Investing.com’s stocks of the week

Summary

While the world economy is still in good shape, some cracks are appearing.

The tariff wars are starting to take their toll on global sentiment.

World equity markets are taking some hits.

Earlier this month, the IMF released its revised World Economic Outlook. While the release is moderately dated, I want to look at it in today's column because it contains a number of salient points.

Growth projections have been revised down for the euro area, Japan, and the United Kingdom, reflecting negative surprises to activity in early 2018.

As I've noted over the last few weeks, the U.S. economy is doing very well (please see this summation in the latest Beige Book). But we've started to see an increasing number of sentiment reports indicating international business is growing concerned. The ZEW number out of Germany has cratered while the latest round of Markit numbers for the EU show a business community that is more on edge. While still high, the European Commission's sentiment number is down. Japan's numbers have been OK, but slightly weaker (retail sales have contracted in three of the last five months; industrial production has been trending lower and contracted in the latest reading). And the UK is three months out from Brexit without a deal in place - and, as of this writing, not much hope of one being signed. The possibility of a hard Brexit (where the rules literally change overnight) is increasing. May's cabinet is in turmoil and members of other EU countries are expressing concern.

Among emerging market and developing economies, growth prospects are also becoming more uneven, amid rising oil prices, higher yields in the United States, escalating trade tensions, and market pressures on the currencies of some economies with weaker fundamentals.

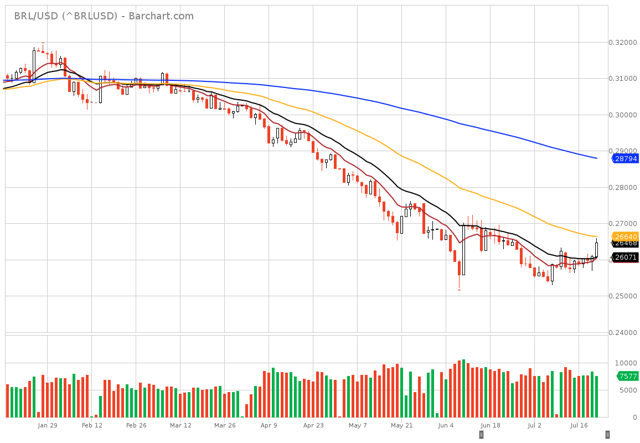

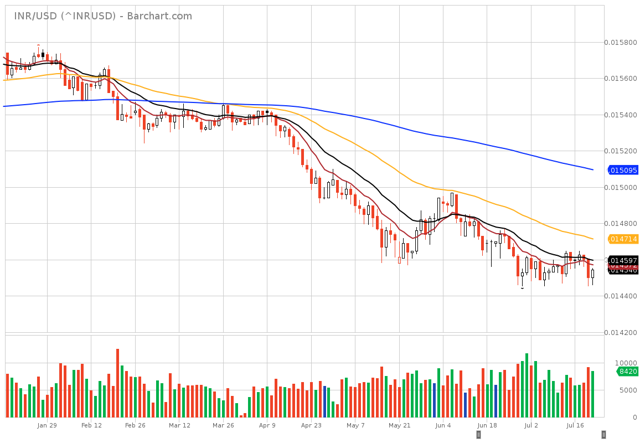

Some EMEs issue bonds tied to dollars; as the dollar rises, the country has to pay more to finance its debt. Most of these countries are natural resource exporters, which means they'll be badly hurt by increased trade tension. And EME currencies have declined over the last six months:

The real is down about 16% since the first of the year.

And the rupee is off about 6.6%.

The report continues:

The balance of risks has shifted further to the downside, including in the short term. The recently announced and anticipated tariff increases by the United States and retaliatory measures by trading partners have increased the likelihood of escalating and sustained trade actions. These could derail the recovery and depress medium-term growth prospects, both through their direct impact on resource allocation and productivity and by raising uncertainty and taking a toll on investment.

It's nearly impossible to understate the potentially disruptive nature of the tariff war. At first, you could argue they were a negotiating ploy meant to bring the Chinese to the bargaining table. But Trump then applied them to U.S. allies. Now he wants to impose them on all Chinese imports while also studying the possibility of levying hefty fines on EU auto imports. Due to the interlocking nature of today's value chains, the tariffs could send large unintended negative ripples throughout the world economy.

The report continues:

Financial market conditions remain accommodative for advanced economies-with compressed spreads, stretched valuations in some markets, and low volatility-but this could change rapidly. Possible triggers include rising trade tensions and conflicts, geopolitical concerns, and mounting political uncertainty.

Earlier this week, the Washington Post ran a story where economists argued that investors were far too complacent about the negative impact of the trade war. With the US market at high valuations, all the market needs to drop is something that signals the good times are over. It's hard to look at the increasing number of goods to which the US is applying tariffs and not conclude that we're getting close to that point.

Higher inflation readings in the United States, where unemployment is below 4 percent but markets are pricing in a much shallower path of interest rate increases than the one in the projections of the Federal Open Market Committee, could also lead to a sudden reassessment of fundamentals and risks by investors.

I'm not sure I buy into this idea completely. But, with the number of goods getting hit by tariffs potentially increasing, the likelihood of sudden inflationary shocks popping rises as well.

Tighter financial conditions could potentially cause disruptive portfolio adjustments, sharp exchange rate movements, and further reductions in capital inflows to emerging markets, particularly those with weaker fundamentals or higher political risks.

Shorter IMF: equity markets could sell off and bond markets could rally.

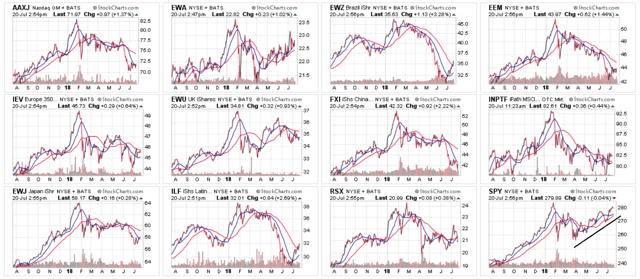

Let's place all of this into an investing perspective. Here are 12 international ETFs for the last year:

First - what don't you see? If you said rallies, put a star by your name. With the exception of the SPYs (lower row, far right) and Australia (top row, 2nd from left), everyone is either moving sideways or lower. Brazil and the emerging markets (top row, two right graphs), Latin America (bottom row, 2nd from left), China (middle row, 2nd from right), all Asia less Japan (top row, far left), and Japan (bottom row, far left) are all moving lower. That's a lot of equity markets having problems.

Short version, things are OK. But they're not as good as we'd like. And risks are rising, probably more than we're willing to admit.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.