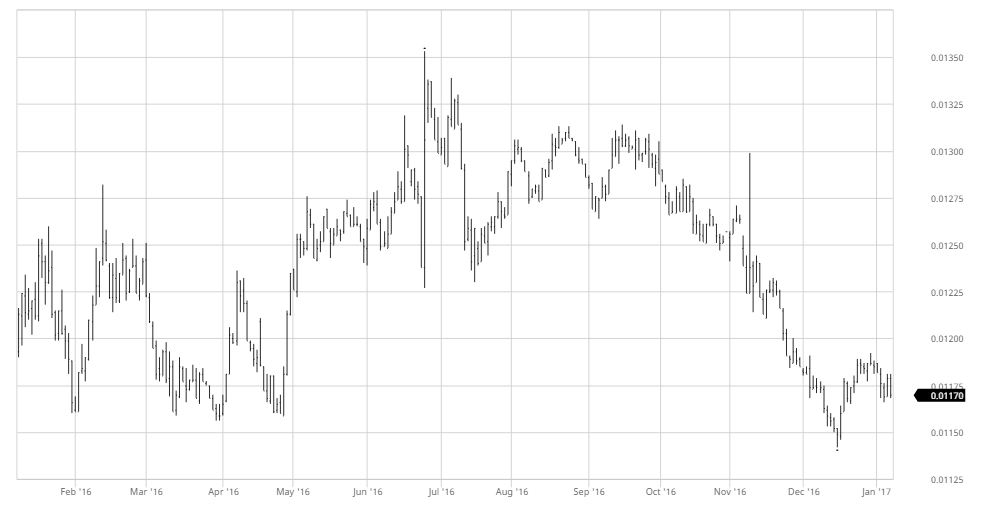

The only Japanese news came from Markit. The manufacturing number recorded a 12-month high 52.4, with output, new orders and employment posting increases. The service sector index was 52.3, the highest level since January. Looking out to the 1H17, the yen has dropped versus the Australian dollar and U.S. dollar:

1-Year Chart of the JPY/AUD

1-Year Chart of the USD/JPY

This should increase Japanese exports over the next 3-6 months.

Canadian news indicated that economy was clearly emerging from its energy-induced recession. December’s job gains increased .3% while the economy added 108,000 in the 4Q16 -- the largest amount since 2Q10. The unemployment rate increased .1% to 6.9% as people re-entered the labor force. And exports posted their strongest gain since May 2008. Non-U.S. exports rose 9.5% while U.S exports increased a still healthy 2.5%.