Market movers today

- Focus this week will turn to the 13th round of high-level trade talks between the U.S. and China taking place in Washington on Thursday and Friday . If we get an interim deal we expect a short-term relief in equity markets. On the other hand, a failure to reach such a deal should put risk appetite under pressure again as U.S. tariffs on USD250bn of Chinese goods are then set to move up from 25% to 30% on Oct. 15 (next week).

- Minutes from the latest Fed meeting will be scrutinized on Wednesday as will a number of Fed speeches . The Fed is set to meet again on Oct. 31 and markets price around 75% probability of a rate cut following the weak data last week. We expect the Fed to cut rates at the next four meetings to counteract the current downward pressure on growth and inflation expectations.

- Another important topic to follow will be the development in the Brexit drama. French President Macron has said negotiations must be concluded by the end of this week (same signals were sent by EU ambassadors last week).

- ECB minutes on Thursday will give more insights into the ECB easing package , which as it turned out came with significant disagreement within the ECB Governing Council.

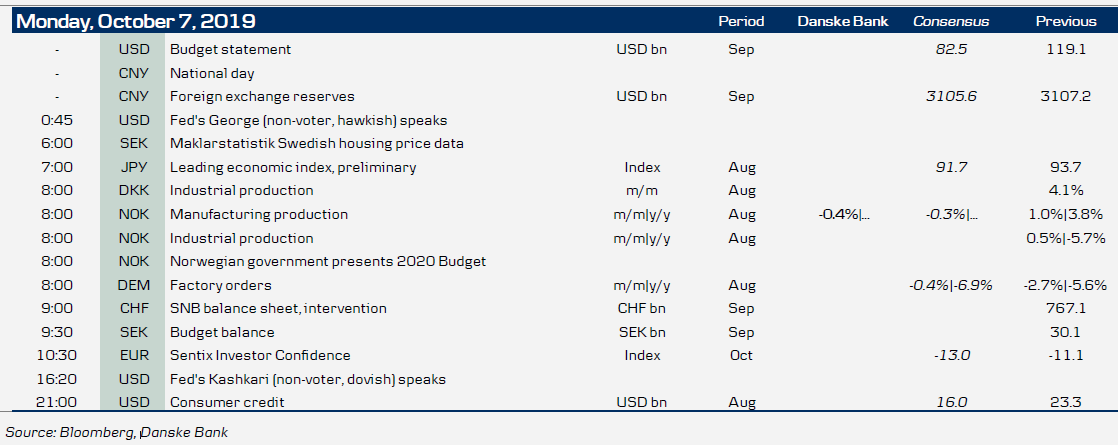

- On the data front we will get German factory orders this morning followed by U.S. core CPI tomorrow and U.S. consumer confidence for October from University of Michigan on Friday.

- In Scandi, focus turns to inflation data from Sweden and Norway, both released on Thursday. Today, the Norwegian government releases its budget proposal for 2020.

Selected market news

Ahead of the high-level trade talks between the U.S. and China, media report that China is not willing to discuss its industrial policy or government subsidies , something which is very important to the U.S. government. China believes that its hand has strengthened with Trump facing an impeachment process and with the US economy slowing. This highlights why there are still many obstacles for reaching a real deal, even if we get an interim deal this week, as we anticipate.

Portugal's socialist Prime Minister Antonio Costa won the general election gaining more seats, but fell short of an absolute majority.

With respect to Brexit, this is a crucial week , as the EU wants a solution by the end of the week if the EU leaders are to accept any deal at the EU summit on Oct.17-18. The UK government has said that it will "consider" publishing the full legal text of its proposal - something it has been reluctant to do so far - if it will be "helpful" for the negotiations. PM Johnson also seems willing to take the Brexit Delay Bill to the court in order to avoid asking for an extension (or at least be forced to do it).

Scandi

In Norway, the government presents its budget for 2020. We expect the fiscal policy proposals to be mildly expansionary, with the structural non-oil deficit climbing from 7.7% this year to 7.9%, i.e. a fiscal stimulus of 0.2pp of GDP. This is marginally more than Norges Bank assumed in September, but not enough to impact on interest rate expectations.

Fixed income markets

The main event in the global bond markets this week will be the trade talks between China and the U.S. by the end of the week. If we get a positive result from the trade talks, bond yields will most likely move higher in the short run, but there is still plenty of risk factors for the market and with inflation expectations grinding lower, a rise in yields is likely to be short-lived. Furthermore, there is a large amount of reinvestments coming to the European government bond market in the coming weeks as shown in our government bond weekly.

In the European markets we will get more budget from the Eurozone governments as they have to send in their 2020 budgets by October 15. So far, there has been limited additional spending in the budgets so the probability of a significant increase in the government bond supply seems modest. The French budget proposal indicated an increase in the supply of just EUR5bn from 200 in 2019 to 205 in 2020. In our government bond weekly we have given a first estimate of the supply for 2020, and with the reopening of QE, the net supply from most core-EU markets is going to be negative in 2020.

We will get more information on Japanese investors’ appetite for European government bonds in the investor data from Japan expected to be released mid-week. In Scandinavia focus will be on the budget from Norway and whether the expected issuance for 2020 will be increased from NOK 50bn. Furthermore, inflation data are coming from both Norway and Sweden.

FX markets

As for most other markets, the high-level trade talks in Washington will be the deciding driver for FX markets this week. If they reach an interim deal the last months have shown that a relief rally in high beta currencies such as NOK, SEK, AUD and NZD can go for at least a week at the expense of especially the JPY. With the latest stabilisation in Chinese data such a rally might go on for longer as the downside risk to the global manufacturing sector seems diminished, see our Chinese Weekly Letter – Is the Chinese business cycle turning?. If on the other hand the trade talks break down we would expect the opposite price action, which would leave the Scandies vulnerable.

For the NOK it’s also an eventful week on the domestic data calendar with most notably the fiscal budget (today), inflation and monthly national accounts. That said, we still think the global environment left from any potential interim trade deal is far more important for where the NOK is headed short-term. A trade deal combined with a potential inflation surprise could leave a good potential for the NOK this week. Meanwhile, if China and US cannot find a common footing the NOK is set to suffer regardless of domestic inflation. Today’s fiscal budget is unlikely to move the NOK. History has shown that even big surprises have (wrongly) had close to no market impact.

Weak manufacturing data last week pushed EUR/SEK beyond our 1M 10.70 target towards our 3M (NYSE:MMM) 10.80 target. This week’s production data is likely to be on the soft side and the September inflation figures look set to undershoot the Riksbank forecast. Hence, we see a good chance that EUR/SEK will drift even higher in the coming days ahead more clarity of the trade talks.

Key figures and events