In March I penned The Fed Is Scared and Will Not Raise Rates Anytime Soon. It is now five months later, and a lot of smart pundits say the Federal Reserve will begin to hike the zero bound federal funds rate in their September, October or December meetings this year. And this week, China threw new uncertainty into USA economic forecasts and the rate discussion with a downward 3% re-peg of its currency.

Follow up:

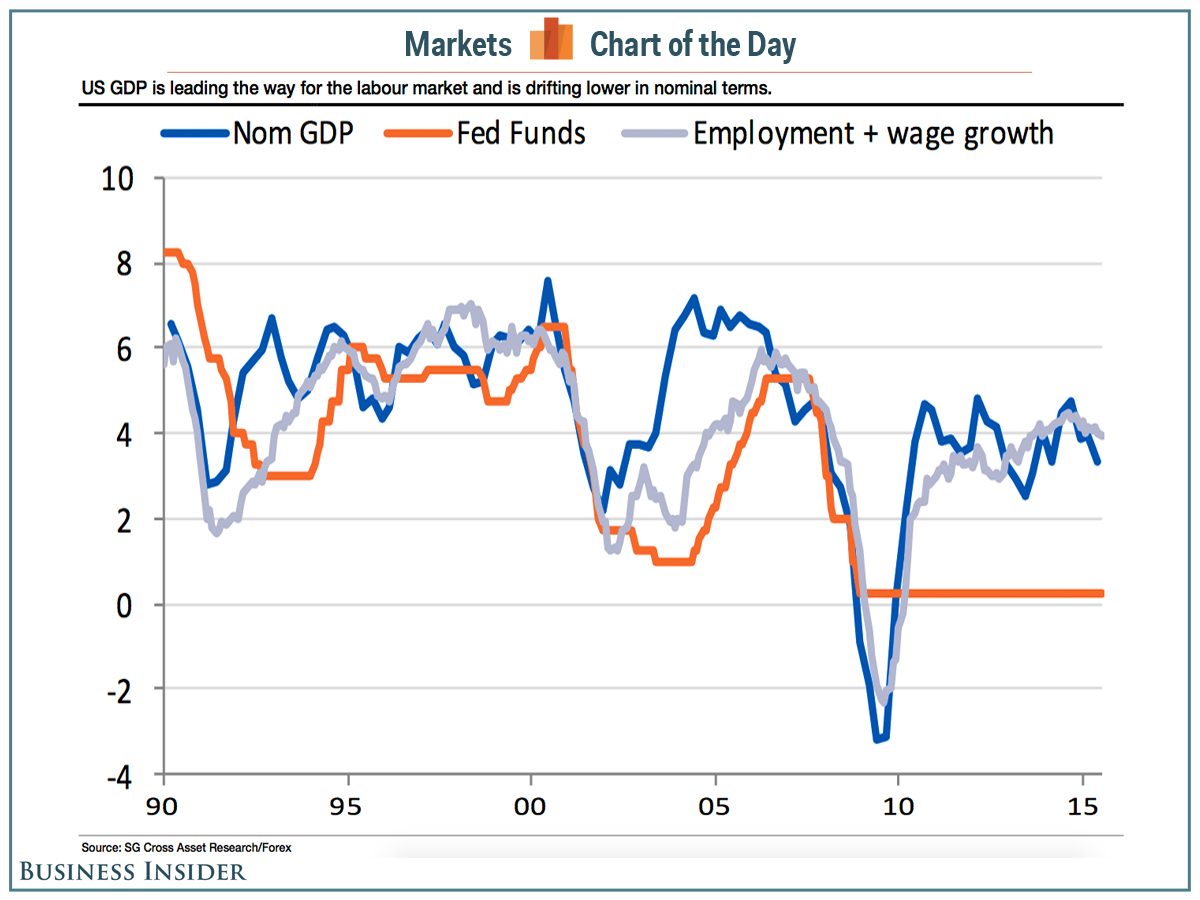

What we have is the Fed funds rate well below the levels seen in times of economic expansion.

