Has global monetary stimulus by the world’s central banks squashed euro-zone collapse fears forever? On Wednesday, European leaders hinted that they may withhold bailout euro-dollars from Athens due to lack of progress on government reform initiatives. The occurrence barely registered as an afterthought on most people’s radar screens.

Of course, there was a time when a hiccup in Greece roiled global equity markets. Not anymore. For that matter, higher energy costs once held sway over stock market enthusiasm. Yet ever-increasing gasoline prices have done little to derail the equity train.

In certain years, corporate profitability and top-line sales moved the needle. If that were the case right now, however, few would celebrate earnings growth of 1%-2%. Even fewer would cheer a revenue decline of 1% for S&P 500 corporations. In fact, sales for companies in the large-cap barometer have not contracted since the third quarter of 2009.

Even a stagnant U.S. economy cannot incite a stock buyer’s strike. Gross Domestic Product (GDP) has likely averaged a paltry 1% over the last 3 quarters. Disability claims have outpaced new jobs in roughly 40 of the last 42 months. Meanwhile, labor force participation remains near 35 year lows. Without the success of rate-sensitive real estate and auto, there would be little cause for optimism.

And therein lies the dilemma. The Federal Reserve and its chairman, Ben Bernanke, have masterfully manipulated interest rates through a combination of overnight lending rate policy, quantitative easing and “Fed Speak.” On the other hand, with the prospect of a directional shift, rising 10-year yields are simultaneously threatening the housing price rebound and the record highs for the big time benchmarks (e.g., S&P 500, Dow Industrials, etc.).

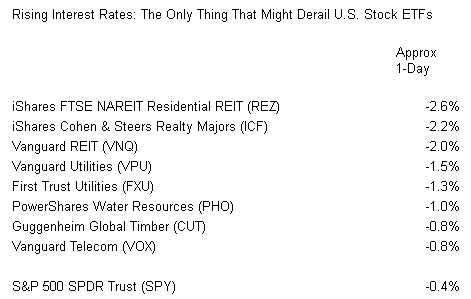

It follows that when a better-than-expected manufacturing data point pushed the 10-year yield from 2.49% up to 2.59% on Wednesday, U.S. stocks shuddered. Stock ETFs that represent sectors that are most sensitive to rising rates were hit the hardest, from residential real estate to utilities to timber to telecom.

It is possible that interest rates will be more volatile in the coming months. That said, the Fed is not likely to taper their bond purchases in September. Such an event would likely cast a dark shadow across every asset class on the board, not just the ones that are sensitive to rising rates. Foreign stocks, domestic stocks, foreign bonds, domestic bonds, preferreds, convertibles, partnerships, trusts — everything would get trampled. Granted, the Fed’s dual mandate does not mention market-based security prices or home prices. Nevertheless, members of the committee will be too reluctant to take the blame for changing direction prematurely.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Interest Rate Volatility Slams Real Estate ETFs And Telecom ETFs

Published 07/25/2013, 04:07 AM

Updated 03/09/2019, 08:30 AM

Interest Rate Volatility Slams Real Estate ETFs And Telecom ETFs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.