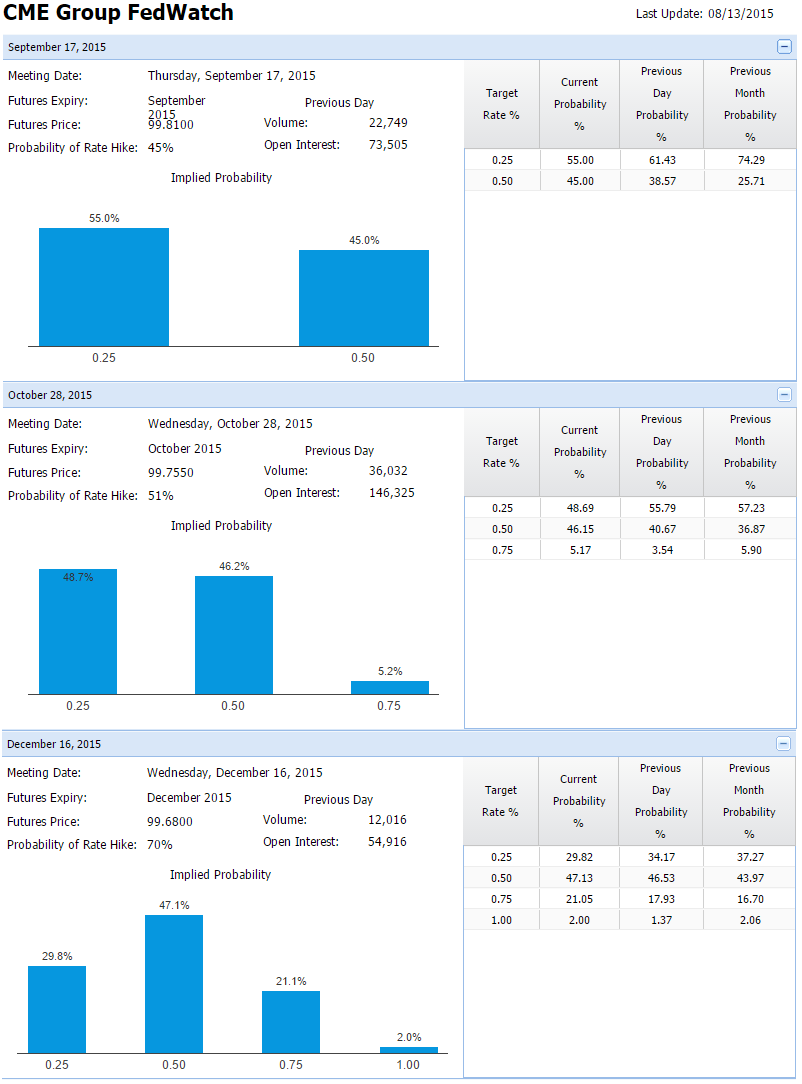

According to CME, FedWatch tool (based on 30-Day Fed Funds futures prices, which have long been used to express the market’s views on the likelihood of changes in U.S. monetary policy), the likelyhood a rate increase is diminishing but is still elevated.

Note that 82% of economists expect a September rate hike.

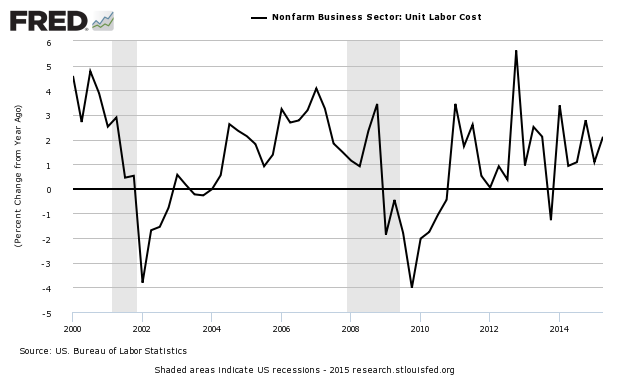

Central banks raise interest rates to slow an overheating economy - normally seen in rising costs (inflation) - and lower interest rates when the economy stalls. Currently there is no evidence inflation is a problem, nor is the precursor to full employment - rising wages or salary is evident. Consider that central bankers cannot wait until they have firm evidence of economic direction as the effects of changes in interest rate take many months to manifest. So when to raise rates is a guessing game.

Says the Peterson Institute’s Justin Wolfers:

There’s no evidence anywhere — in average hourly earnings, or the employment cost index — of wage inflation. It’s low and it’s not rising.

In any event, the economy will hardly notice an initial small interest rate increases as it would be below the noise level of other events occurring in the economy. IMO the Fed should have started raising rates over a year ago when most indicators were showing accelerating growth.

Further, there are questions whether artificially set zero interest rates for as long periods can be proven as economically positive. Low interest rates can create bubbles (or plant the seeds of future bubbles) - possibly creating an economy which becomes addicted to running on low interest rates. Economic "science" is not that advanced - after all, economists have been surprised over-and-over unforeseen economic events (e.g. bubbles, economic downturns).

Yet, what would happen if the Fed raised rates and the economy slumped? Blame would fall on the Fed for crippling the economy as a result of the interest rate increase. Bureaucrats have a tendency to protect their reputations - especially with many in Congress not thinking the Fed is properly doing their job. There are a lot of warning bells foretelling a slowing economy - such as a slowing growth rate in employment and weak growth forecast by leading indicators - even though many pundits are NOT seeing the slowing employment growth rate and only looking at the HEADLINE numbers and its brainless analysis.

Lakshman Achuthan, Co-Founder and Chief Operations Officer of ECRI believes:

The Fed's rate hike plans are on a collision course with the economic cycle. In fact, the Fed is signaling a rate hike this year - if not by September, then by December - clearly expecting a pickup in growth. ECRI's leading indexes suggest the opposite.

Indeed, a service sector slowdown has already joined the manufacturing slowdown that started last fall, and so the slowdown in overall growth is likely to intensify in the coming months. As such, hopes for a "second-half rebound" are likely to be dashed.

.... In hindsight it is clear that the GRC [growth rate cycle] peaked at the end of 2014, following which U.S. economic growth has stayed in a cyclical downswing that was exacerbated - but not caused - by a harsh winter and West Coast port strikes in Q1 2015. The Fed sees those events as the reason for disappointing growth. Yet, as the chart shows, this is now a broad slowdown - not a temporary soft patch - with the downturn in U.S. Coincident Services Index growth (top line) joining the downswing in U.S. Coincident Manufacturing Index growth (bottom line).

At this point, pragmatically does it matter economically whether the Fed raises rates? I will be disappointed in the Fed raises rates and use the "improving" employment situation as a reason for raising rates - as it means they are not analyzing trends.

It is tragic that the Fed waited so long to begin to abandon their zero interest rate policy. Who is to say this delay is not the root cause of the forecast of economic slowing.

Other Economic News this Week:

The Econintersect Economic Index for August 2015 declined to the lowest level since April 2010. The tracked sectors of the economy remain relatively soft with most expanding at the lower end of the range seen since the end of the Great Recession. Our economic index has been in a long term decline since late 2014.

The ECRI WLI growth index is now in positive territory but still indicates the economy will have little growth 6 months from today.

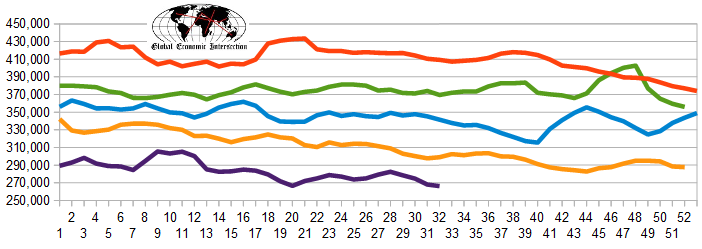

Current ECRI WLI Growth Index

The market was expecting the weekly initial unemployment claims at 260,000 to 272,000 (consensus 270,000) vs the 274,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 268,000 (reported last week as 268,250) to 266,250. The rolling averages generally have been equal to or under 300,000 since August 2014.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Response Genetics, Hercules Offshore

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI